Concept explainers

Ledger accounts,

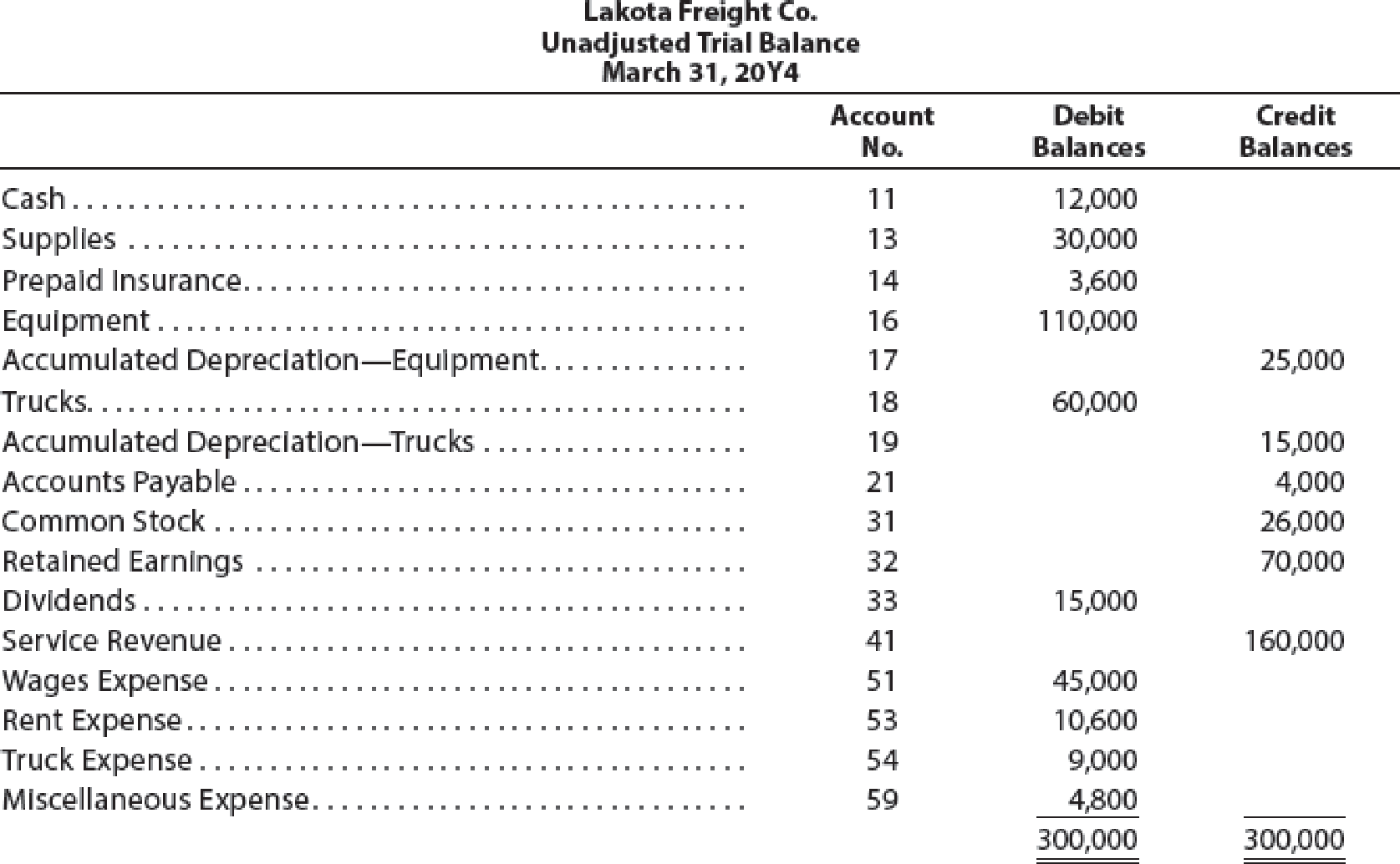

The unadjusted

The data needed to determine year-end adjustments are as follows:

- (a) Supplies on hand at March 31 are $7,500.

- (b) Insurance premiums expired during year are $1,800.

- (c)

Depreciation of equipment during year is $8,350. - (d) Depreciation of trucks during year is $6,200.

- (e) Wages accrued but not paid at March 31 are $600.

Instructions

- 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

- 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.’s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation Expense—Equipment, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of stockholders’ equity, and a

balance sheet . During the year ended March 31, 20Y4, additional common stock of $6,000 was issued. - 6. Journalize and

post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. - 7. Prepare a post-closing trial balance.

1, 3 and 6.

Prepare the T-accounts.

Explanation of Solution

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 12,000 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 30,000 | |||

| 31 | Adjusting | 26 | 22,500 | 7,500 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 3,600 | |||

| 31 | Adjusting | 26 | 1,800 | 1,800 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 110,000 | |||

| Account: Accumulated Depreciation-Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 25,000 | |||

| 31 | Adjusting | 26 | 8,350 | 33,350 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 60,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 15,000 | |||

| 31 | Adjusting | 26 | 6,200 | 21,200 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 4,000 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 600 | 600 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance |

| 26,000 | 26,000 | ||

| Account: Retained Earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 70,000 | |||

| 31 | Closing | 27 | 51,150 | 121,150 | |||

| 31 | Closing | 27 | 15,000 | 106,150 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance |

| 15,000 | |||

| 31 | Closing | 27 | 15,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Closing | 27 | 160,000 | 160,000 | ||

| 31 | Closing | 27 | 108,850 | 51,150 | |||

| 31 | Closing | 27 | 51,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 160,000 | |||

| 31 | Closing | 27 | 160,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 45,000 | |||

| 31 | Adjusting | 26 | 600 | 45,600 | |||

| 31 | Closing | 27 | 45,600 | ||||

| Account: Supplies Expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 22,500 | 22,500 | ||

| 31 | Closing | 27 | 22,500 | ||||

| Account: Rent expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 10,600 | |||

| 31 | Closing | 27 | 10,600 | ||||

| Account: Truck Expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 9,000 | |||

| 31 | Closing | 27 | 9,000 | ||||

| Account: Depreciation Expense- Equipment Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 8,350 | 8,350 | ||

| 31 | Closing | 27 | 8,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 8,350 | 8,350 | ||

| 31 | Closing | 27 | 8,350 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 6,200 | 6,200 | ||

| 31 | Closing | 27 | 6,200 | ||||

| Account: Insurance expense Account no. 57 | |||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||||

| Debit ($) | Credit ($) | ||||||||

| 20Y4 | |||||||||

| March | 31 | Adjusting | 26 | 1,800 | 1,800 | ||||

| 31 | Closing | 27 | 1,800 | ||||||

| Account: Miscellaneous expense Account no. 59 | |||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||||

| Debit ($) | Credit ($) | ||||||||

| 20Y4 | |||||||||

| March | 31 | Balance | ✓ | 4,800 | |||||

| 31 | Closing | 27 | 4,800 | ||||||

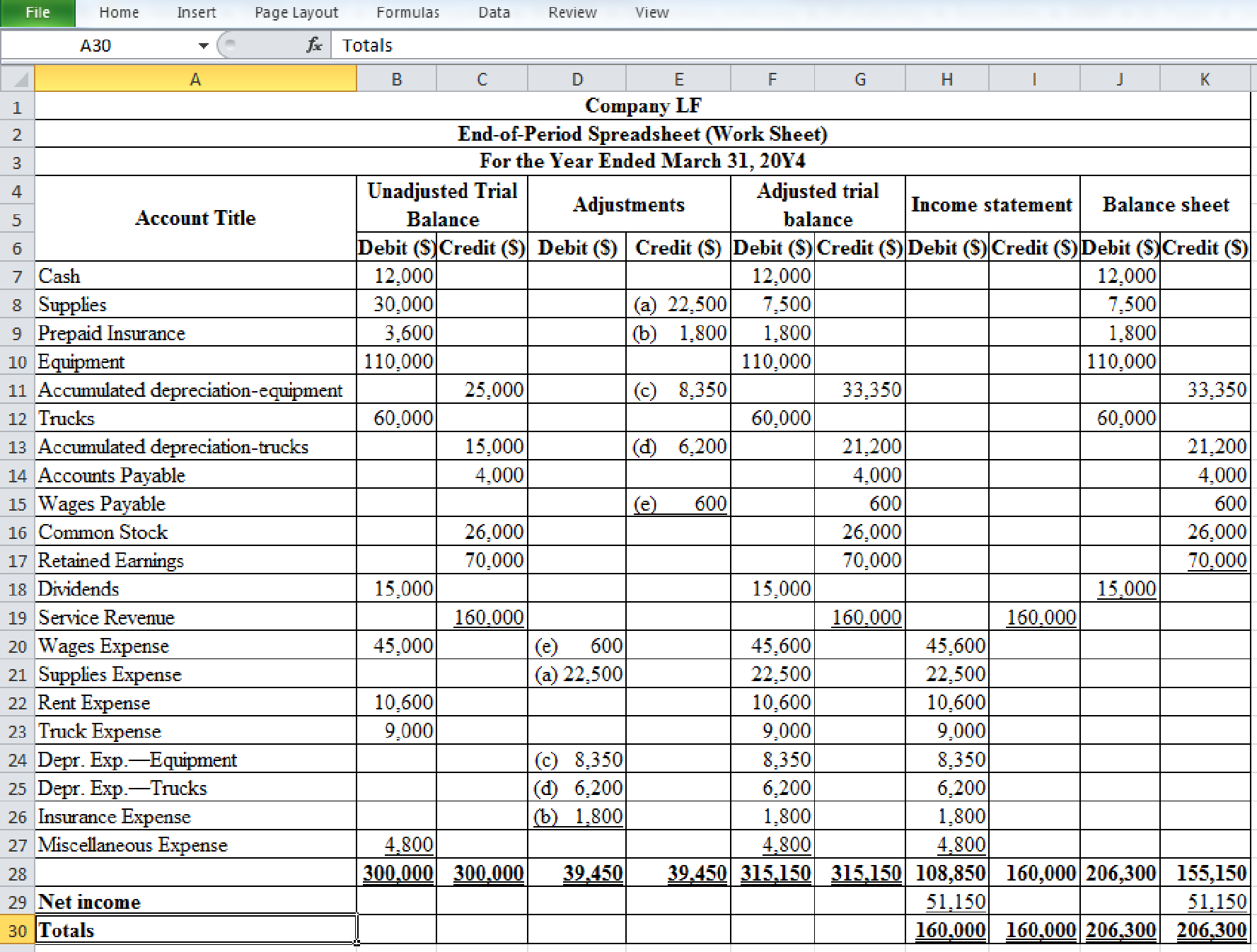

2.

Enter the unadjusted trial balance on an end of period spreadsheet and complete the spread sheet.

Explanation of Solution

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare the end of period spreadsheet and enter the unadjusted trial balance:

Table (1)

3.

Prepare the adjusting entries and post it into the T-accounts.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Prepare the adjusting entries:

| Date | Account title and explanation |

Post. Ref. | Debit ($) | Credit ($) | |

| 20Y4 | Adjusting Entries | ||||

| March 31 | Supplies Expense | 52 | 22,500 | ||

| Supplies | 13 | 22,500 | |||

| (To record the supplies expense used) | |||||

| 20Y4 | Insurance Expense | 57 | 1,800 | ||

| March 31 | Prepaid Insurance | 14 | 1,800 | ||

| (To record the insurance expense) | |||||

| 20Y4 | Depreciation Expense-Equipment | 55 | 8,350 | ||

| March 31 | Accumulated Depreciation-Equipment | 17 | 8,350 | ||

| (To record the depreciation expense for equipment) | |||||

| 20Y4 | Depreciation Expense-Trucks | 56 | 6,200 | ||

| March 31 | Accumulated Depreciation-Trucks | 19 | 6,200 | ||

| (To record the depreciation expense for trucks) | |||||

| 20Y4 | Wages Expense | 51 | 600 | ||

| March 31 | Wages Payable | 22 | 600 | ||

| (To record the wages expense) | |||||

Table (2)

4.

Prepare an adjusted trial balance as of March 31, 20Y4.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance as of March 31, 20Y4:

| Company LF | |||

| Adjusted Trial Balance | |||

| As of March 31, 20Y4 | |||

| Account titles | Account No. | Debit balances | Credit balances |

| Cash | 11 | $12,000 | |

| Supplies | 13 | $7,500 | |

| Prepaid Insurance | 14 | $1,800 | |

| Equipment | 16 | $110,000 | |

| Accumulated Depreciation-Equipment | 17 | $33,350 | |

| Trucks | 18 | $60,000 | |

| Accumulated Depreciation-Trucks | 19 | $21,200 | |

| Accounts Payable | 21 | $4,000 | |

| Wages Payable | 22 | $600 | |

| Common Stock | 31 | $26,000 | |

| Retained Earnings | 32 | $70,000 | |

| Dividends | 33 | $15,000 | |

| Service Revenue | 41 | $160,000 | |

| Wages Expense | 51 | $45,600 | |

| Supplies Expense | 52 | $22,500 | |

| Rent Expense | 53 | $10,600 | |

| Truck Expense | 54 | $9,000 | |

| Depreciation Expense-Equipment | 55 | $8,350 | |

| Depreciation Expense-Trucks | 56 | $6,200 | |

| Insurance Expense | 57 | $1,800 | |

| Miscellaneous Expense | 59 | $4,800 | |

| Totals | $315,150 | $315,150 | |

Table (3)

5.

Prepare an income statement, a statement of stockholders, equity and a balance sheet for the year ended March 31, 20Y4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended March 31, 20Y4:

| Company LF | ||

| Income Statement | ||

| For the Year Ended March 31, 20Y4 | ||

| Particulars | Amount ($) | Amount ($) |

| Service revenue | $160,000 | |

| Expenses: | ||

| Wages expense | $45,600 | |

| Supplies expense | $22,500 | |

| Rent expense | $10,600 | |

| Truck expense | $9,000 | |

| Depreciation expense-equipment | $8,350 | |

| Depreciation expense-trucks | $6,200 | |

| Insurance expense | $1,800 | |

| Miscellaneous expense | $4,800 | |

| Total expenses | ($108,850) | |

| Net income | $51,150 | |

Table (4)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and treasury stock, during the year is referred to as statement of stockholders’ equity.

Prepare a statement of stockholders’ equity for the year ended March 31, 20Y4:

| Company LF | |||

| Statement of Stockholders’ Equity | |||

| For the Year Ended March 31, 20Y4 | |||

| Particulars | Common stock | Retained earnings | Total |

| Beginning balances, April 1, 20Y3 | $ 20,000 | $ 70,000 | $ 90,000 |

| Issued common stock | $ 6,000 | $ 0 | $ 6,000 |

| Net income | $ 0 | $ 51,150 | $ 51,150 |

| Dividends | $ 0 | ($ 15,000) | ($ 15,000) |

| Ending balances, March 31, 20Y4 | $ 26,000 | $ 106,150 | $ 132,150 |

Table (5)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of March 31, 20Y4:

| Company LF | |||

| Balance Sheet | |||

| As of March 31, 20Y4 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current assets: | |||

| Cash | $12,000 | ||

| Supplies | $7,500 | ||

| Prepaid insurance | $1,800 | ||

| Total current assets | $21,300 | ||

| Property, plant, and equipment: | |||

| Equipment | $110,000 | ||

| Accumulated depreciation-equipment | ($33,350) | ||

| Book value-equipment | $76,650 | ||

| Trucks | $60,000 | ||

| Accumulated depreciation-trucks | ($21,200) | ||

| Book value-trucks | $38,800 | ||

| Total property, plant, and equipment | $115,450 | ||

| Total assets | $136,750 | ||

| Liabilities | |||

| Current liabilities: | |||

| Accounts payable | $4,000 | ||

| Wages payable | $600 | ||

| Total liabilities | $4,600 | ||

| Stockholders’ Equity | |||

| Common stock | $26,000 | ||

| Retained earnings | $106,150 | ||

| Total stockholders’ equity | $132,150 | ||

| Total liabilities and stockholders’ equity | $136,750 | ||

Table (6)

6.

Prepare the closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Closing entry for revenue, expense accounts and dividend account:

| Date | Account title and explanation | Post ref | Debit ($) | Credit ($) |

| 20Y4 | Service Revenue | 41 | 160,000 | |

| March 31 | Wages Expense | 51 | 45,600 | |

| Supplies Expense | 52 | 22,500 | ||

| Rent Expense | 53 | 10,600 | ||

| Truck Expense | 54 | 9,000 | ||

| Depreciation Expense-Equipment | 55 | 8,350 | ||

| Depreciation Expense-Trucks | 56 | 6,200 | ||

| Insurance Expense | 57 | 1,800 | ||

| Miscellaneous Expense | 59 | 4,800 | ||

| Retained Earnings | 32 | 51,150 | ||

| (To close the revenue account and expense account to retained earnings account) | ||||

| 20Y4 | Retained Earnings | 32 | 15,000 | |

| March 31 | Dividends | 33 | 15,000 | |

| (To close the dividends accounts to retained earnings account) |

Table (7)

7.

Prepare a post-closing trial balance as of March 31, 20Y4.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance as of March 31, 20Y4:

| Company LF | |||

| Post-Closing Trial Balance | |||

| As of March 31, 20Y4 | |||

| Account title | Account No. | Debit balance | Credit balance |

| Cash | 11 | $12,000 | |

| Supplies | 13 | $7,500 | |

| Prepaid Insurance | 14 | $1,800 | |

| Equipment | 16 | $110,000 | |

| Accumulated Depreciation-Equipment | 17 | $33,350 | |

| Trucks | 18 | $60,000 | |

| Accumulated Depreciation-Trucks | 19 | $21,200 | |

| Accounts Payable | 21 | $4,000 | |

| Wages Payable | 22 | $600 | |

| Common Stock | 31 | $26,000 | |

| Retained Earnings | 32 | $106,150 | |

| Total | $191,300 | $191,300 | |

Table (8)

Want to see more full solutions like this?

Chapter 4 Solutions

Financial And Managerial Accounting

- Journal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated…arrow_forwardJournal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a)arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning