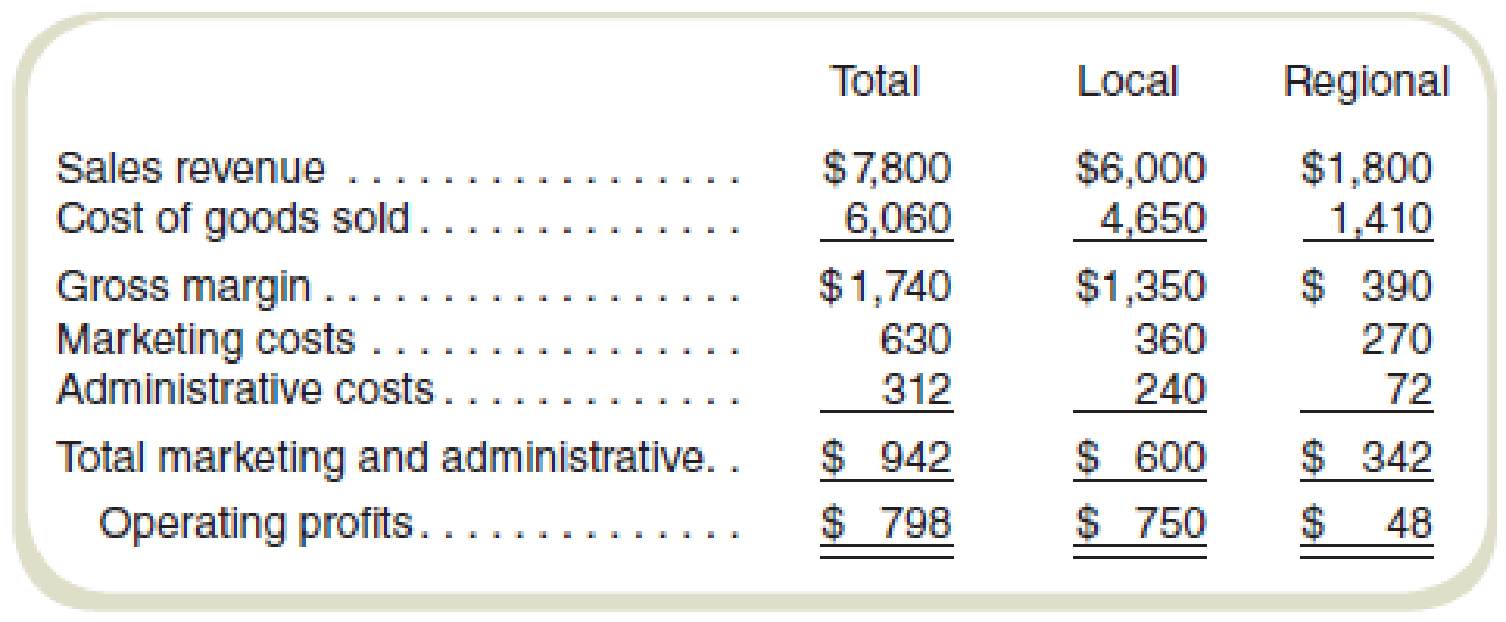

Agnew Manufacturing produces and sells three models of a single product, Standard, Superior, and DeLuxe, in a local market and in a regional market. At the end of the first quarter of the current year, the following income statement (in thousands of dollars) has been prepared:

Management has expressed special concern with the regional market because of the extremely poor return on sales. This market was entered a year ago because of excess capacity. It was originally believed that the return on sales would improve with time, but after a year, no noticeable improvement can be seen from the results as reported in the preceding quarterly statement.

