Concept explainers

Ledger accounts,

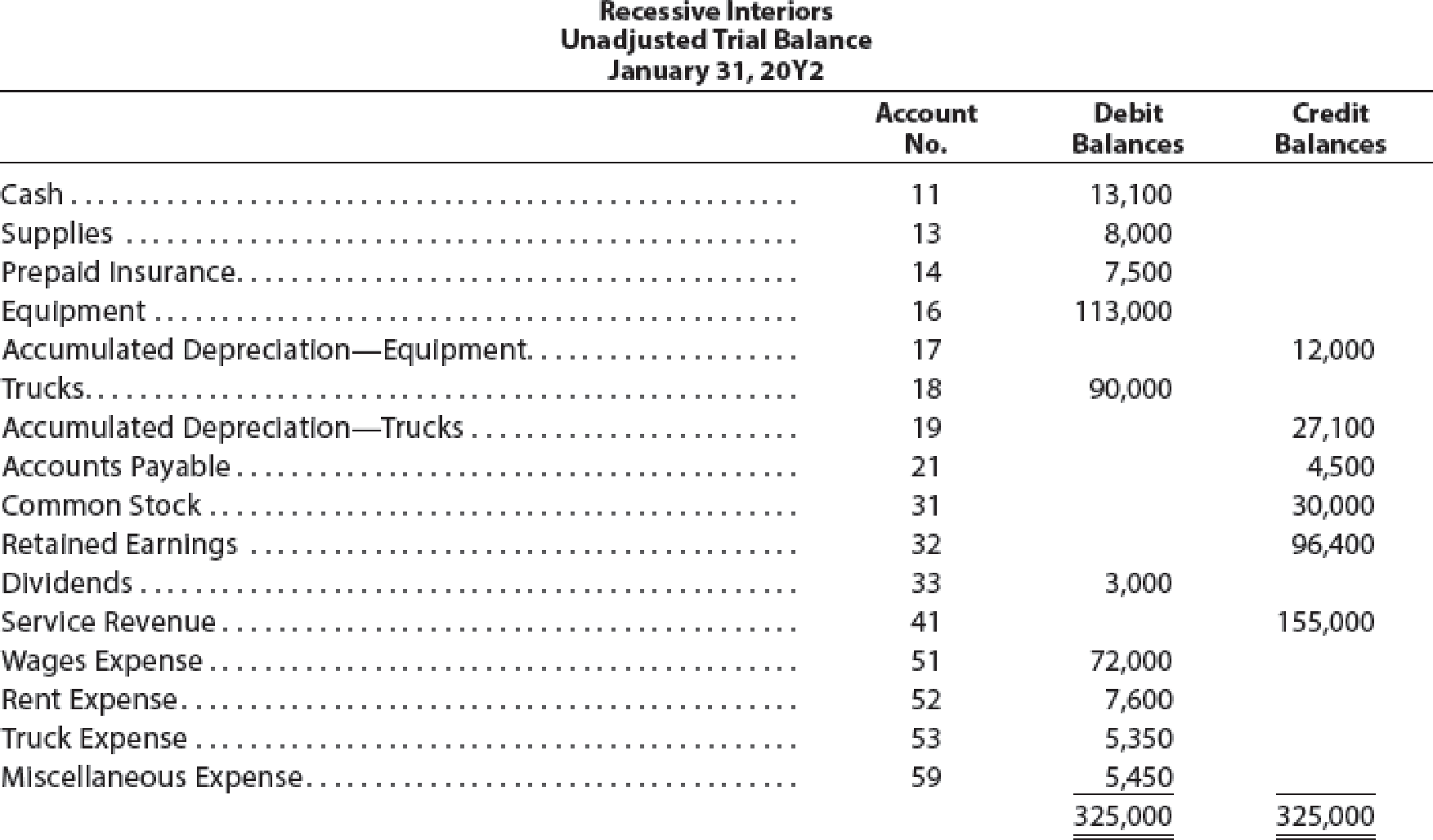

The unadjusted

The data needed to determine year-end adjustments are as follows:

- (a) Supplies on hand at January 31 are $2,850.

- (b) Insurance premiums expired during the year are $3,150.

- (c)

Depreciation of equipment during the year is $5,250. - (d) Depreciation of trucks during the year is $4,000.

- (e) Wages accrued but not paid at January 31 are $900.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

- 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors’ chart of accounts should be used: Wages Payable, 22; Depreciation Expense— Equipment, 54; Supplies Expense, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of stockholders’ equity, and a

balance sheet . During the year ended January 31, 20Y2, additional common stock of $7,500 was issued. - 6. Journalize and

post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. - 7. Prepare a post-closing trial balance.

1, 3 and 6.

Prepare the T-accounts.

Explanation of Solution

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 13,100 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 8,000 | |||

| 31 | Adjusting | 26 | 5,150 | 2,850 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 7,500 | |||

| 31 | Adjusting | 26 | 3,150 | 4,350 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 113,000 | |||

| Account: Accumulated Depreciation-Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 12,000 | |||

| 31 | Adjusting | 26 | 5,250 | 17,250 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 90,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 27,100 | |||

| 31 | Adjusting | 26 | 4,000 | 31,100 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 4,500 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 900 | 900 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 900 | 30,000 | ||

| Account: Retained Earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance |

| 96,400 | |||

| 31 | Closing | 27 | 46,150 | 142,550 | |||

| 31 | Closing | 27 | 3,000 | 139,550 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 3,000 | |||

| 31 | Closing | 27 | 3,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Closing | 27 | 155,000 | 155,000 | ||

| 31 | Closing | 27 | 108,850 | 46,150 | |||

| 31 | Closing | 27 | 46,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 155,000 | |||

| 31 | Closing | 27 | 155,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 1 | Balance | ✓ | 72,000 | |||

| 31 | Adjusting | 26 | 900 | 72,900 | |||

| 31 | Closing | 27 | 72,900 | ||||

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 7,600 | |||

| 31 | Closing | 27 | 7,600 | ||||

| Account: Truck Expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 5,350 | |||

| 31 | Closing | 27 | 5,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 5,250 | 5,250 | ||

| 31 | Closing | 27 | 5,250 | ||||

| Account: Supplies Expenses Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 5,150 | 5,150 | ||

| 31 | Closing | 27 | 5,150 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 4,000 | 4,000 | ||

| 31 | Closing | 27 | 4,000 | ||||

| Account: Insurance expense Account no. 57 | ||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 20Y2 | ||||||||

| January | 31 | Adjusting | 26 | 3,150 | 3,150 | |||

| 31 | Closing | 27 | 3,150 | |||||

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 1 | Balance | ✓ | 5,450 | |||

| 31 | Closing | 27 | 5,450 | ||||

Table (1)

2.

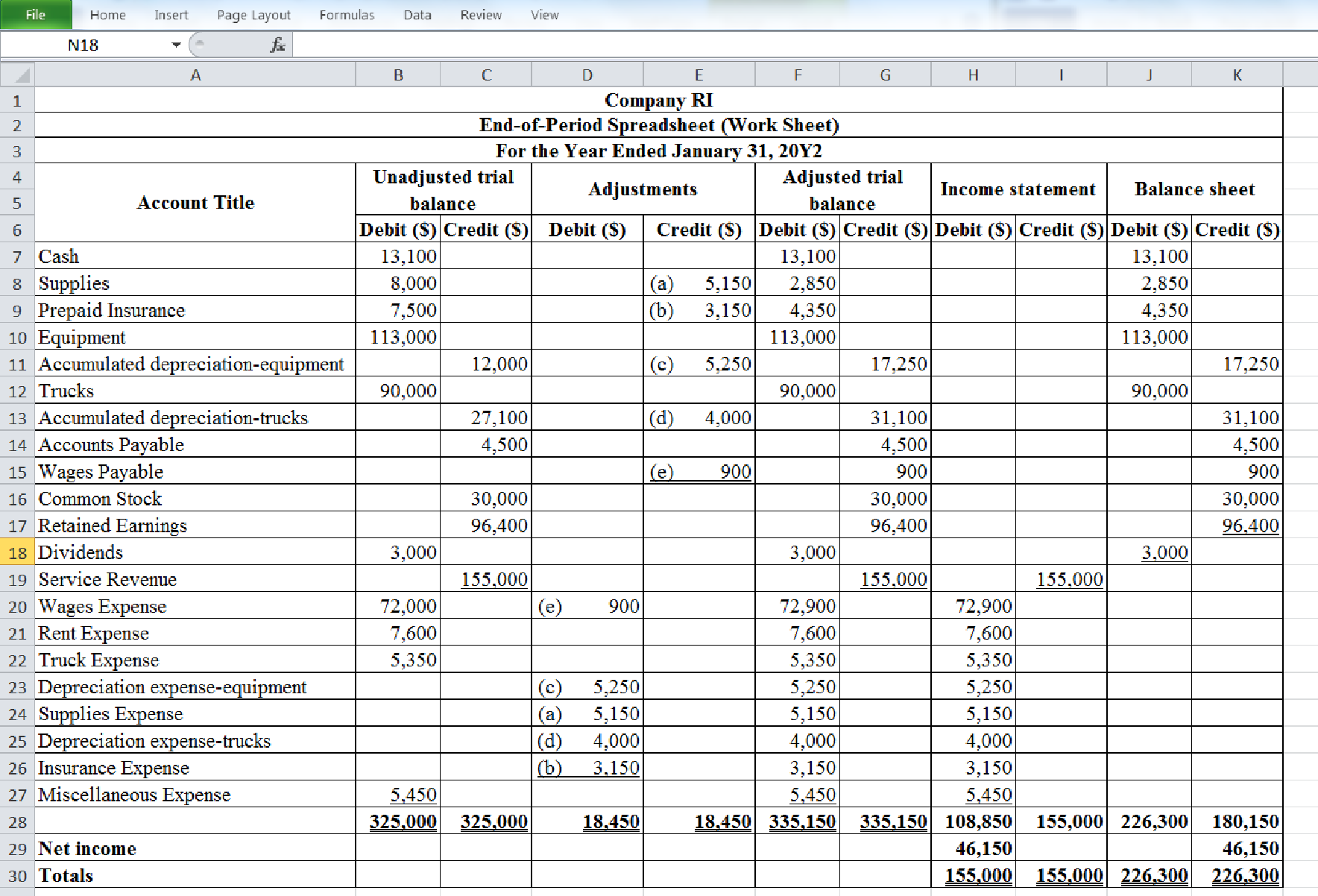

Enter the unadjusted trial balance on an end of period spreadsheet and complete the spread sheet.

Explanation of Solution

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare the end of period spreadsheet and enter the unadjusted trial balance:

Table (2)

3.

Prepare the adjusting entries and post it into the T-accounts.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Prepare the adjusting entries:

| Date | Account title and explanation | Post. Ref. |

Debit ($) | Credit ($) | |

| 20Y2 | |||||

| January | 31 | Supplies Expense | 55 | 5,150 | |

| Supplies | 13 | 5,150 | |||

| (To record the supplies expense) | |||||

| 31 | Insurance Expense | 57 | 3,150 | ||

| Prepaid Insurance | 14 | 3,150 | |||

| (To record the insurance expense) | |||||

| 31 | Depreciation Expense-Equipment | 54 | 5,250 | ||

| Accumulated Depreciation-equipment | 17 | 5,250 | |||

| (To record the depreciation expense) | |||||

| 31 | Depreciation Expense-Trucks | 56 | 4,000 | ||

| Accumulated Depreciation-Trucks | 19 | 4,000 | |||

| (To record the depreciation expense) | |||||

| 31 | Wages Expense | 51 | 900 | ||

| Wages Payable | 22 | 900 | |||

| (To record the wages expense) | |||||

Table (3)

4.

Prepare an adjusted trial balance as of January 31, 20Y2.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance as of January 31, 20Y2:

| Company RI | |||

| Adjusted Trial Balance | |||

| As of January 31, 20Y2 | |||

| Accounts | Account Number | Debit Balances | Credit Balances |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid Insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages Payable | 22 | 900 | |

| Common Stock | 31 | 30,0 00 | |

| Retained earnings | 32 | 96,400 | |

| Dividends | 33 | 3,000 | |

| Service revenue | 41 | 155,000 | |

| Wages expense | 51 | 72,900 | |

| Rent expense | 52 | 7,600 | |

| Truck Expense | 53 | 5,350 | |

| Depreciation Expense- Equipment | 54 | 5,250 | |

| Supplies expense | 55 | 5,150 | |

| Depreciation Expense- Trucks | 56 | 4,000 | |

| Insurance Expense | 57 | 3,150 | |

| Miscellaneous Expense | 59 | 5,450 | |

| Totals | $335,150 | $335,150 | |

Table (4)

5.

Prepare an income statement, a statement of stockholders, equity and a balance sheet for the year ended January 31, 20Y2.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended January 31, 20Y2:

| Company RI | ||

| Income Statement | ||

| For the year ended January 31, 20Y2 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $155,000 | |

| Expenses: | ||

| Wages Expense | $72,900 | |

| Rent Expense | $7,600 | |

| Truck Expense | $5,350 | |

| Depreciation Expense-Equipment | $5,250 | |

| Supplies Expense | $5,150 | |

| Depreciation Expense-Trucks | $4,000 | |

| Insurance Expense | $3,150 | |

| Miscellaneous Expense | $5,450 | ($108,850) |

| Total Expenses | $46,150 | |

Table (5)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and treasury stock, during the year is referred to as statement of stockholders’ equity.

Prepare a statement of stockholders’ equity for the year ended January 31, 20Y2:

| Company RI | |||

| Statement of Stockholders’ Equity | |||

| For the Year Ended January 31, 20Y2 | |||

| Particulars | Common stock | Retained earnings | Total |

| Beginning balances, February 1, 20Y1 | $22,500 | $96,400 | $118,900 |

| Issued common stock | $7,500 | $0 | $7,500 |

| Net income | $0 | $46,150 | $46,150 |

| Dividends | $0 | ($3,000) | ($3,000) |

| Ending balances, January 31, 20Y2 | $30,000 | $139,550 | $169,550 |

Table (6)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of January 31, 20Y2:

| Company RI | |||

| Balance Sheet | |||

| For the year ended January 31, 20Y2 | |||

| Assets | |||

| Current Assets: | Amount ($) | Amount ($) | Amount ($) |

| Cash | $13,100 | ||

| Supplies | 2,850 | ||

| Prepaid Insurance | 4,350 | ||

| Total Current Assets | $20,300 | ||

| Property, plant and equipment: | |||

| Equipment | $113,000 | ||

| Less: Accumulated Depreciation- Equipment | 17,250 | 95,750 | |

| Trucks | 90,000 | ||

| Less: Accumulated Depreciation- Trucks | 31,100 | 58,900 | |

| Total property, plant, and equipment | 154,650 | ||

| Total Assets | $174,950 | ||

| Liabilities | |||

| Current Liabilities: | |||

| Accounts Payable | $4,500 | ||

| Wages Payable | 900 | ||

| Total Liabilities | $5,400 | ||

| Stockholder’s Equity | |||

| Common Stock | 30,000 | ||

| Retained earnings | 139,550 | ||

| Total Stock holder’s Equity | 169,550 | ||

| Total Liabilities and Stockholders’ Equity | $174,950 | ||

Table (7)

6.

Prepare the closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Closing entry for revenue, expense accounts and dividend account:

| Date | Account title and explanation | Post ref | Debit ($) | Credit ($) | |

| 20Y2 | |||||

|

January 31 | Service Revenue | 41 | 155,000 | ||

| Wages Expense | 51 | 72,900 | |||

| Rent Expense | 52 | 7,600 | |||

| Truck Expense | 53 | 5,350 | |||

| Depreciation Expense-Equipment | 54 | 5,250 | |||

| Supplies Expense | 55 | 5,150 | |||

| Depreciation Expense-Trucks | 56 | 4,000 | |||

| Insurance Expense | 57 | 3,150 | |||

| Miscellaneous Expense | 59 | 5,450 | |||

| Retained Earnings (1) | 32 | 46,150 | |||

| (To close the revenue account and expense account to retained earnings account) | |||||

| 20Y2 | Retained Earnings | 32 | 3,000 | ||

|

January 31 | Dividends | 33 | 3,000 | ||

| (To close the dividends accounts to retained earnings account) | |||||

Table (7)

7.

Prepare a post-closing trial balance as of January 31, 20Y2.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance as of January 31, 20Y2:

|

Company RI Post-closing Trial Balance January 31, 20Y2 | |||

| Particulars |

Account Number | Debit $ | Credit $ |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages payable | 22 | 900 | |

| Common Stock | 31 | 30,000 | |

| Retained earnings | 32 | 139,550 | |

| Total | $223,300 | $223,300 | |

Table (8)

Want to see more full solutions like this?

Chapter 4 Solutions

Financial And Managerial Accounting

- HELParrow_forwardWellington Financial Advisors is a financial consulting firm. The firm expects to have $95,000 in indirect costs during the year and bill customers for 12,500 hours. The cost of direct labor is $95 per hour. Calculate the predetermined overhead allocation rate for Wellington Financial Advisors. Need answerarrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardBenjiro Manufacturing, which produces metal furniture, is developing direct labor standards. The basic direct labor rate is $28 per hour. Payroll taxes are 21% of the basic direct labor rate, while fringe benefits such as vacation and health care insurance are $11 per hour. What is the standard rate per direct labor hour?arrow_forward

- Hayden Systems has projected revenues of $8.5 billion, a gross profit margin of 55%, and projected SG&A expenses of $1.7 billion. What is the company's operating (EBIT) margin?arrow_forwardWhat is the book equivalent of taxable income ?arrow_forwardWhat amount of joint cost should be allocated to product beta?arrow_forward

- Deterimine the pension asset/liability at December 31,2023.arrow_forwardAt the beginning of the year, Downtown Athletic had an inventory of $200,000. During the year, the company purchased goods costing $800,000. If Downtown Athletic reported ending inventory of$300,000 and sales of $1,050,000, their cost of goods sold and gross profit rate must be ..........................................arrow_forwardGeneral Accountingarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College