OPEARATIONS MANAG.REV CUSTOM 2017

17th Edition

ISBN: 9781323590058

Author: Pearson

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 48P

Question

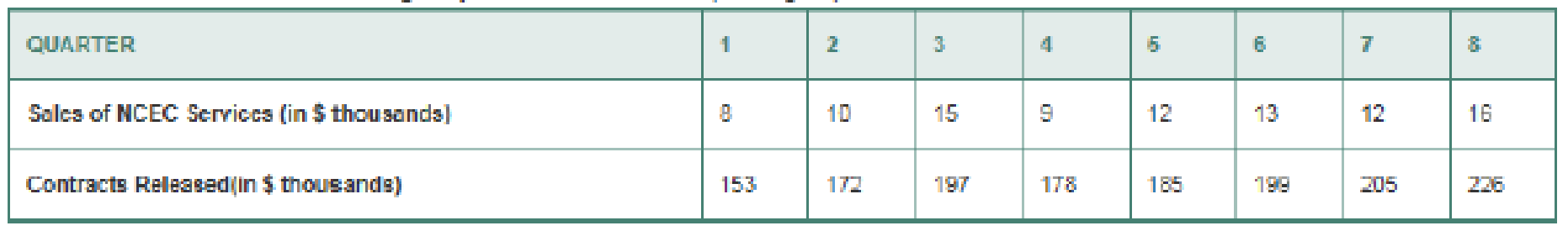

•• 4.48 Dave Fletcher, the general manager of North Carolina Engineering Corporation (NCEC), thinks that his firm’s engineering services contracted to highway construction firms are directly related to the volume of highway construction business contracted with companies in his geographic area. He wonders if this is really so, and if it is, can this information help him plan his operations better by

- a. Using this data, develop a regression equation for predicting the level of demand of NCEC’s services.

- b. Determine the coefficient of correlation and the standard error of the estimate.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Work with the chef and/or production manager to identify a menu item (or potential menu item) for which a standardized

recipe is needed.

Record the recipe with which you started and expand it to meet the number of servings required by the facility. Develop an

evaluation rubric.

Conduct an evaluation of the product. There should be three or more people evaluating the product for quality.

Write a brief report of this activity

•

Product chosen and the reason why it was selected

When and where the facility could use the product

The standardized recipe sheet or card

。

o

Use the facility's format or

Design one of your own using a form of your choice; be sure to include the required elements

•

•

Recipe title

Yield and portion size

Cooking time and temperature

Ingredients and quantities

Specify AP or EP

Procedures (direction)

ASSIGNMENT: Inventory, Answer the following questions

1. How does the facility survey inventory?

2. Is there a perpetual system in place?

3. How often do they do a physical inventory?

4. Participate in taking inventory.

5. Which type of stock system does the facility use?

A. Minimum stock- includes a safety factor for replenishing stock

B. Maximum stock- equal to a safety stock plus estimated usage (past usage and forecasts)

C. Mini-max-stock allowed to deplete to a safety level before a new order is submitted to bring up

inventory up to max again

D. Par stock-stock brought up to the par level each time an order is placed regardless of the amount on

hand at the time of order

E. Other-(describe)

Choose an appropriate product and determine how much of an item should be ordered. Remember the

formula is:

Demand during lead time + safety stock = amount to order

Cost out an inventory according to data supplied. Remember that to do this, you will need to take an

inventory, and will need to…

Human Relations, Systems, and Organization Assignments

ORGANIZATION:

Review the organization chart for the facility

• Draw an organization chart for the department.

•

.

Identify and explain the relationships of different units in the organization and their importance to maintain

the food service department's mission.

Include a copy in your weekly submission. There is a feature in PowerPoint for doing this should you want

to use it.

JOB ORGANIZATION:

⚫ A job description is a broad, general, and written statement for a specific job, based on the findings of a job

analysis. It generally includes duties, purpose, responsibilities, scope, and working conditions of a job

along with the job's title, and the name or designation of the person to whom the employee reports. Job

description usually forms the basis of job specification.

•

Work with your preceptor or supervisor to identify a position for which you will write a job description.

Include a copy of the job description you write in your…

Chapter 4 Solutions

OPEARATIONS MANAG.REV CUSTOM 2017

Ch. 4 - What is a qualitative foretasting model, and when...Ch. 4 - Identify and briefly describe the two general...Ch. 4 - Identify the three forecasting time horizons....Ch. 4 - Briefly describe the steps that are used to...Ch. 4 - A skeptical manager asks what medium-range...Ch. 4 - Explain why such forecasting devices as moving...Ch. 4 - What is the basic difference between a weighted...Ch. 4 - What three methods are used to determine the...Ch. 4 - Research and briefly describe the Delphi...Ch. 4 - What is the primary difference between a...

Ch. 4 - Define time series.Ch. 4 - What effect does the value of the smoothing...Ch. 4 - Explain the value of seasonal indices in...Ch. 4 - Which forecasting technique can place the most...Ch. 4 - In your own words, explain adaptive forecasting.Ch. 4 - What is the purpose of a tracking signal?Ch. 4 - Explain, in your own words, the meaning of the...Ch. 4 - What is the difference between a dependent and an...Ch. 4 - Give examples of industries that are affected by...Ch. 4 - Give examples of industries in which demand...Ch. 4 - Prob. 21DQCh. 4 - The following gives the number of pints of type B...Ch. 4 - 4.2 a. Plot the above data on a graph. Do you...Ch. 4 - Refer to Problem 4.2. Develop a forecast for years...Ch. 4 - A check-processing center uses exponential...Ch. 4 - The Carbondale Hospital is considering the...Ch. 4 - The monthly sales for Yazici Batteries, Inc., were...Ch. 4 - The actual demand for the patients at Omaha...Ch. 4 - Daily high temperatures in St. Louis for the last...Ch. 4 - Lenovo uses the ZX-81 chip in some of its laptop...Ch. 4 - Data collected on the yearly registrations for a...Ch. 4 - Use exponential smoothing with a smoothing...Ch. 4 - Consider the following actual and forecast demand...Ch. 4 - As you can see in the following table, demand for...Ch. 4 - Following are two weekly forecasts made by two...Ch. 4 - Refer to Solved Problem 4.1 on page 138. a. Use a...Ch. 4 - Solved example 4.1 Sales of Volkswagens popular...Ch. 4 - Refer to Solved Problem 4.1. Using smoothing...Ch. 4 - Consider the following actual (At) and forecast...Ch. 4 - Income at the architectural firm Spraggins and...Ch. 4 - Question 4.20 Resolve Problem 4.19 with =.1 and ...Ch. 4 - Question 4.21 Refer to the trend-adjusted...Ch. 4 - Question 4.22 Refer to Problem 4.21. Complete the...Ch. 4 - Question 4.23 Sales of quilt covers at Bud Baniss...Ch. 4 - Question 4.24 Mark Gershon, owner of a musical...Ch. 4 - Question 4.25 The following gives the number of...Ch. 4 - Prob. 26PCh. 4 - Question 4.27 George Kyparisis owns a company...Ch. 4 - Question 4.28 Attendance at Orlandos newest...Ch. 4 - Question 4.29 North Dakota Electric Company...Ch. 4 - Lori Cook has developed the following forecasting...Ch. 4 - Prob. 31PCh. 4 - Question 4.32 The following data relate the sales...Ch. 4 - Question 4.33 The number of internal disk drives...Ch. 4 - Question 4.34 The number of auto accidents in...Ch. 4 - Question 4.35 Rhonda Clark, a Slippery Rock,...Ch. 4 - Accountants at the Tucson firm, Larry Youdelman,...Ch. 4 - Sales of tablet computers at Ted Glickmans...Ch. 4 - Question 4.38 City government has collected the...Ch. 4 - Dr. Lillian Fok, a New Orleans psychologist,...Ch. 4 - Using the data in Problem 4.39, apply linear...Ch. 4 - Bus and subway ridership for the summer months in...Ch. 4 - CEO John Goodale, at Southern Illinois Power and...Ch. 4 - Emergency calls to the 911 system of Durham, North...Ch. 4 - Using the 911 call data in Problem 4.43, forecast...Ch. 4 - The following are monthly actual and forecast...Ch. 4 - Thirteen students entered the business program at...Ch. 4 - Question 4.47 Storrs Cycles has just started...Ch. 4 - Question 4.48 Dave Fletcher, the general manager...Ch. 4 - Question 4.49 Boulanger Savings and Loan is proud...Ch. 4 - Case study Southwestern University: (B) This...Ch. 4 - Case study Southwestern University: (B) This...Ch. 4 - Southwestern University: (B) This integrated case...Ch. 4 - For its first 2 decades of existence, the NBAs...Ch. 4 - For its first 2 decades of existence, the NBAs...Ch. 4 - For its first 2 decades of existence, the NBAs...Ch. 4 - For its first 2 decades of existence, the NBAs...Ch. 4 - Forecasting at Hard Rock Cafe Video Case With the...Ch. 4 - Forecasting at Hard Rock Cafe Video Case With the...Ch. 4 - Forecasting at Hard Rock Cafe Video Case With the...Ch. 4 - Forecasting at Hard Rock Cafe Video Case With the...Ch. 4 - Forecasting at Hard Rock Cafe Video Case With the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- ASSIGNMENT: Production Sheet Watch at least 3 workers prepare foods. Write down what they do and the amount of time it takes for them to complete the task. Calculate the production cost. Example: Food Item: Green Beans Time Worker #1 Worker #2 Worker #3 Start End Time (Hours) Time Time Activity Activity Activity (Hours) (Hours) 11:45 am 12:01 pm 0.27 Steam and 0.05 Microwave blenderize pureed frozen green green beans beans 16.25 Total Production Time 3 minutes minutes Hourly Wage $16.07 $12.28 24% Benefits *** $3.86 $2.95 Labor Costs $5.37 $0.76 *** Check with facility to see Benefit %arrow_forwardMenu Planning and Quality Monitoring Rotation site: Hospital/Commercial Foodservice Rotation Objectives: Menu development (this will be your Theme Meal) 1. Develop a modified menu (vegetarian, vegan, gluten-free, etc.) that is appropriate in texture, color, flavor, eye appeal, temperature, and methods of preparation. 2. Develop a menu that takes into consideration food preferences due to clients' ethnicity and age group. 3. Develop menus that fulfill the nutritional needs of the target population. 4. Develop a modified menu that maintains consistency with a regular menu. 5. Demonstrate knowledge of operational constraints and limitations when designing menus 6. Identify appropriate type and amounts of foods for an emergency plan. ACTIVITY: Quality improvement monitoring 1. Participates in rounds to get feedback from clients on Theme Meal menu. 2. Takes corrective actions if necessary according to results of the quality measures 3. Completes one or more critical incident reports for the…arrow_forwardWork with the chef and/or production manager to identify a menu item (or potential menu item) for which a standardized recipe is needed. Record the recipe with which you started and expand it to meet the number of servings required by the facility. Develop an evaluation rubric. Conduct an evaluation of the product. There should be three or more people evaluating the product for quality. Write a brief report of this activity • Product chosen and the reason why it was selected When and where the facility could use the product The standardized recipe sheet or card ○ Use the facility's format or о Design one of your own using a form of your choice; be sure to include the required elements Recipe title " Yield and portion size ■ Cooking time and temperature Ingredients and quantities Specify AP or EP Procedures (direction)arrow_forward

- Item Prepared: Work with one or more cold food production workers to learn job descriptions, flow of work, how the menu items are prepared and served, and needs for further training or process improvement. Document a specific menu item you prepared. Record the temperature of a product when it goes into the refrigerator or blast chiller. Record how long it took for the product to cool to the appropriate temperature. Evaluate the menu item you were involved in preparing. Follow the product and process to completion and utilize resources to correct any wrong procedures you observe. Take your notes and write a brief report of the actual experience based on the following criteria: 1. Pre-preparation 2. Preparation 3. Compare menu item to diets it is used for by completing a nutritional analysis 4. Temperatures during and after preparation. 5. Tray service to patient or guest (how it looks, holds up, appropriate temperature maintained from production through delivery) 6. Waste disposal (what…arrow_forwardWork with one or more hot food production workers to learn job descriptions, flow of work, how the menu items are prepared and served, and needs for further training or process improvement. Document a specific menu item you prepared. Record the temperature of a product when it is done. If it is to be chilled and reheated later, systematically measure the temperature every 30 minutes and record how long it takes the product to reach a safe temperature for storage. Evaluate the menu item you were involved in preparing. Follow the product and process to completion and utilize resources to correct any wrong procedures you observe. Take notes and write a brief report of the actual experience based on the following criteria: 1. Pre-preparation 2. Preparation 3. Compare menu item to diets it is used for by completing a nutritional analysis 4. Temperatures during and after preparation. 5. Tray service to patient or guest (how it looks, holds up, appropriate temperature maintained from…arrow_forwardRefrigerated/Freezer- Dietary Mangement (Nursing Home) Describe the refrigerated/freezer storage area and procedures. Are any of the refrigerated/ frozen areas locked? Who has access? What kind of shelving is used? Are there any products stored on the floor? Are the items dated as received? How is the stock rotated to ensure that the oldest items are used first? Are temperature and humidity monitored? If yes, how? Has mold ever been a problem? Are there any regular procedures in place to control it? How often are the refrigerated/freezer storage areas cleaned?arrow_forward

- RECEIVING AND STORAGE ASSIGNMENTS- Dietary Mangement (Nursing Home) ASSIGNMENT: Diagram the receiving and storage areas. Use arrows to show the flow of goods as they are received and moved to storage. ASSIGNMENT: In order to accurately understand this area, the intern should work in the receiving area to complete the following assignments and answer the following questions: Inspect the delivery and check it against the purchase Inspect the delivery against the invoice Accept order only if all quantities and quality specifications are met Check perishable items first Check temperatures of refrigerated and frozen items on arrival Look for evidence of thawing or freezer burn Randomly open cases to check contents Complete receiving records Transfer goods to appropriate storage Who checks the packing slip against the invoice? Does the facility ever use “blind” receiving where the receiving clerk checks the order against an invoice where the amounts have been blanked out and the clerk…arrow_forwardPurchasing, Receiving, Storage, and Inventory Instructions- Dietary management in a nursing home in ABQ NM What workers are involved in the purchasing, receiving, storage and inventory process. Complete the table below: Position Description of their job duties Date/ What did they do? Answer the questions below: PURCHASING: 1. Is there a centralized purchasing department for the facility? If yes, observe someone in that department for a half day if possible, if no write N/A 2. What kinds of items are required to go out for formal bid? 3. What about capital purchases? What is the dollar amount at which an item must go on the capital rather than the operating budget? 4. Does the facility participate with a group to cooperatively purchase items? 5. Is there a Prime Vendor? If yes, how often is the contract renegotiated? 6. Is informal or open-market buying used for any items? Which ones? 7. Who orders…arrow_forwardCritical Incident Report- Dietary Mangement Critical incidences involve critical thinking and problem solving techniques. This exercise is the opportunity to analyze and decide on the appropriateness of the action and to determine better ways to solve problems, approach employees and get the job done. This exercise should help in doing it better the next time. As you observe or become more involved in the situations that require problem solving or critical thinking use this exercise to identify the what, who, and when and determine how the actions taken or not taken affected the outcome. You must write up two or more experiences. The summary is to include two parts: 1. Objective data of what occurred and how it occurred: 2. Analysis of what happened and what we could or would have done to make the outcome better.arrow_forward

- Prepare a graph of the monthly forecasts and average forecast demand for Chicago Paint Corp., a manufacturer of specialized paint for artists. Compute the demand per day for each month (round your responses to one decimal place). Month B Production Days Demand Forecast Demand per Day January 21 950 February 19 1,150 March 21 1,150 April 20 1,250 May 23 1,200 June 22 1,000' July 20 1,350 August 21 1,250 September 21 1,050 October 21 1,050 November 21 December 225 950 19 850arrow_forwardThe president of Hill Enterprises, Terri Hill, projects the firm's aggregate demand requirements over the next 8 months as follows: 2,300 January 1,500 May February 1,700 June 2,100 March April 1,700 1,700 July August 1,900 1,500 Her operations manager is considering a new plan, which begins in January with 200 units of inventory on hand. Stockout cost of lost sales is $125 per unit. Inventory holding cost is $25 per unit per month. Ignore any idle-time costs. The plan is called plan C. Plan C: Keep a stable workforce by maintaining a constant production rate equal to the average gross requirements excluding initial inventory and allow varying inventory levels. Conduct your analysis for January through August. The average monthly demand requirement = units. (Enter your response as a whole number.) In order to arrive at the costs, first compute the ending inventory and stockout units for each month by filling in the table below (enter your responses as whole numbers). Ending E Period…arrow_forwardMention four early warning indicators that a business may be at risk.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Marketing

Marketing

ISBN:9780357033791

Author:Pride, William M

Publisher:South Western Educational Publishing

Contemporary Marketing

Marketing

ISBN:9780357033777

Author:Louis E. Boone, David L. Kurtz

Publisher:Cengage Learning

Introduction to Forecasting; Author: Ekeeda;https://www.youtube.com/watch?v=5eIbVXrJL7k;License: Standard YouTube License, CC-BY