Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 3PB

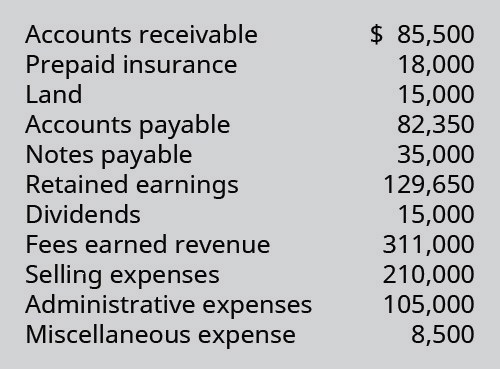

The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need correct answer general Accounting

MCQ

correct answer please help me

Chapter 5 Solutions

Principles of Accounting Volume 1

Ch. 5 - Which of the following accounts is considered a...Ch. 5 - Which of the following accounts is considered a...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - Which of these accounts would be present in the...Ch. 5 - Which of these accounts would not be present in...Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which account would be credited when closing the...Ch. 5 - Which account would be credited when closing the...

Ch. 5 - Which of these accounts is included in the...Ch. 5 - Which of these accounts is not included in the...Ch. 5 - On which of the following would the year-end...Ch. 5 - Which of these accounts is included in the...Ch. 5 - If current assets are $112,000 and current...Ch. 5 - If current assets are $100,000 and current...Ch. 5 - Explain what is meant by the term real accounts...Ch. 5 - Explain what is meant by the term nominal accounts...Ch. 5 - What is the purpose of the closing entries?Ch. 5 - What would happen if the company failed to make...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - The account called Income Summary is often used in...Ch. 5 - What are the four entries required for closing,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - What account types are included in a post-closing...Ch. 5 - Which of the basic financial statements can be...Ch. 5 - Describe the calculation required to compute...Ch. 5 - Describe the calculation required to compute the...Ch. 5 - Describe the progression of the three trial...Ch. 5 - Identify whether each of the following accounts is...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate:...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify which of the following accounts would be...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - From the following Company B adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company R adjusted trial...Ch. 5 - From the following Company T adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company S adjusted trial...Ch. 5 - Assume you are the controller of a large...Ch. 5 - Assume you are a senior accountant and have been...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

1. Based on the descriptions and analyses in this chapter, would Boeing be better described as a global firm or...

Operations Management

The put option’s leverage ratio is -1.9. Introduction: Expected return is the method of finding the average ant...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

3. Which method almost always produces the most depreciation in the first year?

a. Units-of-production

b. Strai...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

How is inventory tracked under a perpetual inventory system?

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hello tutor please help mearrow_forwardWhat is the company's unit contribution margin?arrow_forwardA company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License