Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 1P

The city of Asher had the following transactions, among others, in 20X7:

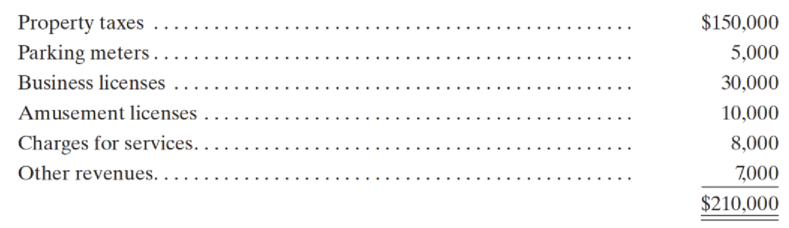

- 1. The council estimated that revenues of $210,000 would be generated for the General Fund in 20X7. The sources and amounts of expected revenues are as follows:

- 2. Property taxes of $152,000 were levied by the council; $2,000 of these taxes are expected to be uncollectible.

- 3. The council adopted a budget revision increasing the estimate of amusement licenses revenues by $2,000 and decreasing the estimate for business licenses revenues by $2,000. 4.

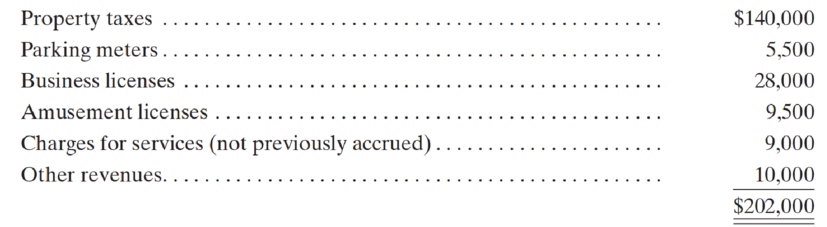

- 4. The following collections were made by the city:

- 5. The resources of a discontinued Capital Projects Fund were transferred to the General Fund, $4,800.

- 6. Enterprise Fund cash of $5,000 was paid to the General Fund to subsidize its operations.

- a. Prepare general journal entries and budgetary entries to record the transactions in the General Ledger and Revenues Subsidiary Ledger accounts.

- b. Prepare a

trial balance of the RevenuesLedger after posting the general journal entries pre- pared in item (a). Show agreement with the control accounts - c. Prepare the general

journal entry (ies) to close the revenue accounts in the General Ledger and Revenues Ledger.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

choose best answer

Financial accounting

What is the material price variance of this general accounting question?

Chapter 5 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 5 - Prob. 1QCh. 5 - Prob. 2QCh. 5 - The term deferred revenues seems out of place in...Ch. 5 - Governments often collect cash or must record...Ch. 5 - Modified accrual basis revenue recognition is...Ch. 5 - (a) Should estimated uncollectible amounts of...Ch. 5 - (a) What are expenditure-driven intergovernmental...Ch. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - During the course of your audit of a city, you...

Ch. 5 - Prob. 11QCh. 5 - Prob. 1.1ECh. 5 - Prob. 1.2ECh. 5 - Prob. 1.3ECh. 5 - Prob. 1.4ECh. 5 - What would the answer be to number 4 if the city...Ch. 5 - A county received 3,000,000 from the state. Of...Ch. 5 - A Special Revenue Fund expenditure of 40,000 was...Ch. 5 - A state received an unrestricted gift of 80,000 of...Ch. 5 - Prob. 1.9ECh. 5 - Prob. 1.10ECh. 5 - Prob. 2.1ECh. 5 - Prob. 2.2ECh. 5 - Prob. 2.3ECh. 5 - Prob. 2.4ECh. 5 - Prob. 2.5ECh. 5 - Prob. 2.6ECh. 5 - Prob. 2.7ECh. 5 - Prob. 2.8ECh. 5 - Prob. 2.9ECh. 5 - Prob. 2.10ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - a. Prepare the general journal entries to record...Ch. 5 - Prob. 6ECh. 5 - Prepare general journal entries to record the...Ch. 5 - Prob. 8ECh. 5 - The City and County of PreVatte received a state...Ch. 5 - Make all required General Fund journal entries for...Ch. 5 - The city of Asher had the following transactions,...Ch. 5 - 1. The following are the estimated revenues for a...Ch. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 1CCh. 5 - Prob. 2C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. • The equipment cost Aqua $423,414 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be $60,000. Negotiations led to Maywood guaranteeing a $85,000 residual value. • Equal payments under the lease are $120,000 and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a 7% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. & 2. Prepare the appropriate entries for Maywood on January 1, 2024 and December 31, 2024, related to the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in…arrow_forwardWhat is the break even point in sales provide answerarrow_forwardhelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License