Concept explainers

Recording Transactions (Including Adjusting Journal Entries), Preparing Financial Statements and Closing Journal Entries, and Computing Net Profit Margin and

Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1, 2017. The annual reporting period ends December 31. The

Transactions during 2018 (summarized in thousands of dollars) follow:

- a. Borrowed $22 cash on July 1, 2018, signing a six-month note payable.

- b. Purchased equipment for $25 cash on July 2, 2018.

- c. Issued additional shares of common stock for $5 on July 3.

- d. Purchased software on July 4, $3 cash.

- e. Purchased supplies on July 5 on account for future use, $7.

- f. Recorded revenues on December 6 of $55, including $8 on credit and $47 received in cash.

- g. Recognized salaries and wages expense on December 7 of $30; paid in cash.

- h. Collected

accounts receivable on December 8, $9. - i. Paid accounts payable on December 9, $10.

- j. Received a $3 cash deposit on December 10 from a hospital for a contract to start January 5, 2019.

Data for adjusting journal entries on December 31:

- k. Amortization for 2018, $1.

- l. Supplies of $3 were counted on December 31, 2018.

- m. Depreciation for 2018, $4.

- n. Accrued interest of $1 on notes payable.

- o. Salaries and wages incurred but not yet paid or recorded, $3.

- p. Income tax expense for 2018 was $4 and will be paid in 2019.

Required:

- 1. Set up T-accounts for the accounts on the trial balance and enter beginning balances. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you.

- 2. Record journal entries for transactions (a) through (j).

- 3. Post the journal entries from requirement 2 to T-accounts and prepare an unadjusted trial balance. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you using your answers to requirement 2.

- 4. Record the adjusting journal entries (k) through (p).

- 5. Post the

adjusting entries from requirement 4 and prepare an adjusted trial balance. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you using your previous answers. - 6. Prepare an income statement, statement of

retained earnings , andbalance sheet . - 7. Prepare the closing

journal entry . - 8.

Post the closing entry from requirement 7 and prepare a post-closing trial balance. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you using your previous answers. - 9. How much net income did the physical therapy clinic generate during 2018? What was its net profit margin? Is the business financed primarily by liabilities or stockholders’ equity? What is its current ratio?

1, 3, 5 and 8

Prepare the necessary T-account for the given transactions.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Prepare the T-account:

