Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.10.2MBA

Gross profit percent and markup percent

Companies with low gross profit and markup percents often have higher volumes of sales than companies with high gross profit and markup percents.

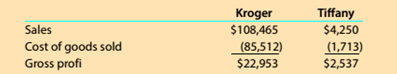

The following data (in millions) were adapted from recent financial statements of The Kroger Co. (KR) and Tiffany & Co. (TIF) Kroger operates supermarkets, while Tiffany designs and sells jewelry, china, watches, and other expensive merchandise.

Compute the gross profit percent and average markup percent Kroger and Tiffany. Round to one decimal place.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the firm's debt equity ratio accounting question

Need answer

Hello teacher please give me solution

Chapter 4 Solutions

Survey of Accounting (Accounting I)

Ch. 4 - If merchandise purchased on account is returned,...Ch. 4 - Prob. 2SEQCh. 4 - Prob. 3SEQCh. 4 - On a multiple-step income statement, the excess of...Ch. 4 - As of December 31, 20Y4, Ames Corporation's...Ch. 4 - What distinguishes a retail business from a...Ch. 4 - Prob. 2CDQCh. 4 - Prob. 3CDQCh. 4 - Prob. 4CDQCh. 4 - Prob. 5CDQ

Ch. 4 - When you purchase a new car, the “sticker price”...Ch. 4 - Prob. 7CDQCh. 4 - Differentiate between the multiple and single-step...Ch. 4 - Prob. 9CDQCh. 4 - Can a business earn a gross profit but incur a net...Ch. 4 - Prob. 11CDQCh. 4 - Prob. 12CDQCh. 4 - Determining gross profit During the current year,...Ch. 4 - Determining cost of goods sold For a recent year,...Ch. 4 - Purchase-related transaction Burr Company...Ch. 4 - Purchase-related transactions A retailer Is...Ch. 4 - Prob. 4.5ECh. 4 - Prob. 4.6ECh. 4 - Determining amounts to be paid on invoices...Ch. 4 - Prob. 4.8ECh. 4 - Sales-related transactions After the amount due on...Ch. 4 - Sales-related transactions Merchandise is sold on...Ch. 4 - Prob. 4.11ECh. 4 - Prob. 4.12ECh. 4 - Prob. 4.13ECh. 4 - Prob. 4.14ECh. 4 - Adjustment for merchandise inventory shrinkage...Ch. 4 - Adjustment for Customer Refunds and Returns Assume...Ch. 4 - Prob. 4.17ECh. 4 - Multiple-step income statement On March 31, 20Y5,...Ch. 4 - Single-step income statement Summary operating...Ch. 4 - Multiple-step income statement Identify the enurs...Ch. 4 - Purchase-related transactions The following...Ch. 4 - Sales-related transactions The- following selected...Ch. 4 - Prob. 4.3PCh. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Single-step income statement Selected accounts and...Ch. 4 - Prob. 4.5.2PCh. 4 - Prob. 4.6.1PCh. 4 - Prob. 4.6.2PCh. 4 - Prob. 4.1MBACh. 4 - Sales transactions Using transactions listed in...Ch. 4 - Prob. 4.3MBACh. 4 - Prob. 4.4MBACh. 4 - Prob. 4.5.1MBACh. 4 - Gross margin percent and markup percent Target...Ch. 4 - Gross margin percent and markup percent Target...Ch. 4 - Prob. 4.6MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Prob. 4.7.2MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Prob. 4.9MBACh. 4 - Prob. 4.10.1MBACh. 4 - Gross profit percent and markup percent Companies...Ch. 4 - Prob. 4.10.3MBACh. 4 - Prob. 4.1CCh. 4 - Prob. 4.2CCh. 4 - Prob. 4.3.1CCh. 4 - Determining cost of purchase The following is an...Ch. 4 - Prob. 4.4.1CCh. 4 - Prob. 4.4.2CCh. 4 - Prob. 4.4.3CCh. 4 - Prob. 4.5C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Helparrow_forwardGeneral accountingarrow_forwardTower Company owned a service truck that was purchased at the beginning of Year 1 for $48,000. It had an estimated life of three years and an estimated salvage value of $3,000. Tower company uses straight-line depreciation. Its financial condition as of January 1, Year 3, is shown on the first line of the horizontal statements model. In Year 3, Tower Company spent the following amounts on the truck: January 4 Overhauled the engine for $7,600. The estimated life was extended one additional year, and the salvage value was revised to $2,000. July 6 Obtained oil change and transmission service, $410. August 7 Replaced the fan belt and battery, $510. December 31 Purchased gasoline for the year, $9,100. December 31 Recognized Year 3 depreciation expense. Required Record the Year 3 transactions in a statements model. Note: In the Statement of Cash Flows column, use the initials OA for operating activities, FA for financing activities, or IA for investing activity. Enter any decreases to…arrow_forward

- Cara's Cookie Company provided the following accounts from its year-end trial balance. (Click the icon to view the year-end trial balance accounts.) The company is subject to a 35% income tax rate. Requirement Prepare a multiple-step income statement for the current year. Trial balance Cara's Cookie Company Adjusted Trial Balance (Selected Accounts) For the Current Year Ended Account Debit Credit Prepare Cara's multiple-step income statement for the current year, one section at a time. (List the subheadings in the order they Cara's Cookie Company Statement of Net Income Common Stock (no par): Beginning Balance Retained Earnings: Beginning Balance $ 462,000 1,200,000 Accumulated Other Comprehensive Income: Beginning Balance Dividends $ 63,000 69,000 Sales 3,200,000 For the Current Year Ended Sales Less: Cost of Goods Sold 3,200,000 610,000 Interest Income 3,800 Dividend Income 3,600 Gross Profit Operating Expenses: Selling Expenses: Gain on Disposal of Plant Assets 92,000 2,590,000…arrow_forwardHistory 口 AA 1 ୪ Fri Feb 14 2:45 PM Mc Gw Mini Cases Qmcgrow hill goodweek tires pr × | Ask a Question | bartleby × + Bookmarks Profiles Tab Window Help Graw McGraw Hill MC ☑ Hill prod.reader-ui.prod.mheducation.com/epub/sn_d82a5/data-uuid-0e12dd568f3f4e438c00faed4ea436f1 Chrome File Edit View Λ LTI Launch 88 Netflix YouTube A BlackBoard Mail - Stiffler, Zac... SBI Jobs E Aa Finish update: ☐ All Bookmarks Goodweek Tires, Inc. After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5…arrow_forwardDamerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.arrow_forward

- Subject: general Accountingarrow_forwardHow much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Markup and Markdown; Author: GreggU;https://www.youtube.com/watch?v=EFtodgI46UM;License: Standard Youtube License