Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 2MAD

Analyze Dollar General

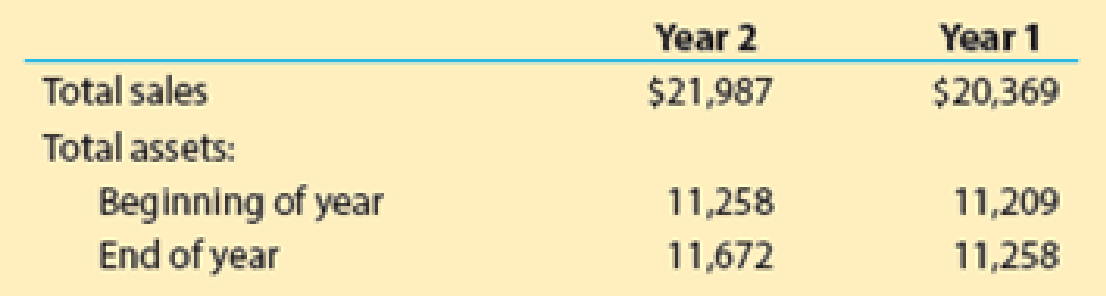

Dollar General Corporation (DG) is a discount retailer with more than 12,000 stores. It offers a wide range of merchandise normally for $10 or less. The following data (in millions) were taken from recent financial statements of Dollar General:

a. Compute the asset turnover ratio for Year 2 and Year 1. Round to two decimal places.

b. Interpret the change in the asset turnover ratio from Year 1 to Year 2.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bella Brands operates with two divisions, Aftershave and Deodorant. The Aftershave Division produces a chemical that the Deodorant Division also uses. The Aftershave Division also sells this chemical to other firms for $10 per ounce. The cost information for the Aftershave Division is as follows:

Variable costs per ounce

$ 6.00

Fixed costs per ounce

$ 15.00

Monthly production capacity

30,000

ounces

If the Aftershave Division is not operating at full capacity and is able to supply the Deodorant Division with its needs for the chemical, what is the minimum transfer price that the Aftershave Division will accept?

Multiple Choice

None of the choices is correct.

$10.00 per ounce

$6.00 per ounce

$15.00 per ounce

$3.00 per ounce

Brar Incorporated supplied the following financial information for analysis:

Depreciable assets (purchased at the beginning of year 1)

$ 4,500,000

Profits before depreciation (all in cash flows at end of year):

Year 1

960,000

Year 2

1,400,000

Year 3

2,100,000

Replacement cost of depreciable assets at end of:

Year 1

$ 5,000,000

Year 2

6,200,000

Year 3

7,600,000

The assets are depreciated at a rate of 12% per year and have no salvage value. What is the ROI for year 2 using historical cost, net book value?

Multiple Choice

26.60%

24.72%

25.15%

22.64%

None of these.

Bella Brands operates with two divisions, Aftershave and Deodorant. The Aftershave Division produces a chemical that the Deodorant Division also uses. The Aftershave Division also sells this chemical to other firms for $27 per ounce. The cost information for the Aftershave Division is as follows:

Variable costs per ounce

$ 6.00

Fixed costs per ounce

$ 15.00

Monthly production capacity

30,000

ounces

If the Aftershave Division is operating at full capacity and can sell all of the chemical that it can produce, what is the minimum transfer price that the Aftershave Division will accept?

Multiple Choice

None of the choices is correct.

$6.00 per ounce

$21.00 per ounce

$15.00 per ounce

$27.00 per ounce

Chapter 5 Solutions

Financial And Managerial Accounting

Ch. 5 - Prob. 1DQCh. 5 - Can a business earn a gross profit but incur a net...Ch. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - How are sales to customers using MasterCard and...Ch. 5 - What is the nature of (A) a credit memo issued by...Ch. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 3BECh. 5 - Freight terms Determine the amount to be paid in...Ch. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Hahn Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Prob. 7ECh. 5 - Purchase-related transactions Journalize entries...Ch. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 14ECh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Sales-related transactions Showcase Co., a...Ch. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Normal balances of accounts for retail business...Ch. 5 - Income statement and accounts for retail business...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for retail business The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a retail business From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 33ECh. 5 - Prob. 34ECh. 5 - Appendix 1 Adjusting entry for gross method The...Ch. 5 - Appendix 1 Discount taken in next fiscal year...Ch. 5 - Prob. 37ECh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Cost of goods sold and related items The following...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - A Sales and purchase-related transactions for...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Appendix 2 Purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 PR 5-9A Sales and purchase-related...Ch. 5 - 2. Net income, 185,000 Appendix 2 PR 5-10A...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Sales and purchase-related transactions for seller...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income Statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Sales and purchase-related transactions using...Ch. 5 - Appendix 2 Sales and purchase-related transactions...Ch. 5 - Appendix 2 PR 5-10B Periodic inventory accounts,...Ch. 5 - Palisade Creek Co. is a retail business that uses...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Analyze and compare CSX, Union Pacific, and YRC...Ch. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Analyze and compare Kroger and Tiffany The Kroger...Ch. 5 - Prob. 7MADCh. 5 - Ethics in Action Margie Johnson is a staff...Ch. 5 - Prob. 2TIFCh. 5 - Prob. 5TIFCh. 5 - Prob. 6TIFCh. 5 - Prob. 7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License