Foundations Of Financial Management

17th Edition

ISBN: 9781260013917

Author: BLOCK, Stanley B., HIRT, Geoffrey A., Danielsen, Bartley R.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 16P

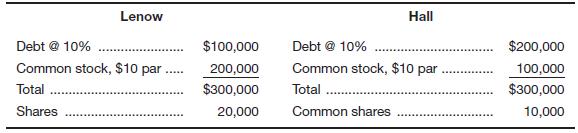

Lenow’s Drug Stores and Hall’s Pharmaceuticals are competitors in the discount drug chain store business. The separate capital structures for Lenow and Hall are presented here:

a. Compute earnings per share if earnings before interest and taxes are

b. Explain the relationship between earnings per share and the level of EBIT.

c. If the cost of debt went up to 12 percent and all other factors remained equal, what would be the break-even level for EBIT?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume the following relationships for the Caulder Corp.:Sales/Total assets 1.3×Return on assets (ROA) 4.0%Return on equity (ROE) 8.0%Calculate Caulder’s profit margin and debt-to-capital ratio assuming the firm uses only debt andcommon equity, so total assets equal total invested capital

Solve this question

Assume you are given the following relationships for the Haslam Corporation:

Sales/total assets

1.2

Return on assets (ROA)

3%

Return on equity (ROE)

5%

Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places.

Profit margin: %

Liabilities-to-assets ratio: %

Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places.

Chapter 5 Solutions

Foundations Of Financial Management

Ch. 5 - Discuss the various uses for break-even analysis....Ch. 5 - What factors would cause a difference in the use...Ch. 5 - Explain how the break-even point and operating...Ch. 5 - Prob. 4DQCh. 5 - What does risk taking have to do with the use of...Ch. 5 - Discuss the limitations of financial leverage....Ch. 5 - Prob. 7DQCh. 5 - Explain how combined leverage brings together...Ch. 5 - Explain why operating leverage decreases as a...Ch. 5 - Prob. 10DQ

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Draw two break-even graphs-one for a conservative...Ch. 5 - Prob. 5PCh. 5 - Shawn Pen & Pencil Sets Inc. has fixed costs of ....Ch. 5 - Calloway Cab Company determines its break-even...Ch. 5 - Prob. 8PCh. 5 - Boise Timber Co. computes its break-even point...Ch. 5 - The Sterling Tire Company’s income statement for...Ch. 5 - Prob. 11PCh. 5 - Healthy Foods Inc. sells 50-pound bags of grapes...Ch. 5 - United Snack Company sells 50-pound bags of...Ch. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Lenow’s Drug Stores and Hall’s Pharmaceuticals...Ch. 5 - The capital structure for Cain Supplies is...Ch. 5 - Sterling Optical and Royal Optical both make glass...Ch. 5 - Prob. 19PCh. 5 - Sinclair Manufacturing and Boswell Brothers Inc....Ch. 5 - DeSoto Tools Inc. is planning to expand...Ch. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Mr. Gold is in the widget business. He currently...Ch. 5 - Delsing Canning Company is considering an...Ch. 5 - Prob. 2WECh. 5 - Now click on "Financials." Look at the Income...Ch. 5 - Prob. 4WECh. 5 - Prob. 5WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need help please provide Solutions with explanationarrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets 2.2x Return on assets (ROA) 6% Return on equity (ROE) 15% a. Calculate Caulder's profit margin assuming the firm uses only debt and common equity, so total assets equal total invested capital. Round your answer to two decimal places. % b. Calculate Caulder's debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardGeneral Accountingarrow_forward

- General accountingarrow_forwardGive typed solutionarrow_forwardA1 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 A B V 1 X Sales Costs Net income ✓ C Income statement $ Sales increase Payout rate fx $ Dividends Add. To RE D 36,000 29,800 6,200 15% 50% Pro forma income statement Sales Costs Net income E F G Assets $ Total $ Assets H Total I Balance sheet 26,400 Debt Equity 26,400 Total Complete the following analysis. Do not hard code values in your calculations. Pro forma balance sheet Debt Equity Total $ External financing needed $ J 6,300 20,100 26,400 Karrow_forward

- 4-10)Assume the following relationships for Brauer Corp.:Sales/Total Assets 1.5XReturn on Assets (ROA) 3.0%Return on Equity (ROE) 5.0%Calculate Brauer’s profit margin and debt-to-asset ratio assuming the firm uses only debt and common equity.arrow_forwardssume the following relationships for the Caulder Corp.: Sales/Total assets 1.2\times Return on assets (ROA ) 5.0% Return on equity (ROE) 15.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places.arrow_forwardPlease if you can help with these 2, better skip pls Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.5× Return on assets (ROA) 8.0% Return on equity (ROE) 15.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: % 2. Thomson Trucking has $9 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 5.25%. What is its times-interest-earned (TIE) ratio? Round your answer to two decimal places.arrow_forward

- a)Assume that the following data is extracted from the financial statements of Richy-Rich bank: equity is $350 million, interest expense is $115 million, provision for loan loss (P) is $35 million, noninterest income is $30 million, noninterest expense is $50 million and a tax rate is 33%. What is the minimum total interest income required to give a return on equity (ROE) of 20%? Show workings when necessary. b) Be-smart Bank reported an equity multipler ratio of 6.5 at the end of year 2021. If the bank’s total debt at the end of year 2021 was $5 million, how much of its assets were financed with equity? Show calculations when necessary. c) What are the main sources of funding for commercial banks? Using bullet points, classify these sources and briefly describe each category.arrow_forwardConsider the following simplified financial statements for the Yoo Corporation. Assume there are no income taxes and the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements and determine the external financing needed. Income statement $ Sales Costs Net income Sales increase Payout rate 36,000 29,800 $ 6,200 Dividends ALL 15% 50% Pro forma income statement Sales Costs Net income Balance sheet 26,400 Debt Equity Total $ 26,400 Total Assets $ Complete the following analysis. Do not hard code values in your calculations. Pro forma balance sheet Debt Assets Total Equity Total $ External financing needed $ 6,300 20,100 26,400arrow_forwardCarson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a) Debt ratio: b) Average collection period: c) Fixed asset turnover: d) Return on equity:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License