| Cash (A) account | |||

| Beginning Balance | $7 | ||

| a | 22 | ||

| c | 5 | b | $25 |

| f | 47 | d | 3 |

| h | 9 | g | 30 |

| j | 3 | j | 10 |

| Ending Balance | $25 | ||

| Accounts Receivable (A) account | |||||||

| Beginning Balance | 3 | ||||||

| f | 8 | h | 9 | ||||

| Ending Balance | 2 | ||||||

|

Supplies(A) account | |||||||

| Beginning Balance | 3 | ||||||

| e | 7 | ||||||

| 10 | |||||||

| l | 7 | ||||||

| Ending Balance | 3 | ||||||

|

Equipment (A) account | |||||||

| Beginning Balance | 8 | ||||||

| b | 25 | ||||||

| Ending Balance | 33 | ||||||

| Accumulated depreciation -Equipment (xA) account | |||

| Beginning Balance |

1 | ||

| k | 4 | ||

| Ending Balance | 5 | ||

| Software (A) account | |||

| Beginning Balance | 5 | ||

| d | 3 | ||

| Ending Balance | 8 | ||

|

Accumulated Amortization (xA) account | |||

| Beginning Balance | 1 | ||

| k | 1 | ||

| Ending Balance | 2 | ||

|

Accounts payable (L) account | |||

| Beginning Balance | 5 | ||

| i | 10 | e | 7 |

| Ending Balance | 2 | ||

|

Notes payable (L) account | |||

| Beginning Balance | 0 | ||

| a | 22 | ||

| Ending Balance | 22 | ||

| Salaries and wages payable (L) account | |||

| Beginning Balance | 0 | ||

| o | 3 | ||

| Ending Balance | 3 | ||

| Interest payable (L) | |||

| Beginning Balance | 0 | ||

| n | 1 | ||

| Ending Balance | 1 | ||

| Income tax payable (L) account | |||

| p | 4 | ||

| Ending Balance | 4 | ||

Deferred revenue (L) account

| j | 3 | ||

| Ending Balance | 3 | ||

|

Common Stock (SE) account | |||

| Beginning Balance |

15 | ||

| c | 5 | ||

| Ending Balance | 20 | ||

| Retained earnings (SE) account | |||

| Beginning Balance | 4 | ||

| CE1 | 5 | ||

| Ending Balance | 9 | ||

| Service Revenue (R) account | |||

| f | 55 | ||

| CE1 | 55 | ||

| Ending Balance | 0 | ||

| Depreciation expense (E) account | |||

| m | 4 | ||

| CE1 | 4 | ||

| Ending Balance | 0 | ||

| Amortization Expense ( E) account | |||

| Beginning Balance | 0 | ||

| k | 1 | ||

| CE1 | 1 | ||

| Ending Balance | 0 | ||

| Income Tax Expense ( E) account | |||

| p | 4 | ||

| CE1 | 4 | ||

| Ending Balance | 0 | ||

| Interest Expense ( E) account | |||

| n | 1 | ||

| CE1 | 1 | ||

| Ending Balance | 0 | ||

| Salaries and Wages Expense(E) account | |||

| g | 30 | ||

| o | 3 | CE1 | 33 |

| Ending Balance | 0 | ||

| Supplies Expense ( E) account | |||

| l | 7 | ||

| CE1 | 7 | ||

| Ending Balance | 0 | ||

2.

Record the necessary journal entries for transactions (a) to (j).

Explanation of Solution

Record the necessary journal entries for transactions (a) to (j) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| a) | Cash (+A) | 22 | |||

| Notes payable (Short-term) (+L) | 22 | ||||

| (To record borrowed cash on note) | |||||

| b) | Equipment (+A) | 25 | |||

| Cash (-A) | 25 | ||||

| (To record purchase of equipment) | |||||

| c) | Cash (+A) | 5 | |||

| Common Stock (+SE) | 5 | ||||

| (To record issued common stock for cash) | |||||

| d) | Software (+A) | 3 | |||

| Cash (-A) | 3 | ||||

| (To record Purchase of additional software) | |||||

| e) | Supplies (+A) | 7 | |||

| Accounts payable (+L) | 7 | ||||

| (To record supplies purchased for future use) | |||||

| f) | Cash (+A) | 47 | |||

| Accounts Receivable (+A) | 8 | 55 | |||

| Service Revenue (+R, +SE) | |||||

| (To record service revenue earned during the year 2018) | |||||

| g) | Salaries and Wages Expense (+E, -SE) | 30 | |||

| Cash (-A) | 30 | ||||

| (To record salaries and wages expense incurred during 2018) | |||||

| h) | Cash (+A) | 9 | |||

| Accounts Receivable (-A) | 9 | ||||

| (To record cash collected on customer’s account) | |||||

| i) | Accounts payable (-L) | 10 | |||

| Cash (-A) | 10 | ||||

| (To record cash paid to creditors) | |||||

| j) | Cash (+A) | 3 | |||

| Deferred Revenue (+L) | 3 | ||||

| (To record receiving of customers deposit before doing work) | |||||

Table (1)

3.

Prepare an unadjusted trial balance based on requirement 2.

Explanation of Solution

Prepare an unadjusted trial balance based on requirement 2 as follows:

| Incorporation NPT | ||

| Unadjusted Trial Balance | ||

| At December 31, 2018 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 25 | |

| Accounts Receivable | 2 | |

| Supplies | 10 | |

| Equipment | 33 | |

| Accumulated Depreciation–Equipment | 1 | |

| Software | 8 | |

| Accumulated Amortization | 1 | |

| Accounts Payable | 2 | |

| Notes Payable (short–term) | 22 | |

| Salaries and Wages Payable | ||

| Interest Payable | ||

| Income Tax Payable | ||

| Deferred revenue | 3 | |

| Common Stock | 20 | |

| Retained Earnings | 4 | |

| Service Revenue | 55 | |

| Salaries and Wages Expense | 30 | |

| Supplies Expense | ||

| Depreciation Expense | ||

| Amortization Expense | ||

| Interest Expense | ||

| Income Tax Expense | ||

| Total | 108 | 108 |

Table (2)

4.

Record the adjusting journal entries from transaction (k) to (p).

