Methods of Estimating Costs: Engineering Estimates

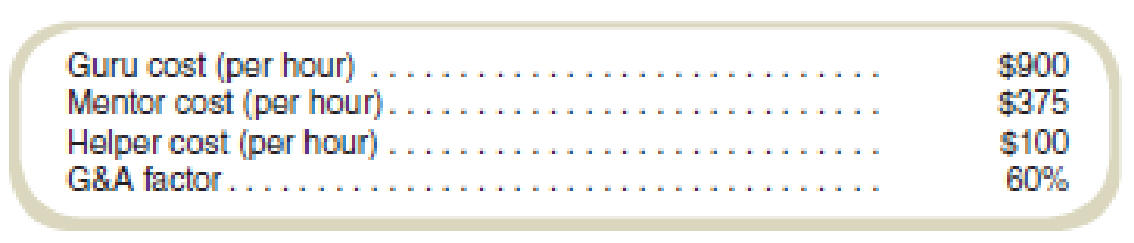

Twain Services offers leadership training for local companies. It employs three levels of seminar leaders, based on experience, education, and management level being targeted: guru, mentor, and helper. When Twain bids on requests for seminars, it estimates the costs using a set of standardized billing rates. It then adds an estimate for travel, supplies, and so on (referred to as out-of-pocket costs). Next it applies a percentage to the total of seminar leader cost and out-of-pocket cost for general and administrative (G&A) expense. The estimates for each of these elements are shown below:

Required

Marcus Foundries has asked Twain for a set of seminars for managers at several levels. The bidding manager at Twain estimates that the work will require 10 guru-hours, 125 mentor-hours, and 150 helper-hours. She estimates out-of-pocket costs to be $25,000. What is the estimated cost of the proposed seminars, based on these estimates?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub