Concept explainers

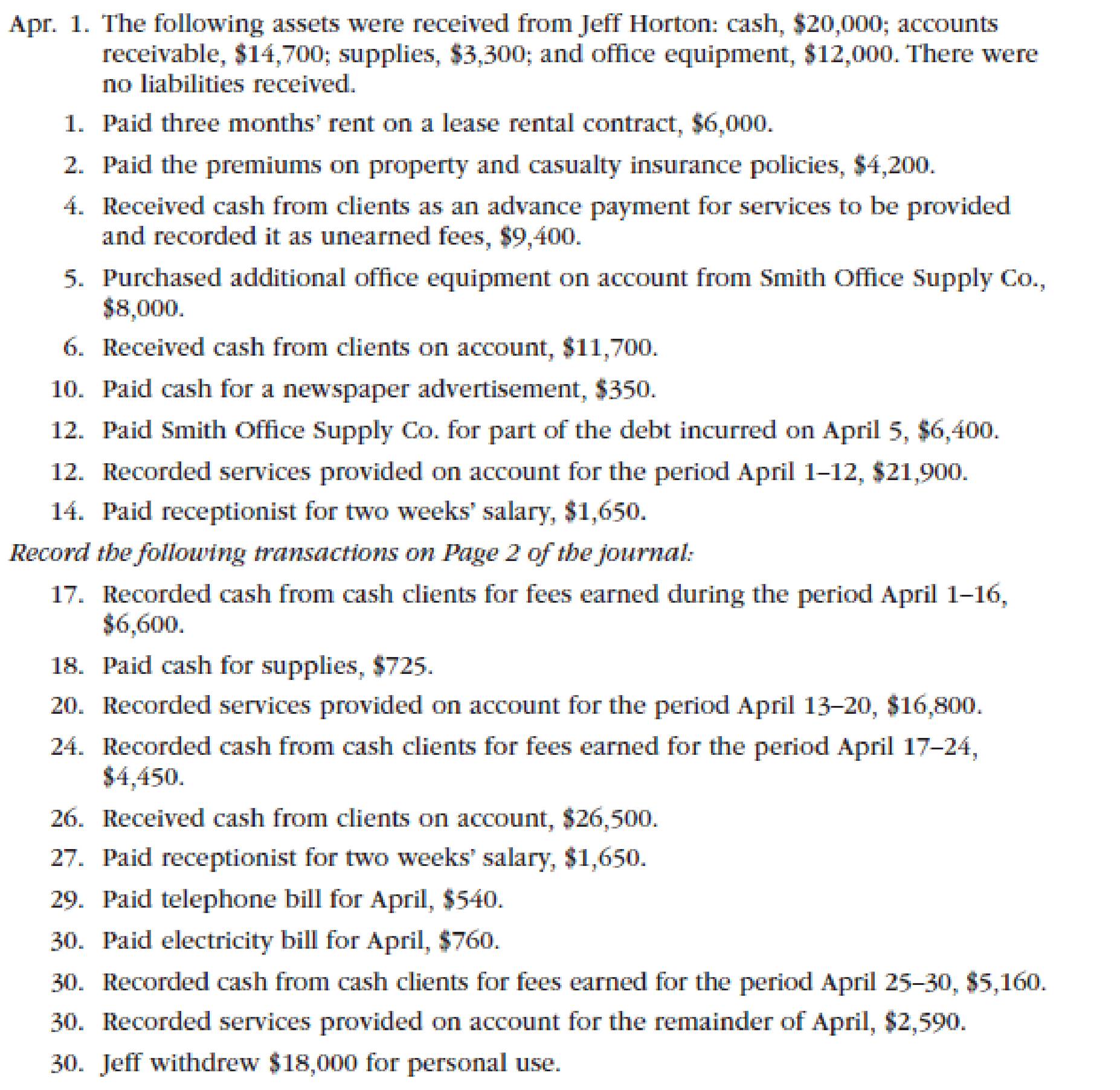

For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April:

Instructions

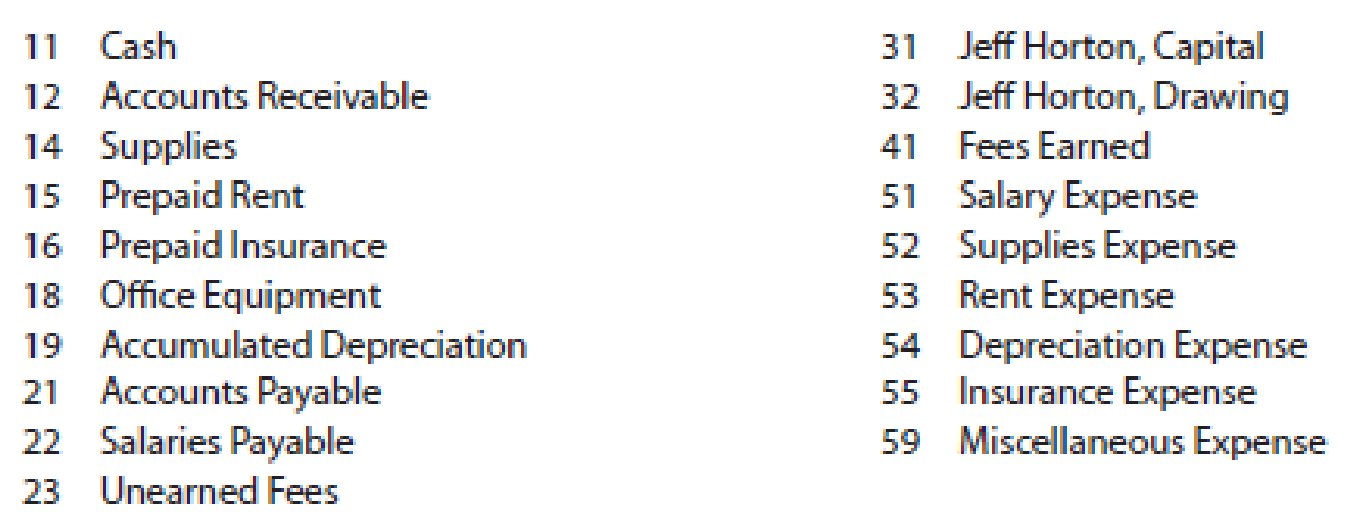

1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.)

2. Post the journal to a ledger of four-column accounts.

3. Prepare an unadjusted

4. At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

- a. Insurance expired during April is $350.

- b. Supplies on hand on April 30 are $1,225.

- c.

Depreciation of office equipment for April is $400. - d. Accrued receptionist salary on April 30 is $275.

- e. Rent expired during April is $2,000.

- f. Unearned fees on April 30 are $2,350.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet.

6. Journalize and post the

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a statement of owner’s equity, and a

9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry.

10. Prepare a post-closing trial balance.

1.

Journalize transactions of April in a two column journal beginning on page 1.

Explanation of Solution

Journal: Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts: T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance: The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries: An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement: An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet: A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries: Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance: After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

Journalize the transactions of April in a two column journal beginning on page 1.

| Journal Page 1 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Cash | 11 | 20,000 | ||

| April | 1 | Accounts receivable | 12 | 14,700 | |

| Supplies | 14 | 3,300 | |||

| Office equipment | 18 | 12,000 | |||

| J’s Capital | 31 | 50,000 | |||

| (To record the receipt of assets) | |||||

| 1 | Prepaid Rent | 15 | 6,000 | ||

| Cash | 11 | 6,000 | |||

| (To record the payment of rent) | |||||

| 2 | Prepaid insurance | 16 | 4,200 | ||

| Cash | 11 | 4,200 | |||

| (To record the payment of insurance premium) | |||||

| 4 | Cash | 11 | 9,400 | ||

| Unearned fees | 23 | 9,400 | |||

| (To record the cash received for the service yet to be provide) | |||||

| 5 | Office equipment | 18 | 8,000 | ||

| Accounts payable | 21 | 8,000 | |||

| (To record the purchase of supplies of account) | |||||

| 6 | Cash | 11 | 11,700 | ||

| Accounts receivable | 12 | 11,700 | |||

| (To record the cash received from clients) | |||||

| 10 | Miscellaneous expense | 59 | 350 | ||

| Cash | 11 | 350 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 12 | Accounts payable | 21 | 6,400 | ||

| Office supplies | 11 | 6,400 | |||

| (To record the payment made to creditors on account) | |||||

| 12 | Accounts receivable | 12 | 21,900 | ||

| Fees earned | 41 | 21,900 | |||

| (To record the revenue earned and billed) | |||||

| 14 | Salary Expense | 51 | 1,650 | ||

| Cash | 11 | 1,650 | |||

| (To record the payment made for salary) | |||||

Table (1)

| Journal Page 2 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Cash | 11 | 6,600 | ||

| April | 17 | Fees earned | 41 | 6,600 | |

| (To record the receipt of cash) | |||||

| 18 | Supplies | 14 | 725 | ||

| Cash | 11 | 725 | |||

| (To record the payment made for automobile expense) | |||||

| 20 | Accounts receivable | 12 | 16,800 | ||

| Fees earned | 41 | 16,800 | |||

| (To record the payment of advertising expense) | |||||

| 24 | Cash | 11 | 4,450 | ||

| Fees earned | 41 | 4,450 | |||

| (To record the cash received from client for fees earned) | |||||

| 26 | Cash | 11 | 26,500 | ||

| Accounts receivable | 12 | 26,500 | |||

| (To record the cash received from clients) | |||||

| 27 | Salary expense | 51 | 1,650 | ||

| Cash | 11 | 1,650 | |||

| (To record the payment of salary) | |||||

| 29 | Miscellaneous Expense | 59 | 540 | ||

| Cash | 11 | 540 | |||

| (To record the payment of telephone charges) | |||||

| 31 | Miscellaneous Expense | 59 | 760 | ||

| Cash | 11 | 760 | |||

| (To record the payment of electricity charges) | |||||

| 30 | Cash | 11 | 5,160 | ||

| Fees earned | 41 | 5,160 | |||

| (To record the cash received from client for fees earned) | |||||

| 30 | Accounts receivable | 12 | 2,590 | ||

| Fees earned | 41 | 2,590 | |||

| (To record the revenue earned and billed) | |||||

| 30 | J’s Drawing | 32 | 18,000 | ||

| Cash | 11 | 18,000 | |||

| (To record the drawing made for personal use) | |||||

Table (2)

(2), (6) and (9)

Record the balance of each accounts in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 20,000 | 20,000 | |||

| 1 | 1 | 6,000 | 14,000 | ||||

| 2 | 1 | 4,200 | 9,800 | ||||

| 4 | 1 | 9,400 | 19,200 | ||||

| 6 | 1 | 11,700 | 30,900 | ||||

| 10 | 1 | 350 | 30,500 | ||||

| 12 | 1 | 6,400 | 24,150 | ||||

| 14 | 1 | 1,650 | 22,500 | ||||

| 17 | 2 | 6,600 | 29,100 | ||||

| 18 | 2 | 725 | 28,375 | ||||

| 24 | 2 | 4,450 | 32,825 | ||||

| 26 | 2 | 26,500 | 59,325 | ||||

| 27 | 2 | 1,650 | 57,675 | ||||

| 29 | 2 | 540 | 57,135 | ||||

| 30 | 2 | 760 | 56,375 | ||||

| 30 | 2 | 5,160 | 61,535 | ||||

| 30 | 2 | 18,000 | 43,535 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 14,700 | 14,700 | |||

| 6 | 1 | 11,700 | 3,000 | ||||

| 12 | 1 | 21,900 | 24,900 | ||||

| 20 | 2 | 16,800 | 41,700 | ||||

| 26 | 2 | 26,500 | 15,200 | ||||

| 30 | 2 | 2,590 | 17,790 | ||||

Table (4)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 3,300 | 3,300 | |||

| 18 | 2 | 725 | 4,025 | ||||

| 30 | Adjusting | 3 | 2,800 | 1,225 | |||

Table (5)

| Account: Prepaid Rent Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 6,000 | 6,000 | |||

| 30 | Adjusting | 3 | 2,000 | 4,000 | |||

Table (6)

| Account: Prepaid Insurance Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 2 | 1 | 4,200 | 4,200 | |||

| 30 | Adjusting | 3 | 350 | 3,850 | |||

Table (7)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 12,000 | 12,000 | |||

| 5 | 1 | 8,000 | 20,000 | ||||

Table (8)

| Account: Accumulated Depreciation-Office equipment Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 31 | Adjusting | 3 | 400 | 400 | ||