Explanation of Solution

Record the adjusting journal entries from transaction (k) to (p) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) | ||

| k. | Amortization Expense (+E, -SE) | 1 | |||

| Accumulated Amortization (+xA, -A) | 1 | ||||

| (To record adjusting entry for amortization expenses) | |||||

| l. | Supplies expense (+E, -SE) (refer working note 1) | 7 | |||

| Supplies(-A) | 7 | ||||

| (To record the use of supplies) | |||||

| m. | Depreciation expense (+E, -SE) | 4 | |||

| Accumulated depreciation –Equipment (+xA, -A) | 4 | ||||

| (To record adjusting entry for depreciation expense) | |||||

| n. | Interest expense (+E, -SE) | 1 | |||

| Interest payable(+L) | 1 | ||||

| (To record the adjusting entry for interest expense) | |||||

| o. | Salaries and wages expense (+E, -SE) | 3 | |||

| Salaries and wages payable (+L) | 3 | ||||

| (To record the adjusting entry for salaries and wages expenses) | |||||

| p. | Income tax expense(+E, -SE) | 4 | |||

| Income tax payable(+L) | 4 | ||||

| (To record the adjusting entry for income tax expense) | |||||

Table (3)

Working note 1:

Calculate the value of supplies expenses:

5.

Prepare an adjusted trial balance from requirement 4.

Explanation of Solution

Prepare an adjusted trial balance for Incorporation NPT for December 31, 2018 as follows:

| Incorporation NPT | ||

| Adjusted Trial Balance | ||

| At December 31, 2018 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 25 | |

| Accounts Receivable | 2 | |

| Supplies | 3 | |

| Equipment | 33 | |

| Accumulated Depreciation–Equipment | 5 | |

| Software | 8 | |

| Accumulated Amortization | 2 | |

| Accounts Payable | 2 | |

| Notes Payable (short–term) | 22 | |

| Salaries and Wages Payable | 3 | |

| Interest Payable | 1 | |

| Income Tax Payable | 4 | |

| Deferred revenue | 3 | |

| Common Stock | 20 | |

| Retained Earnings | 4 | |

| Service Revenue | 55 | |

| Salaries and Wages Expense | 33 | |

| Supplies Expense | 7 | |

| Depreciation Expense | 4 | |

| Amortization Expense | 1 | |

| Interest Expense | 1 | |

| Income Tax Expense | 4 | |

| Total | 121 | 121 |

Table (4)

6.

Prepare an income statement, Statement of retained earnings and balance sheet.

Explanation of Solution

Prepare an income statement for the year ended December 31, 2018 as follows:

| Incorporation NPT | ||

| Income Statement | ||

| For the year ended December 31, 2018 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Service revenue | 55 | |

| Total revenues | 55 | |

| Less: Expenses | ||

| Salaries and wage expense | 33 | |

| Supplies expense | 7 | |

| Amortization expense | 1 | |

| Depreciation expense | 4 | |

| Interest expense | 1 | |

| Income tax expense | 4 | |

| Total expenses | 50 | |

| Net income | 5 | |

Table (5)

Prepare a statement of retained earnings as follows:

| Incorporation NPT | ||

| Statement of Retained Earnings | ||

| For the year ended December 31, 2018 | ||

| (in thousands) | ||

| Particulars | Amount ($) | Amount ($) |

| Balance, January 1, 2018 | 4 | |

| Add: Net income | 5 | |

| 9 | ||

| Less: Dividends | (0) | |

| Balance, December 31, 2018 | 9 | |

Table (6)

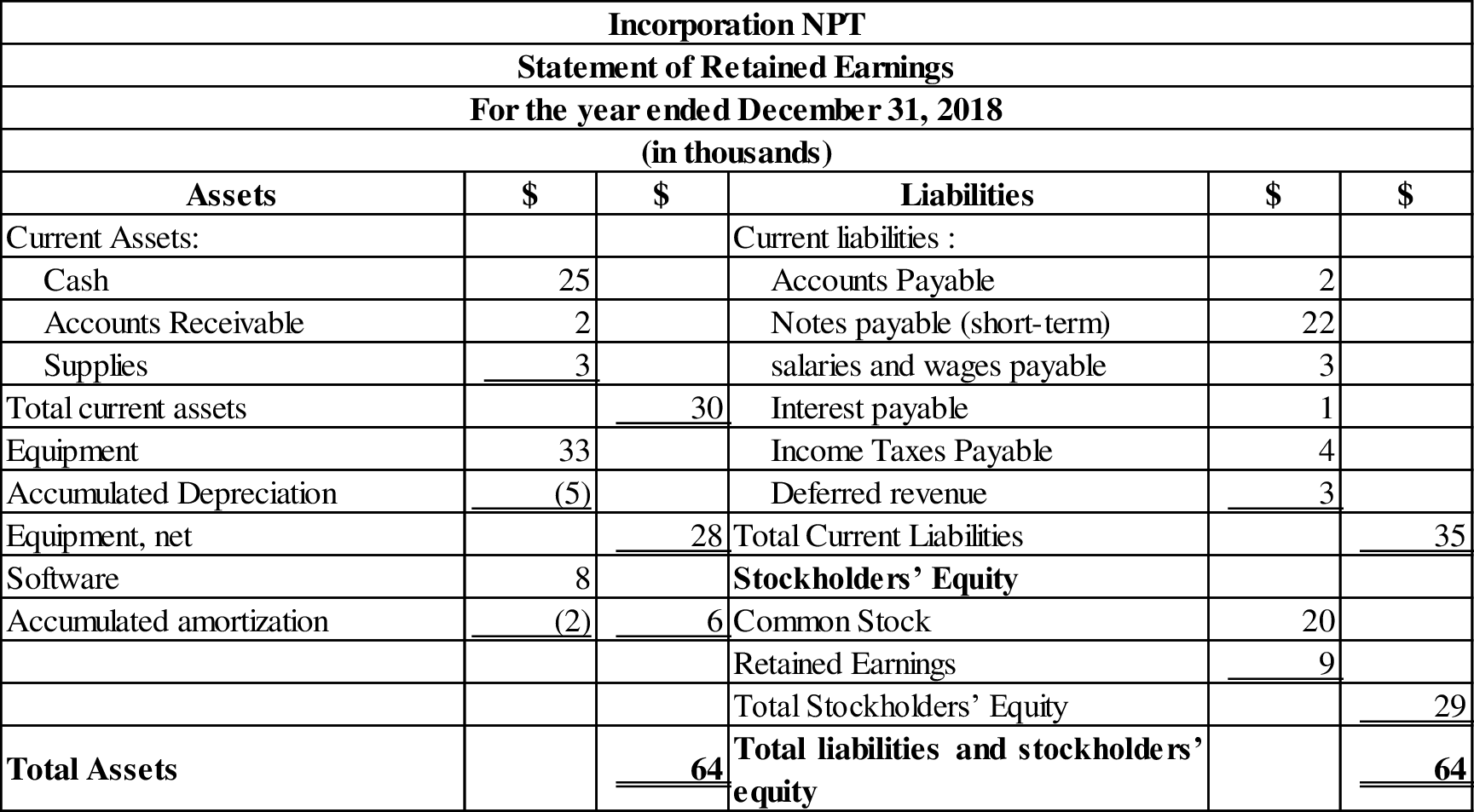

Prepare a balance sheet for the year December 31, 2018 as follows:

Table (7)

7.

Prepare the closing entry for Incorporation NPT on December 31, 2018.

Explanation of Solution

Prepare closing entries for Incorporation NPT on December 31, 2018 as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| December 31, 2018 | Sales revenue(-R) | 55 | |

| Salaries and wages expense(-E) | 33 | ||

| Depreciation expense(-E) | 4 | ||

| Supplies expense(-E) | 7 | ||

| Amortization expense (-E) | 1 | ||

| Income tax expense(-E) | 4 | ||

| Interest expense (-E) | 1 | ||

|

Retained earnings(+SE) (refer table 5) | 5 | ||

| (To record the closing entries for Incorporation NPT) |

Table (8)

For closing of temporary accounts, the balances of revenues, expenses, and dividend accounts are transferred to retained earnings in order to bring zero balance for expenses and revenues accounts.

8.

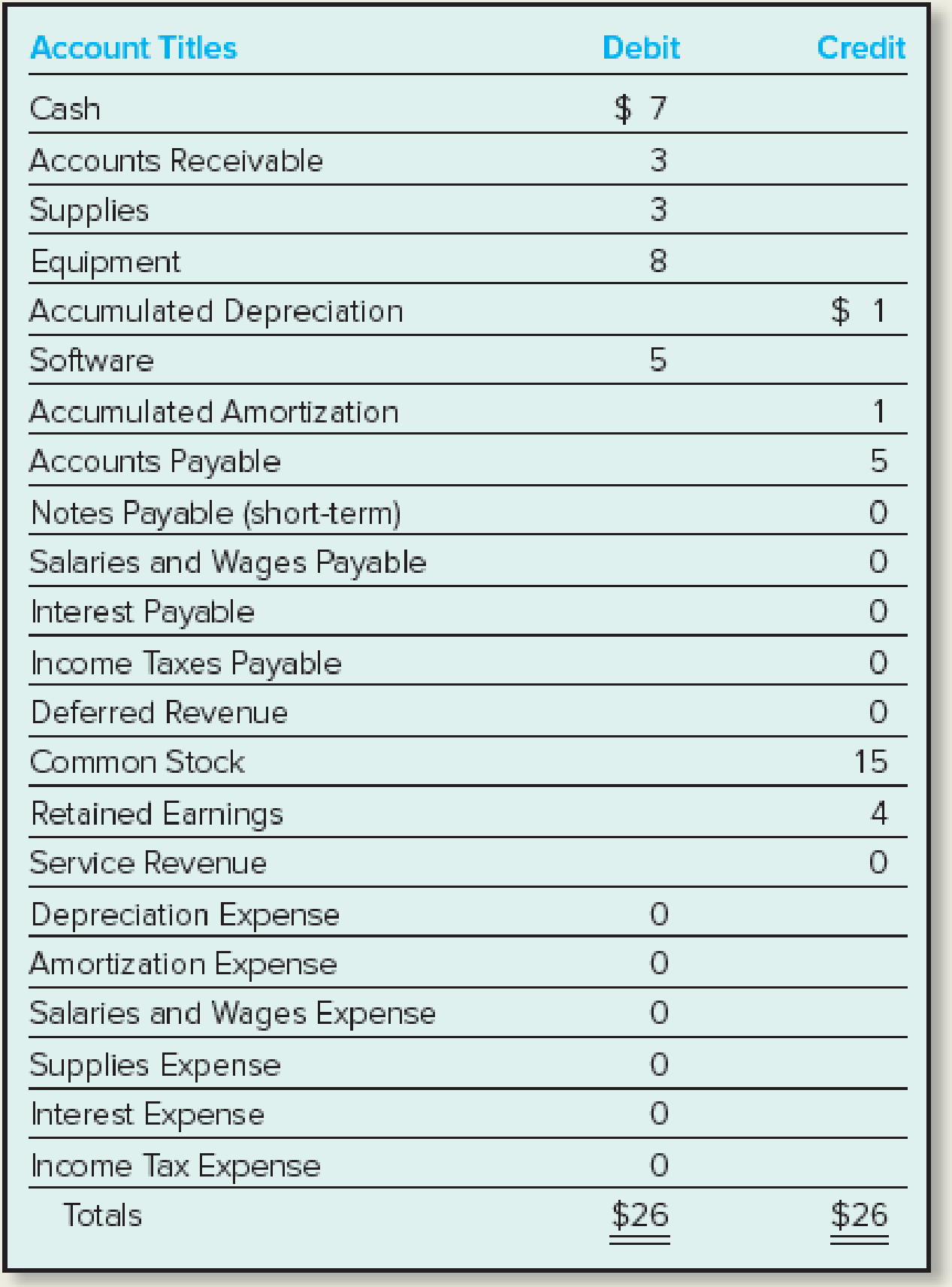

Prepare a post-closing trial balance from the requirement 7.

Explanation of Solution

Prepare a Post-closing trial balance for Incorporation NPT for December 31, 2018 follows:

| Incorporation NPT | ||

| Post-closing Trial Balance | ||

| At December 31, 2018 | ||

| (in thousands) | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 25 | |

| Accounts Receivable | 2 | |

| Supplies | 3 | |

| Equipment | 33 | |

| Accumulated Depreciation–Equipment | 5 | |

| Software | 8 | |

| Accumulated Amortization | 2 | |

| Accounts Payable | 2 | |

| Notes Payable (short–term) | 22 | |

| Salaries and Wages Payable | 3 | |

| Interest Payable | 1 | |

| Income Taxes Payable | 4 | |

| Deferred revenue | 3 | |

| Common Stock | 20 | |

| Retained Earnings | 9 | |

| Service Revenue | 0 | |

| Salaries and Wages Expense | 0 | |

| Supplies Expense | 0 | |

| Depreciation Expense | 0 | |

| Amortization expense | 0 | |

| Interest Expense | 0 | |

| Income Tax Expense | 0 | |

| Total | 71 | 71 |

Table (9)

9.

Ascertain the net income of Incorporation NPT that has been generated during 2018 and calculate the net profit margin. Explain whether the company has been financed primarily by liabilities or stockholders’ equity and to find the current ratio.

Explanation of Solution

The net income of Incorporation NPT for 2018:

Incorporation NPT generated net income of $5(thousand) in the year 2018.

Calculate the net profit margin:

The net profit margin of Incorporation NPT is 9.1%.

Whether the Incorporation NPT is financed primarily by liabilities or stockholders’ equity as follows:

The invested amount of assets primarily comes from liabilities of Incorporation NPT, because the liabilities have financed $35 thousand of the Incorporation NPT’s total assets, whereas stockholder’s equity has financed $29 thousand.

Calculate the current ratio:

The current ratio is 0.86:1.

Want to see more full solutions like this?

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING LL

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense? Need helparrow_forwardClassify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College