Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 2P

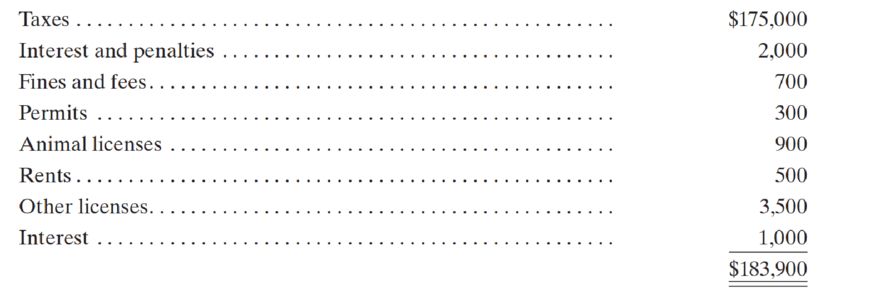

- 1. The following are the estimated revenues for a Special Revenue Fund (SRF) of the city of Marcelle on January 1, 20X5:

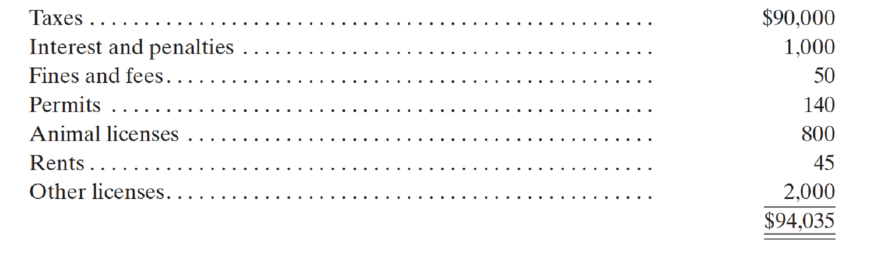

- 2. The city records its transactions on a cash basis during the year and adjusts to the modified accrual basis at year end. At the end of January, the following SRF collections had been made.

- 3. An unanticipated grant-in-aid of $5,000 was received from the state on February 1.

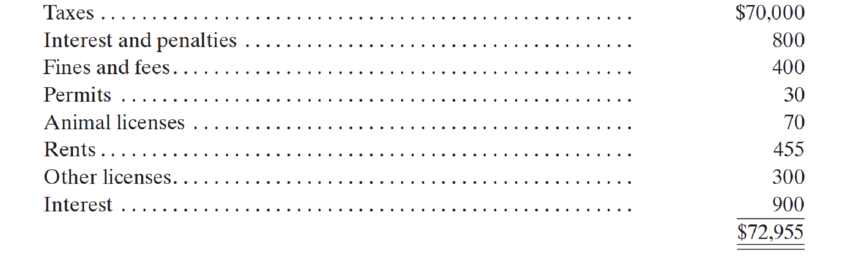

- 4. Special Revenue Fund collections for the remaining 11 months were as follows:

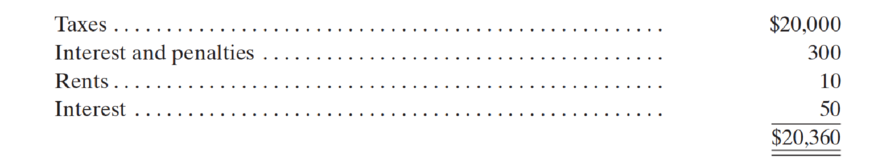

- 5. Accrued SRF receivables at year end were as follows:

Only half of the taxes and interest and penalties receivable is expected to be collected during the first 60 days of 20X6. All of the rent and interest receivable should be received in January 20X6.

Required

- a. Prepare the General Ledger and Subsidiary Ledger entries to record the SRF estimated revenues, revenue collections, and revenue accruals.

- b. Post to SRF General Ledger worksheet (or T-accounts) and to subsidiary revenue accounts.

- c. Prepare SRF closing entries for both the General and Revenues Subsidiary Ledgers.

- d. Post to the SRF General Ledger worksheet (or T-accounts) and to the subsidiary revenue accounts.

- e. Prepare a SRF statement of estimated revenues compared with actual revenues (i.e., essentially the revenue portion of a budgetary comparison statement) for 20X5.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Write down as many descriptions describing rock and roll that you can.

From these descriptions can you come up with s denition of rock and roll?

What performers do you recognize?

What performers don’t you recognize?

What can you say about musical inuence on these current rock musicians?

Try to break these inuences into genres and relate them to the rock musicians. What does

Mick Jagger say about country artists?

What does pioneering mean?

What kind of ensembles w

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Chapter 5 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 5 - Prob. 1QCh. 5 - Prob. 2QCh. 5 - The term deferred revenues seems out of place in...Ch. 5 - Governments often collect cash or must record...Ch. 5 - Modified accrual basis revenue recognition is...Ch. 5 - (a) Should estimated uncollectible amounts of...Ch. 5 - (a) What are expenditure-driven intergovernmental...Ch. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - During the course of your audit of a city, you...

Ch. 5 - Prob. 11QCh. 5 - Prob. 1.1ECh. 5 - Prob. 1.2ECh. 5 - Prob. 1.3ECh. 5 - Prob. 1.4ECh. 5 - What would the answer be to number 4 if the city...Ch. 5 - A county received 3,000,000 from the state. Of...Ch. 5 - A Special Revenue Fund expenditure of 40,000 was...Ch. 5 - A state received an unrestricted gift of 80,000 of...Ch. 5 - Prob. 1.9ECh. 5 - Prob. 1.10ECh. 5 - Prob. 2.1ECh. 5 - Prob. 2.2ECh. 5 - Prob. 2.3ECh. 5 - Prob. 2.4ECh. 5 - Prob. 2.5ECh. 5 - Prob. 2.6ECh. 5 - Prob. 2.7ECh. 5 - Prob. 2.8ECh. 5 - Prob. 2.9ECh. 5 - Prob. 2.10ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - a. Prepare the general journal entries to record...Ch. 5 - Prob. 6ECh. 5 - Prepare general journal entries to record the...Ch. 5 - Prob. 8ECh. 5 - The City and County of PreVatte received a state...Ch. 5 - Make all required General Fund journal entries for...Ch. 5 - The city of Asher had the following transactions,...Ch. 5 - 1. The following are the estimated revenues for a...Ch. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 1CCh. 5 - Prob. 2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License