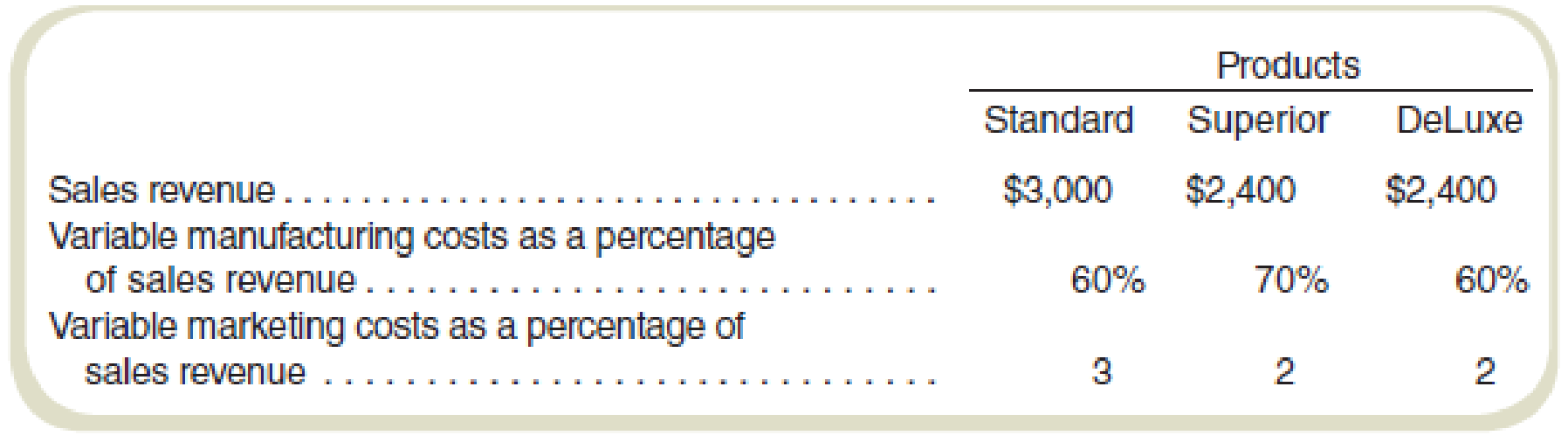

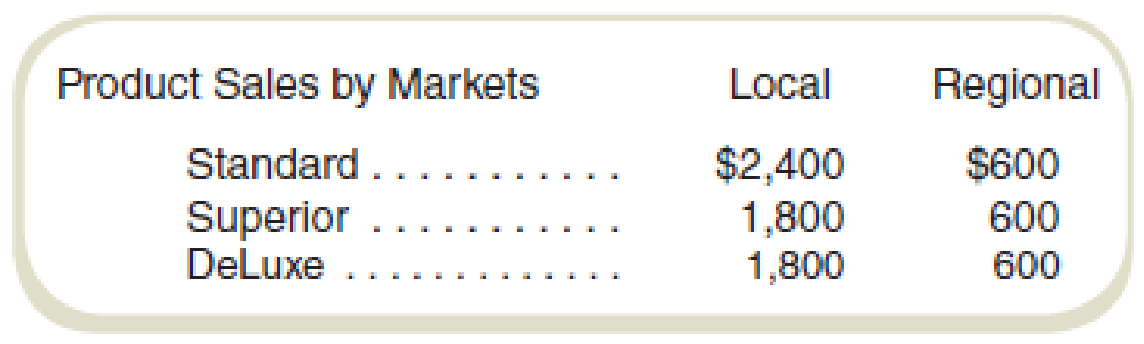

In attempting to decide whether to eliminate the regional market, the following information has been gathered:

All administrative costs and fixed

Required

- a. Assuming there are no alternative uses for Agnew’s present capacity, would you recommend dropping the regional market? Why or why not?

- b. Prepare the quarterly income statement showing contribution margins by products. Do not allocate fixed costs to products.

- c. It is believed that a new model can be ready for sale next year if Agnew decides to go ahead with continued research. The new product would replace DeLuxe and can be produced by simply converting equipment presently used in producing the DeLuxe model. This conversion will increase fixed costs by $60,000 per quarter. What must be the minimum contribution margin per quarter for the new model to make the changeover financially feasible?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Connect Access Card For Fundamentals Of Cost Accounting

- What is the total cost of job.... Please answer the general accounting questionarrow_forwardArmour, Inc., an advertising agency, applies overhead to jobs on the basis of direct professional labor hours. Overhead was estimated to be $226,000, direct professional labor hours were estimated to be 28,000, and direct professional labor cost was projected to be $425,000. During the year, Armour incurred actual overhead costs of $205,200, actual direct professional labor hours of 23,900, and actual direct labor costs of $333,000. By year-end, the firm's overhead wasarrow_forwardWhat is the degree of opereting leverage? General accountingarrow_forward

- Given correct answer financial accounting questionarrow_forwardPlatz Company makes chairs and planned to sell 4,100 chairs in its master budget for the coming year. The budgeted selling price is $36 per chair, variable costs are $17 per chair, and budgeted fixed costs are $45,000 per month. At the end of the year, it was determined that Platz actually sold 4,400 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $14,500 unfavorable b. $11,200 favorable c. $10,800 favorable d. $12,700 favorablearrow_forwardProvide correct answer the general accounting questionarrow_forward

- Helparrow_forwardWhat is the degree of opereting leverage?arrow_forwardSimba Company's standard materials cost per unit of output is $13.63 (2.35 pounds * $5.80). During July, the company purchases and uses 3,000 pounds of materials costing $17,200 in making 1,450 units of the finished product. Compute the total, price, and quantity materials variances.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning