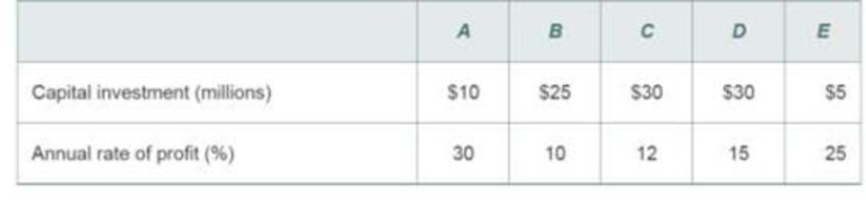

Tennessee Tool Works (TTW) is considering investment in five independent projects,

Any profitable combination of them is feasible.

TTW has$50million available to invest, and these funds are currently earning 7% interest annually from municipal bonds. If the funds available are limited to $50 million, what is TTW’s MARR that is implied by this particular situation? (5.2)

Selection of the project.

Explanation of Solution

The firm has limited investment. It can select the project that give more profit rate in order to maximize the profit. Thus, the firm can select the project A, E and D. The MARR for the firm is equal the best return of the rejected projects. Since the best return from the rejected project is 12%, the firm’s MARR is 12%.

Want to see more full solutions like this?

Chapter 5 Solutions

Pearson eText for Engineering Economy -- Instant Access (Pearson+)

Additional Business Textbook Solutions

Foundations Of Finance

Operations Management

MARKETING:REAL PEOPLE,REAL CHOICES

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

- Sue is a sole proprietor of her own sewing business. Revenues are $150,000 per year and raw material (cloth, thread) costs are $130,000 per year. Sue pays herself a salary of $60,000 per year but gave up a job with a salary of $80,000 to run the business. ○ A. Her accounting profits are $0. Her economic profits are - $60,000. ○ B. Her accounting profits are $0. Her economic profits are - $40,000. ○ C. Her accounting profits are - $40,000. Her economic profits are - $60,000. ○ D. Her accounting profits are - $60,000. Her economic profits are -$40,000.arrow_forwardSelect a number that describes the type of firm organization indicated. Descriptions of Firm Organizations: 1. has one owner-manager who is personally responsible for all aspects of the business, including its debts 2. one type of partner takes part in managing the firm and is personally liable for the firm's actions and debts, and the other type of partner takes no part in the management of the firm and risks only the money that they have invested 3. owners are not personally responsible for anything that is done in the name of the firm 4. owned by the government but is usually under the direction of a more or less independent, state-appointed board 5. established with the explicit objective of providing goods or services but only in a manner that just covers its costs 6. has two or more joint owners, each of whom is personally responsible for all of the partnership's debts Type of Firm Organization a. limited partnership b. single proprietorship c. corporation Correct Numberarrow_forwardThe table below provides the total revenues and costs for a small landscaping company in a recent year. Total Revenues ($) 250,000 Total Costs ($) - wages and salaries 100,000 -risk-free return of 2% on owner's capital of $25,000 500 -interest on bank loan 1,000 - cost of supplies 27,000 - depreciation of capital equipment 8,000 - additional wages the owner could have earned in next best alternative 30,000 -risk premium of 4% on owner's capital of $25,000 1,000 The economic profits for this firm are ○ A. $83,000. B. $82,500. OC. $114,000. OD. $83,500. ○ E. $112,500.arrow_forward

- Output TFC ($) TVC ($) TC ($) (Q) 2 100 104 204 3 100 203 303 4 100 300 400 5 100 405 505 6 100 512 612 7 100 621 721 Given the information about short-run costs in the table above, we can conclude that the firm will minimize the average total cost of production when Q = (Round your response to the nearest whole number.)arrow_forwardThe following data show the total output for a firm when specified amounts of labour are combined with a fixed amount of capital. Assume that the wage per unit of labour is $20 and the cost of the capital is $100. Labour per unit of time 0 1 Total Output 0 25 T 2 3 4 5 75 137 212 267 The marginal product of labour is at its maximum when the firm changes the amount of labour hired from ○ A. 0 to 1 unit. ○ B. 3 to 4 units. OC. 2 to 3 units. OD. 1 to 2 units. ○ E. 4 to 5 units.arrow_forwardThe table below provides the annual revenues and costs for a family-owned firm producing catered meals. Total Revenues ($) 600,000 Total Costs ($) - wages and salaries 250,000 -risk-free return of 7% on owners' capital of $300,000 21,000 - rent 101,000 - depreciation of capital equipment 22,000 -risk premium of 9% on owners' capital of $300,000 27,000 - intermediate inputs 146,000 -forgone wages of owners in alternative employment -interest on bank loan 70,000 11,000 The implicit costs for this family-owned firm are ○ A. $70,000. OB. $97,000. OC. $589,000. OD. $118,000. ○ E. $48,000.arrow_forward

- Suppose a production function for a firm takes the following algebraic form: Q= 2KL - (0.3)L², where Q is the output of sweaters per day. Now suppose the firm is operating with 10 units of capital (K = 10) and 6 units of labour (L = 6). What is the output of sweaters? A. 64 sweaters per day OB. 49 sweaters per day OC. 109 sweaters per day OD. 72 sweaters per day OE. 118 sweaters per dayarrow_forward3. Consider a course allocation problem with strict and non-responsive preferences. Isthere a mechanism that is efficient and strategy-proof? If so, state the mechanismand show that it satisfies efficiency and strategyproofness. {hint serial dictatorship and show using example}4. Consider a course allocation problem with responsive preferences and at least 3students. Is there a mechanism that is efficient and strategy-proof that is not theSerial Dictatorship? If so, state the mechanism and show that it satisfies efficiencyand strategyproofness.5. Suggest a mechanism for allocating students to courses in a situation where preferences are non-responsive, and study its properties (efficiency and strategyproofness). Please be creativearrow_forward3. Consider a course allocation problem with strict and non-responsive preferences. Isthere a mechanism that is efficient and strategy-proof? If so, state the mechanismand show that it satisfies efficiency and strategyproofness. {hint serial dictatorship}4. Consider a course allocation problem with responsive preferences and at least 3students. Is there a mechanism that is efficient and strategy-proof that is not theSerial Dictatorship? If so, state the mechanism and show that it satisfies efficiencyand strategyproofness.5. Suggest a mechanism for allocating students to courses in a situation where preferences are non-responsive, and study its properties (efficiency and strategyproofness). Please be creativearrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning