Concept explainers

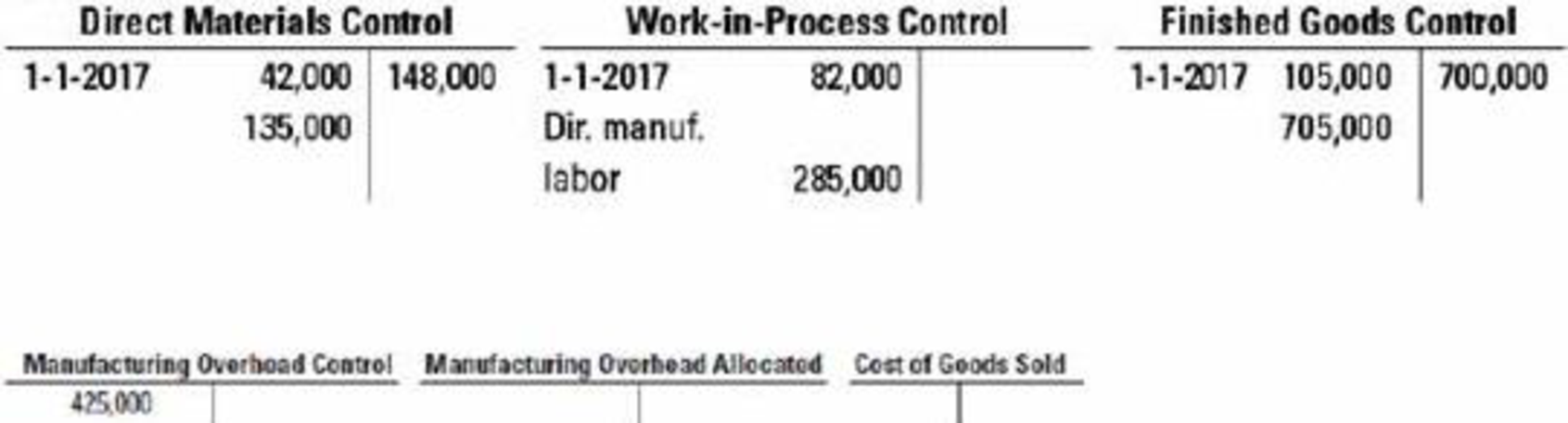

General ledger relationships, under- and overallocation. (S. Sridhar adapted) Keezel Company uses normal costing in its

Additional information follows:

- a. Direct manufacturing labor wage rate was $15 per hour.

- b. Manufacturing

overhead was allocated at $20 per direct manufacturing labor-hour. - c. During the year sales revenues were $1,550,000, and marketing and distribution costs were $810,000.

- 1. What was the amount of direct materials issued to production during 2017?

Required

- 2. What was the amount of manufacturing overhead allocated to jobs during 2017?

- 3. What was the total cost of jobs completed during 2017?

- 4. What was the balance of work-in-process inventory on December 31, 2017?

- 5. What was the cost of goods sold before proration of under- or overallocated overhead?

- 6. What was the under- or overallocated manufacturing overhead in 2017?

- 7. Dispose of the under- or overallocated manufacturing overhead using the following:

- a. Write-off to Cost of Goods Sold

- b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold

- 8. Using each of the approaches in requirement 7, calculate Keezel’s operating income for 2017.

- 9. Which approach in requirement 7 do you recommend Keezel use? Explain your answer briefly.

Learn your wayIncludes step-by-step video

Chapter 4 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Accounting (12th Edition)

- Delta Manufacturing has a standard wage rate of $12.50 per direct labor- hour (DLH), and each unit of output requires 5.2 DLHs. In June, 3,200 units were produced, the actual wage rate was $12.20 per DLH, and the actual hours worked were 17,500 DLHs. Compute the Labor Efficiency Variance for June.arrow_forwardWhat is Greenleaf's 2021 return on common stockholders' equity?arrow_forwardKindly help me with accounting questionsarrow_forward

- Check my work The finance director for the City of Green Falls printed the General Fund Revenues and Appropriations Ledgers shown below for the year just ended. REVENUES LEDGER Ref. Account Description Est. Revenues Dr(Cr) Revenues Balance Cr(Dr) Dr(Cr) Estimated Revenues-Taxes-Real Property 102 Budget Authorization 6,452,400 6,452,400 103 Accrued Revenue 104 Previous Deferral 109 Deferral 6,455,000 345,000 (308,000) (2,600) (347,600) (39,600) 110 Budget Amendment 111 Closing entry 40,000 (6,492,400) 400 (6,492,000) 112 Closing entry (6,492,000) Estimated Revenues-Taxes-Sales 102 Budget Authorization. 103 Received in Cash 110 Budget Amendment 111 Closing Entry 112 Closing Entry 736,250 (25,000) (711,250) 710,600 736,250 25,650 650 (710,600) (710,600) e Q Search ་ PRE a 1 < 2/arrow_forwardPrecision Tools Inc. has the following information related to its direct materials usage: Standard Quantity: 120,000 units Actual Quantity: 140,000 units Standard Price: $2.50 per unit Actual Price: $2.80 per unit A. Calculate the materials price variance and state whether it is favorable or unfavorable. B. Calculate the materials usage variance and state whether it is favorable or unfavorable.arrow_forwardJob Costing: The warehouse supervisor at Alpha Electronics implements a strict cycle counting process where system accuracy must stay above 99%. Daily variances between 1-2% require immediate recount, while those exceeding 2% trigger supervisor review and investigation. During today's audit of electronic components, the system showed 2,400 items, but physical count revealed only 2,356 items present in the warehouse. The supervisor needs to determine the variance percentage before deciding on next steps.??arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning