Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

13th Edition

ISBN: 9781337800594

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

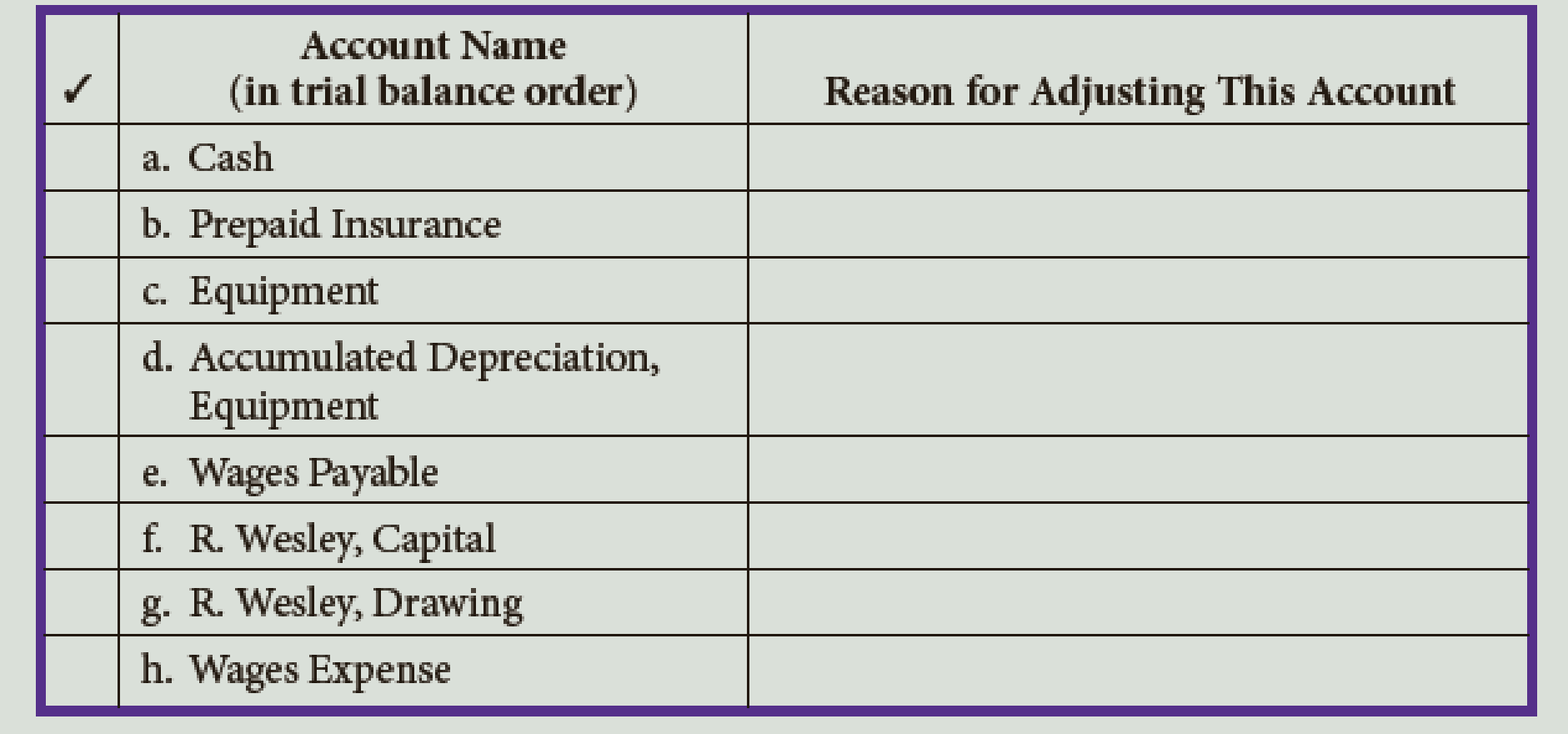

Chapter 4, Problem 3E

Place a check mark next to any account(s) requiring adjustment. Explain why those accounts must be adjusted.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

KIARA LIMITED

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:

ASSETS

Property, plant and equipment (cost)

Accumulated depreciation

Long-term investments

Inventory

Accounts receivable

Company tax paid in advance

Bank

EQUITY AND LIABILITIES

2024

2023

R

R

2 490 000

1 620 000

(630 000)

660 000

1 050 000

1 230 000

30 000

(480 000)

450 000

1 290 000

900 000

0

750 000

660 000

5 580 000

4 440 000

Ordinary share capital

2 700 000

2 000 000

Retained income

1 500 000

1 158 000

Long-term loan from Kip Bank (15%)

900 000

1 000 000

Accounts payable

480 000

228 000

Company tax payable

0

54 000

5 580 000

4 440 000

ADDITIONAL INFORMATION

All purchases and sales are on credit.

Interim dividends paid during the year amounted to R150 750.

Credit terms of 3/10 net 60 days are granted by creditors.

Accounting Question

REQUIRED

Study the information given below and answer the following questions. Where discount factors are required

use only the four decimals present value tables that appear after the formula sheet or in the module guide.

Ignore taxes.

5.1 Calculate the Accounting Rate of Return on average investment of the second alternative

(expressed to two decimal places).

5.2 Determine which of the two investment opportunities the company should choose by

calculating the Net Present Value of each alternative. Your answer must include the

calculation of the present values and NPV.

5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal

places). Your answer must include two net present value calculations (using consecutive

rates/percentages) and interpolation.

INFORMATION

The management of Bentall Incorporated is considering two investment opportunities:

(5 marks)

(9 marks)

(6 marks)

The first alternative involves the purchase of a new machine for R900 000 which…

Chapter 4 Solutions

Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- REQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forwardWhat is the expected return on a portfolio with a beta of 0.8 on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License