Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 3PB

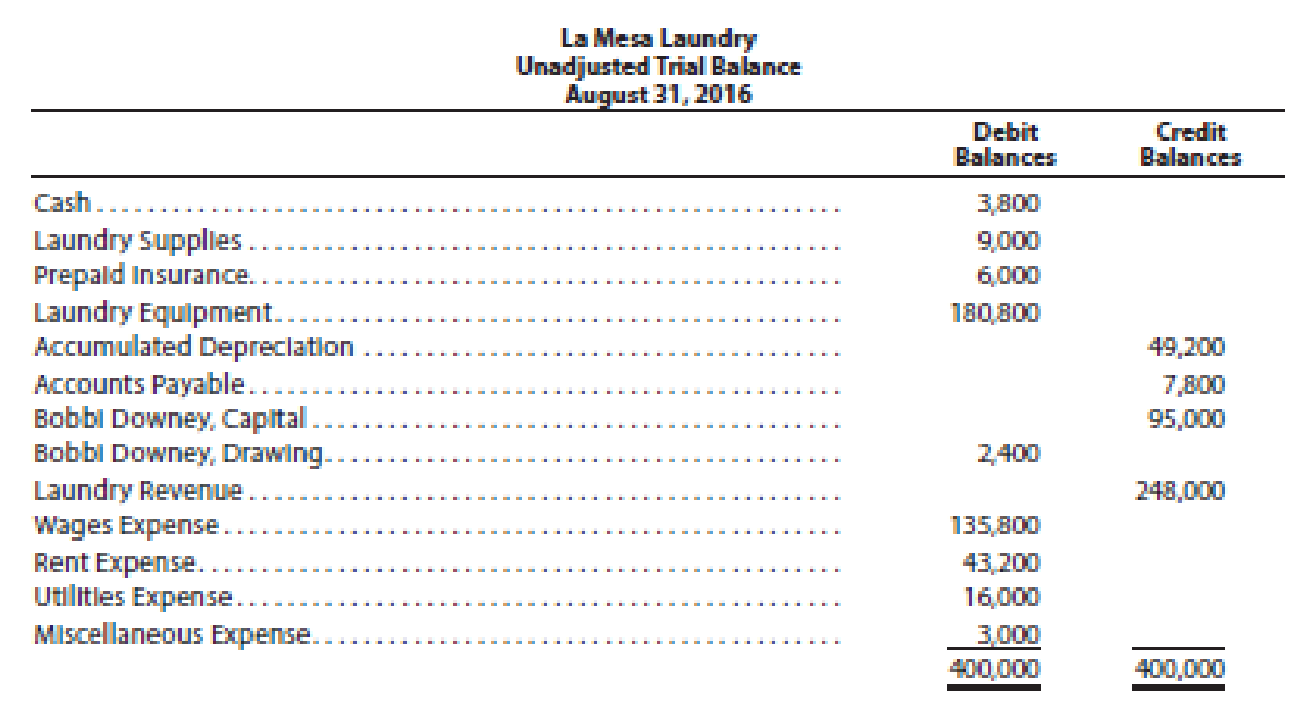

The unadjusted

The data needed to determine year-end adjustments are as follows:

- a. Wages accrued but not paid at August 31 are $2,200.

- b.

Depreciation of equipment during the year is $8,150. - c. Laundry supplies on hand at August 31 are $2,000.

- d. Insurance premiums expired during the year are $5,300.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 31 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

- 3. Journalize and post the

adjusting entries . Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.” - 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of owner’s equity (no additional investments were made during the year), and a

balance sheet . - 6. Journalize and

post the closing entries. Identify the closing entries by “Clos.” - 7. Prepare a post-closing trial balance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

None

accounting?

general accounting question?

Chapter 4 Solutions

Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Recent fiscal years for several well-known...

Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Marcie Davies owns and operates Gemini Advertising...Ch. 4 - Prob. 2PEBCh. 4 - The following accounts appear in an adjusted trial...Ch. 4 - The following accounts appear in an adjusted trial...Ch. 4 - After the accounts have been adjusted at October...Ch. 4 - After the accounts have been adjusted at April 30,...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - Balance sheet data for HQ Properties Company...Ch. 4 - Balance sheet data for Brimstone Company follows:...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Prob. 2ECh. 4 - Bamboo Consulting is a consulting firm owned and...Ch. 4 - Elliptical Consulting is a consulting firm owned...Ch. 4 - The following account balances were taken from the...Ch. 4 - The following revenue and expense account balances...Ch. 4 - FedEx Corporation had the following revenue and...Ch. 4 - Apex Systems Co. offers its services to residents...Ch. 4 - Selected accounts from the ledger of Restoration...Ch. 4 - Prob. 10ECh. 4 - At the balance sheet date, a business owes a...Ch. 4 - Prob. 12ECh. 4 - List the errors you find in the following balance...Ch. 4 - Prob. 14ECh. 4 - Prior to its closing, Income Summary had total...Ch. 4 - After all revenue and expense accounts have been...Ch. 4 - Prob. 17ECh. 4 - Prob. 18ECh. 4 - An accountant prepared the following post-closing...Ch. 4 - Rearrange the following steps in the accounting...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - Prob. 22ECh. 4 - Prob. 23ECh. 4 - Alert Security Services Co. offers security...Ch. 4 - Alert Security Services Co. offers security...Ch. 4 - Prob. 26ECh. 4 - Based on the data in Exercise 4-24, prepare the...Ch. 4 - Based on the data in Exercise 4-25, prepare the...Ch. 4 - Prob. 1PACh. 4 - Finders Investigative Services is an investigative...Ch. 4 - The unadjusted trial balance of Epicenter Laundry...Ch. 4 - The unadjusted trial balance of Lakota Freight Co....Ch. 4 - For the past several years, Steffy Lopez has...Ch. 4 - Last Chance Company offers legal consulting advice...Ch. 4 - The Gorman Group is a financial planning services...Ch. 4 - The unadjusted trial balance of La Mesa Laundry at...Ch. 4 - The unadjusted trial balance of Recessive...Ch. 4 - For the past several years, Jeff Horton has...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Picasso Graphics is a graphics arts design...Ch. 4 - The following is an excerpt from a telephone...Ch. 4 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

- Please help me solve this general accounting problem with the correct financial process.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License