Table (9)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 5 | 1 | 8,000 | 8,000 | |||

| 12 | 1 | 6,400 | 1,600 | ||||

Table (10)

| Account: Salaries Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | Adjusting | 3 | 275 | 275 | ||

Table (11)

| Account: Unearned Fees Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 4 | 1 | 9,400 | 9,400 | |||

| 30 | Adjusting | 3 | 7,050 | 2,350 | |||

Table (12)

| Account: J’s Capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | 1 | 50,000 | 50,000 | |||

| 30 | Closing | 4 | 53,775 | 103,775 | |||

| 30 | Closing | 4 | 18,000 | 85,775 | |||

Table (13)

| Account: J’s Drawing Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | 2 | 18,000 | 18,000 | |||

| 30 | Closing | 4 | 18,000 | ||||

Table (14)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 12 | 1 | 21,900 | 21,900 | |||

| 17 | 2 | 6,600 | 28,500 | ||||

| 20 | 2 | 16,800 | 45,300 | ||||

| 24 | 2 | 4,450 | 49,750 | ||||

| 30 | 2 | 5,160 | 54,910 | ||||

| 30 | 2 | 2,590 | 57,500 | ||||

| 30 | Adjusting | 3 | 7,050 | 64,550 | |||

| 30 | Closing | 4 | 64,550 | ||||

Table (15)

| Account: Salary expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 14 | 1 | 1,650 | 1,650 | |||

| 27 | 2 | 1,650 | 3,300 | ||||

| 30 | Adjusting | 3 | 275 | 3,575 | |||

| 30 | Closing | 4 | 3,575 | ||||

Table (16)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | Adjusting | 3 | 2,800 | 2,800 | ||

| 30 | Closing | 4 | 2,800 | ||||

Table (17)

| Account: Supplies expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | Adjusting | 3 | 2,000 | 2,000 | ||

| 30 | Closing | 4 | 2,000 | ||||

Table (18)

| Account: Depreciation expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | Adjusting | 3 | 400 | 400 | ||

| 30 | Closing | 4 | 400 | ||||

Table (19)

| Account: Insurance expense Account no. 54 | ||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2016 | ||||||||

| April | 30 | Adjusting | 3 | 350 | 350 | |||

| 30 | Closing | 4 | 350 | |||||

Table (20)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 10 | 1 | 350 | 350 | |||

| 29 | 2 | 540 | 890 | ||||

| 31 | 2 | 760 | 1,650 | ||||

| 31 | Closing | 4 | 1,650 | ||||

Table (21)

(3)

Prepare the unadjusted trial balance of Consulting R at April, 31.

Explanation of Solution

Prepare an unadjusted trial balance of Consulting R for the month ended April, 31 as follows:

|

R Consulting Unadjusted Trial Balance April 31, 2016 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 43,535 | |

| Accounts receivable | 12 | 17,790 | |

| Supplies | 14 | 4,025 | |

| Prepaid rent | 15 | 6,000 | |

| Prepaid insurance | 16 | 4,200 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated depreciation-Office equipment | 19 | 0 | |

| Accounts payable | 21 | 1,600 | |

| Salaries payable | 22 | 0 | |

| Unearned fees | 23 | 9,400 | |

| J’s Capital | 31 | 50,000 | |

| J’s Drawing | 32 | 18,000 | |

| Fees earned | 41 | 57,500 | |

| Salary expense | 51 | 3,300 | |

| Supplies expense | 52 | 0 | |

| Rent expense | 53 | 0 | |

| Depreciation expense | 54 | 0 | |

| Insurance expense | 55 | 0 | |

| Miscellaneous expense | 59 | 0 | |

| Total | $118,500 | $118,500 | |

Table (22)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $118,800.

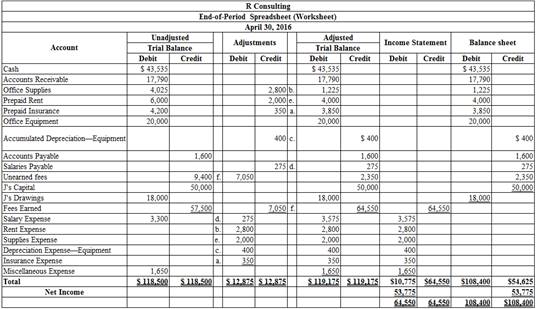

(5)

Enter the unadjusted trial balance on an end-of-period spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (23)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

(6)

Journalize the adjusting entries of Consulting R for April 30.

Explanation of Solution

The adjusting entries of Consulting R for April 30, 2016 are as follows:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) | |

| 2016 | Insurance expense | 55 | 350 | ||

| April | 30 | Prepaid insurance | 16 | 350 | |

| (To record the insurance expense for April) | |||||

| 31 | Supplies expense | 52 | 2,800 | ||

| Supplies | 14 | 2,800 | |||

| (To record the supplies expense) | |||||

| 31 | Depreciation expense | 54 | 400 | ||

| Accumulated Depreciation | 19 | 400 | |||

| (To record the depreciation and the accumulated depreciation) | |||||

| 31 | Salaries expense | 51 | 275 | ||

| Salaries payable | 22 | 275 | |||

| (To record the accrued salaries payable) | |||||

| 31 | Rent expense | 53 | 2,000 | ||

| Prepaid rent | 15 | 2,000 | |||

| (To record the rent expense for April) | |||||

| 31 | Unearned fees | 23 | 7,050 | ||

| Fees earned | 41 | 7,050 | |||

| (To record the receipt of unearned fees) | |||||

Table (24)

Working notes:

(7)

Prepare an adjusted trial balance of Consulting R for April 30, 2016.

Explanation of Solution

An adjusted trial balance of Consulting R for April 30, 2016 is prepared as follows:

|

R Consulting Adjusted Trial Balance April 30, 2016 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 43,535 | |

| Accounts receivable | 12 | 17,790 | |

| Supplies | 14 | 1,225 | |

| Prepaid rent | 15 | 4,000 | |

| Prepaid insurance | 16 | 3,850 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated Depreciation-Office equipment | 19 | 400 | |

| Accounts payable | 21 | 1,600 | |

| Salaries payable | 22 | 275 | |

| Unearned fees | 23 | 2,350 | |

| J’s Capital | 31 | 50,000 | |

| J’s Drawing | 32 | 18,000 | |

| Fees earned | 41 | 64,550 | |

| Salary expense | 51 | 3,575 | |

| Supplies Expense | 52 | 2,800 | |

| Rent Expense | 53 | 2,000 | |

| Depreciation expense | 54 | 400 | |

| Insurance expense | 55 | 350 | |

| Miscellaneous expense | 59 | 1,650 | |

| Total | $119,175 | $119,175 | |

Table (25)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $119,175.

(8)

Prepare an income statement for the year ended April 31, 2016.

Explanation of Solution

An income statement for the year ended April 30, 2016 is as follows:

| R Consulting | ||

| Income Statement | ||

| For the year ended April 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | $64,550 | |

| Expenses: | ||

| Salaries Expense | $3,575 | |

| Supplies Expense | 2,800 | |

| Rent Expense | 2,000 | |

| Depreciation Expense- Building | 400 | |

| Insurance Expense | 350 | |

| Miscellaneous Expense | 1,650 | |

| Total Expenses | 10,775 | |

| Net Income | $53,775 | |

Table (26)

Hence, the net income of R Consulting for the year ended April 30, 2016 is $53,775.

Prepare statement of owners’ equity for the year ended April 30, 2016.

Explanation of Solution

The statement of owners’ equity for the year ended April 30, 2016 is as follows:

| R Consulting | ||

| Statement of Owner’s Equity | ||

| For the Month Ended April 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| JH Capital, April 1, 2016 | ||

| Investments during the month | $50,000 | |

| Add: Net income | 53,775 | |

| Less: Drawings | (18,000) | |

| Increase in owner’s equity | 85,775 | |

| JH Capital, April 31, 2016 | $85,775 | |

Table (27)

Hence, owners’ equity for the month ended April 30, 2016 is $85,775.

Prepare balance sheet of R Consulting at April 30, 2016.

Explanation of Solution

| R Consulting | |||

| Balance Sheet | |||

| At April 30, 2016 | |||

| Assets | |||

| Current Assets: | $ | $ | |

| Cash | 43,535 | ||

| Accounts Receivable | 17,790 | ||

| Supplies | 1,225 | ||

| Prepaid Rent | 4,000 | ||

| Prepaid Insurance | 3,850 | ||

| Total Current Assets | 70,400 | ||

| Property, plant and equipment: | |||

| Office Equipment | 20,000 | ||

| Less: Accumulated Depreciation | 400 | ||

| Total Plant Assets | 19,600 | ||

| Total Assets | 90,000 | ||

| Liabilities | |||

| Current Liabilities: | |||

| Accounts Payable | 1,600 | ||

| Salaries Payable | 275 | ||

| Unearned rent | 2,350 | ||

| Total Liabilities | 4,225 | ||

| Owners’ Equity | |||

| JH’s capital | 85,775 | ||

| Total Liabilities and Owners’ Equity | 90,000 | ||

Table (28)

Therefore, the total assets and total liabilities plus owners’ equity of Consulting R at April 31, 2016 is $90,000.

(9)

Journalize closing entries for R Consulting.

Answer to Problem 5PB

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| April 30, 2016 | Fees Earned | 41 | 64,550 | |

| Income Summary | 33 | 64,550 | ||

| (To record the closure of revenues account ) | ||||

| April 30, 2016 | Income Summary | 33 | 10,775 | |

| Salary Expense | 51 | 3,575 | ||

| Rent Expense | 52 | 2,800 | ||

| Supplies Expense | 53 | 2,000 | ||

| Depreciation Expense- Building | 54 | 400 | ||

| Insurance Expense | 55 | 350 | ||

| Miscellaneous Expense | 59 | 1,650 | ||

| (To close the expenses account. Then the balance amount are transferred to income summary account) | ||||

| April 30, 2016 | Income Summary | 33 | 53,775 | |

| JH Capital | 31 | 53,775 | ||

| (To close balance of income summary are transferred to owners’ capital account) | ||||

| April 30, 2016 | JH’s Capital | 31 | 18,000 | |

| JH’ Drawing | 32 | 18,000 | ||

| (To Close the capital and drawings account) | ||||

Table (29)

Explanation of Solution

- A Service fee earned is revenue account. Since the amount of revenue is closed and transferred to JH’s capital account. Here, G Consulting earned an income of $64,550, and $18,000. Therefore, it is debited.

- Salaries Expense, Rent Expense, Insurance Expense, Utilities Expense, Supplies Expense, Depreciation Expense, Advertising Expense, JH Capital, and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

- Owner’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

- Owner’s drawings are a component of owner’s equity. It is credited because the balance of owners’ drawing account is transferred to owners ‘capital account.

(10)

Journalize closing entries for R Consulting.

Explanation of Solution

Prepare a post–closing trial balance of R Consulting for the month ended April 30, 2016 as follows:

|

Consulting R Post-closing Trial Balance April 30, 2016 | |||

| Particulars | Account Number | Debit $ | Credit $ |

| Cash | 11 | 43,535 | |

| Accounts receivable | 12 | 17,790 | |

| Supplies | 14 | 1,225 | |

| Prepaid rent | 15 | 4,000 | |

| Prepaid insurance | 16 | 3,850 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated depreciation –Office Equipment | 19 | 400 | |

| Accounts payable | 21 | 1,600 | |

| Salaries payable | 22 | 275 | |

| Unearned rent | 23 | 2,350 | |

| JH’s Capital | 31 | 85,775 | |

| Total | $90,400 | $90,400 | |

Table (5)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $90,400.

Want to see more full solutions like this?

Chapter 4 Solutions

Financial Accounting

- Please provide the solution to this financial accounting question using proper accounting principles.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardWhat is the amount includible in income in the first year of withdrawals assuming 12 monthly payments?arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Please give me answer with accounting questionarrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardGinga Marketing Group is a digital marketing business. At the end of its accounting period, December 31, 2023, Ginga had assets of $875,000 and liabilities of $320,000. Determine the net income (or loss) during 2024, assuming that as of December 31, 2024, assets were $960,000, liabilities were $290,000, and no additional capital stock was issued or dividends paid.arrow_forward

- Sara Manufacturing has an asset with an original basis of $45,000, and depreciation has been claimed in the amount of $27,000. If the asset's adjusted basis is $28,000, what is the amount of capital improvements that have been made to the asset? A. $8,000 B. $10,000 C. $18,000 D. $25,000 E. None of these choices are correct.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning