Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 10EA

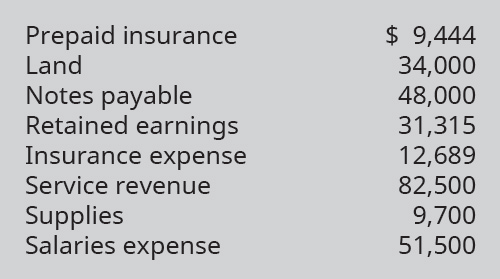

Identify which of the following accounts would not be listed on the company’s Post-Closing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Abc

Hello tutor please give me correct solution

General accounting

Chapter 5 Solutions

Principles of Accounting Volume 1

Ch. 5 - Which of the following accounts is considered a...Ch. 5 - Which of the following accounts is considered a...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - Which of these accounts would be present in the...Ch. 5 - Which of these accounts would not be present in...Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which account would be credited when closing the...Ch. 5 - Which account would be credited when closing the...

Ch. 5 - Which of these accounts is included in the...Ch. 5 - Which of these accounts is not included in the...Ch. 5 - On which of the following would the year-end...Ch. 5 - Which of these accounts is included in the...Ch. 5 - If current assets are $112,000 and current...Ch. 5 - If current assets are $100,000 and current...Ch. 5 - Explain what is meant by the term real accounts...Ch. 5 - Explain what is meant by the term nominal accounts...Ch. 5 - What is the purpose of the closing entries?Ch. 5 - What would happen if the company failed to make...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - The account called Income Summary is often used in...Ch. 5 - What are the four entries required for closing,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - What account types are included in a post-closing...Ch. 5 - Which of the basic financial statements can be...Ch. 5 - Describe the calculation required to compute...Ch. 5 - Describe the calculation required to compute the...Ch. 5 - Describe the progression of the three trial...Ch. 5 - Identify whether each of the following accounts is...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate:...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify which of the following accounts would be...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - From the following Company B adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company R adjusted trial...Ch. 5 - From the following Company T adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company S adjusted trial...Ch. 5 - Assume you are the controller of a large...Ch. 5 - Assume you are a senior accountant and have been...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Define cost object and give three examples.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Basic accounting equation (Learning Objective 5) 10-15 min. Hanson Corp. ? 44,900 + 10,300 Tiny Tots Daycare In...

Financial Accounting, Student Value Edition (5th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

5. Which inventory costing method results in the lowest net income during a period of rising inventory costs?

W...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. • The equipment cost Aqua $423,414 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be $60,000. Negotiations led to Maywood guaranteeing a $85,000 residual value. • Equal payments under the lease are $120,000 and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a 7% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. & 2. Prepare the appropriate entries for Maywood on January 1, 2024 and December 31, 2024, related to the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in…arrow_forwardWhat is the break even point in sales provide answerarrow_forwardhelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY