Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

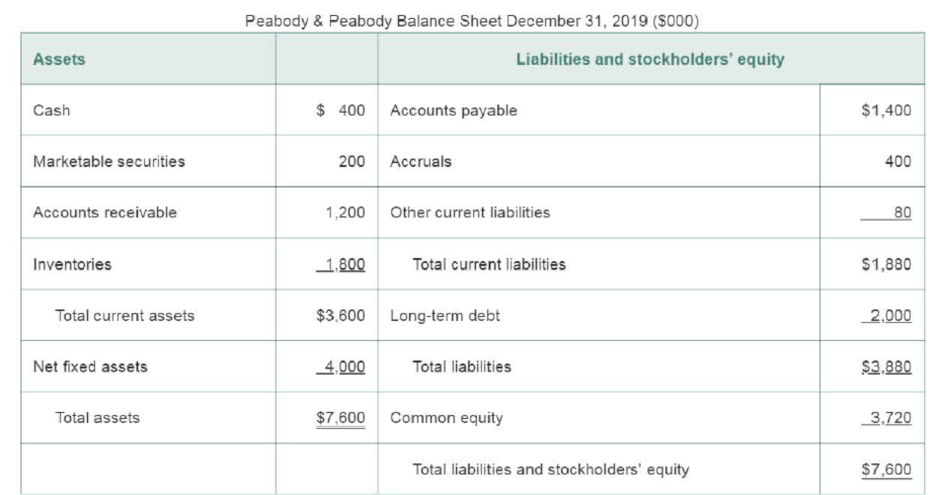

Chapter 4, Problem 4.19P

Learning Goal 5

P4-19 Pro forma

- 1. The percent of sales for items that vary directly with sales are as follows:

Accounts receivable, 12%

Inventory, 18%

Accounts payable, 14%

Net profit margin, 3%

- 2. Marketable securities and other current liabilities are expected to remain unchanged.

- 3. A minimum cash balance of $480,000 is desired.

- 4. A new machine costing $650,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Total

depreciation in 2020 isforecast as $290,000, and in 2021 $390,000 of depreciation will be taken. - 5. Accruals are expected to rise to $500,000 by the end of 2021.

- 6. No sale or retirement of long-term debt is expected.

- 7. No sale or repurchase of common stock is expected.

- 8. The dividend payout of 50% of net profits is expected to continue.

- 9. Sales are expected to be $11 million in 2020 and $12 million in 2021.

- 10. The December 31, 2019, balance sheet follows.

- a. Prepare a pro forma balance sheet dated December 31, 2021.

- b. Discuss the financing changes suggested by the statement prepared in part a.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Wizzy Wigs is an unleveraged firm with $80 million in total assets, 2 million shares outstanding, and $15 million in EBIT. The shares price is $40, tax adjusted cost of debt 4.61%, and corporate tax rate of 21%. What are the returns on equity (ROEs) for the firm if it shifts to a 0.75 debt-to-equity ratio and for an individual with 700 shares who created homemade leverage at the same DE ratio?

◻ firm 25.61%; inv. 24.99%

firm 18.24%; inv. 19.46%

firm 38.59%; inv. 35.53%

firm 23.19%; inv. 22.46%

firm 30.07%; inv. 30.19%

Please show work on excel spreadsheet

You are running a hot Internet company. Analysts predict that its earnings will grow at 20% per year for the next 9 years. After that, as

competition increases, earnings growth is expected to slow to 4% per year and continue at that level forever. Your company has just announced

earnings of $4 million. What is the present value of all future earnings if the interest rate is 9%? (Assume all cash flows occur at the end of the year.)

The present value of all future earnings is

million. (Round to two decimal places.)

3. Losses for an insurance company next year are estimated to be 100 million with standard deviation

250 million. Using lognormal and two-parameter Pareto distributions to obtain the VaR at the

95%, 97.5%, 99% security levels. Comment on your findings.

Chapter 4 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 4.1 - Prob. 4.1RQCh. 4.1 - Prob. 4.2RQCh. 4.2 - Briefly describe the first four modified...Ch. 4.2 - Describe the overall cash flow through the firm in...Ch. 4.2 - Prob. 4.5RQCh. 4.2 - 4-B Why is depreciation (as well as amortization...Ch. 4.2 - Prob. 4.7RQCh. 4.2 - Prob. 4.8RQCh. 4.2 - Prob. 4.9RQCh. 4.3 - Prob. 4.10RQ

Ch. 4.3 - Prob. 4.11RQCh. 4.3 - Prob. 4.12RQCh. 4.3 - What is the cause of uncertainty in the cash...Ch. 4.4 - Prob. 4.14RQCh. 4.5 - Prob. 4.15RQCh. 4.5 - Prob. 4.16RQCh. 4.6 - Prob. 4.17RQCh. 4.6 - What is the significance of the plug figure,...Ch. 4.7 - Prob. 4.19RQCh. 4.7 - Prob. 4.20RQCh. 4 - Opener-in-Review The chapter opener described a...Ch. 4 - Learning Goals 2, 3 ST4-1 Depreciation and cash...Ch. 4 - Prob. 4.2STPCh. 4 - Prob. 4.3STPCh. 4 - Prob. 4.1WUECh. 4 - Prob. 4.2WUECh. 4 - Learning Goal 3 E4-3 Determine the operating cash...Ch. 4 - Prob. 4.4WUECh. 4 - Learning Goal 5 E4-5 Rimier Corp. forecasts sales...Ch. 4 - Prob. 4.1PCh. 4 - Learning Goal 2 P4-2 Depreciation In early 2019,...Ch. 4 - Prob. 4.3PCh. 4 - Learning Goals 2, 3 P4-4 Depreciation and...Ch. 4 - Learning Goal 3 P4-5 Classifying inflows and...Ch. 4 - Prob. 4.6PCh. 4 - Learning Goal 4 P4-8 Cash receipts A firm has...Ch. 4 - Learning Goal 4 P4-9 Cash disbursements schedule...Ch. 4 - Learning Goal 4 P4-10 Cash budget: Basic Grenoble...Ch. 4 - Prob. 4.11PCh. 4 - Learning Goal 4 P4-12 Cash budget: Advanced The...Ch. 4 - Prob. 4.13PCh. 4 - Prob. 4.14PCh. 4 - Learning Goal 4 P4-15 Multiple cash budgets:...Ch. 4 - Learning Goal 5 P4-16 Pro forma income statement...Ch. 4 - Learning Goal 5 P4-17 Pro forma income statement:...Ch. 4 - Learning Goal 5 P4-18 Pro forma balance sheet:...Ch. 4 - Learning Goal 5 P4-19 Pro forma balance sheet...Ch. 4 - Learning Goal 5 P4-20 Integrative: Pro forma...Ch. 4 - Learning Goal 5 P4-21 Integrative: Pro forma...Ch. 4 - Prob. 4.22PCh. 4 - Prob. 1SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company sold 4 million shares in its IPO, at a priceof $18.50 per share. Management negotiated a fee(the underwriting spread) of 7% on this transaction.What was the dollar cost of this fee?arrow_forwardConsider the following three bonds (see Table 1), which all have a par value of $100 and pay coupons semiannually if the coupon rate is not zero. What is the 6.5-year spot rate on a BEY basis? Bond Coupon Rate Price Maturity(yrs) A 106 3 6 75 B 0 6 115 C 4 6.5arrow_forwardProblem 6-8 Project Evaluation Dog Up! Franks is looking at a new sausage system with an installed cost of $445,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $53,000. The sausage system will save the firm $139,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $25,000. If the tax rate is 23 percent and the discount rate is 11 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forward

- An investment has an expected return of X percent per year, is expected to make annual payments of $3,170 for 7 years, is worth $14,532, and the first payment is expected in 1 year What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou just took out a loan for $29,449 that requires annual payments of $4,570 for 20 years. The interest rate on the loan is X percent per year and the first regular payment will be made in 1 year. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardCould you please help explain the follow-up interviews in a data collecting method? How is to use the follow-up interviews in qualitative data collection methods? Could the qualitative data collection methods can be used in the thematic analysis?arrow_forward

- We often hear about the importance of financial statement analysis. Given the various statements prepared and all the information included therein, the question becomes which of the financial statements should get a closer review and why? Explain what the basic financial statements are and what is the purpose of each statement. Within the different statements, in your opinion what is/are the key areas of information to focus on and why? Be specific as to the importance of your selection.arrow_forwardDon't used hand raiting and don't used Ai solutionarrow_forwardRevision Questions for This Week Suppose you see the following regression table: earnings Coef. Std. Err. married 7737.006 265.0139 _cons 9058.677 210.3906 1. What are the 95 confidence intervals for (i) the intercept, (ii). the slope, rounded to the second decimal place? 2. Are any of the coefficients statistically significant at the 5% level of significance? Explain. 3. Return to the t-statistic example from earlier (below). Do either of the 95% confidence intervals contain zero? Should they? log(wage) = .284.092 educ· (.104) (.007)arrow_forward

- Kenji’s Tax Scenario Kenji is a young professional with taxable income of $138,000 as an advertising account executive. What is Kenji’s total tax liability? (Note: Round your answer to the nearest cent, if necessary.) What is Kenji’s top marginal tax rate? What is Kenji's average tax rate?arrow_forward1. A project manager is using the payback method to make the final decision on which project to undertake. The company has a 9% required rate of return and expects a 5% rate of inflation for the following five years. i. ii. What is the non-discounted payback of a project that has cash flows as shown in the table? What is the rate of return? (use equation given in class) Cash Outflow Cash inflow Net Flow Year 10 $500,000 0 1 12. * 0 $75,000 & $50,000 $150,000 3 $200,000 $350,000 4 0 $150,000 5 0 $750,000arrow_forwardProblem 4. Consider the following balance sheet for Watchover Savings Incorporated (in millions): Assets Liabilities and Equity Floating-rate mortgages (currently 12% per annum) Now deposits (currently 8% per $ 82 annum) $ 116 30-year fixed-rate loans (currently 9% per annum) 5-year time deposits (currently 8% per 101 annum) 29 Equity 38 $ 183 Total $ 183 Total a. What is Watchover's expected net interest income at year-end? b. What will be the net interest income at year-end if interest rates rise by 3 percent? c. Using the one-year cumulative repricing gap model, what is the change in the expected net interest income for a 3 percent increase in interest rates?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY