Concept explainers

Preparing

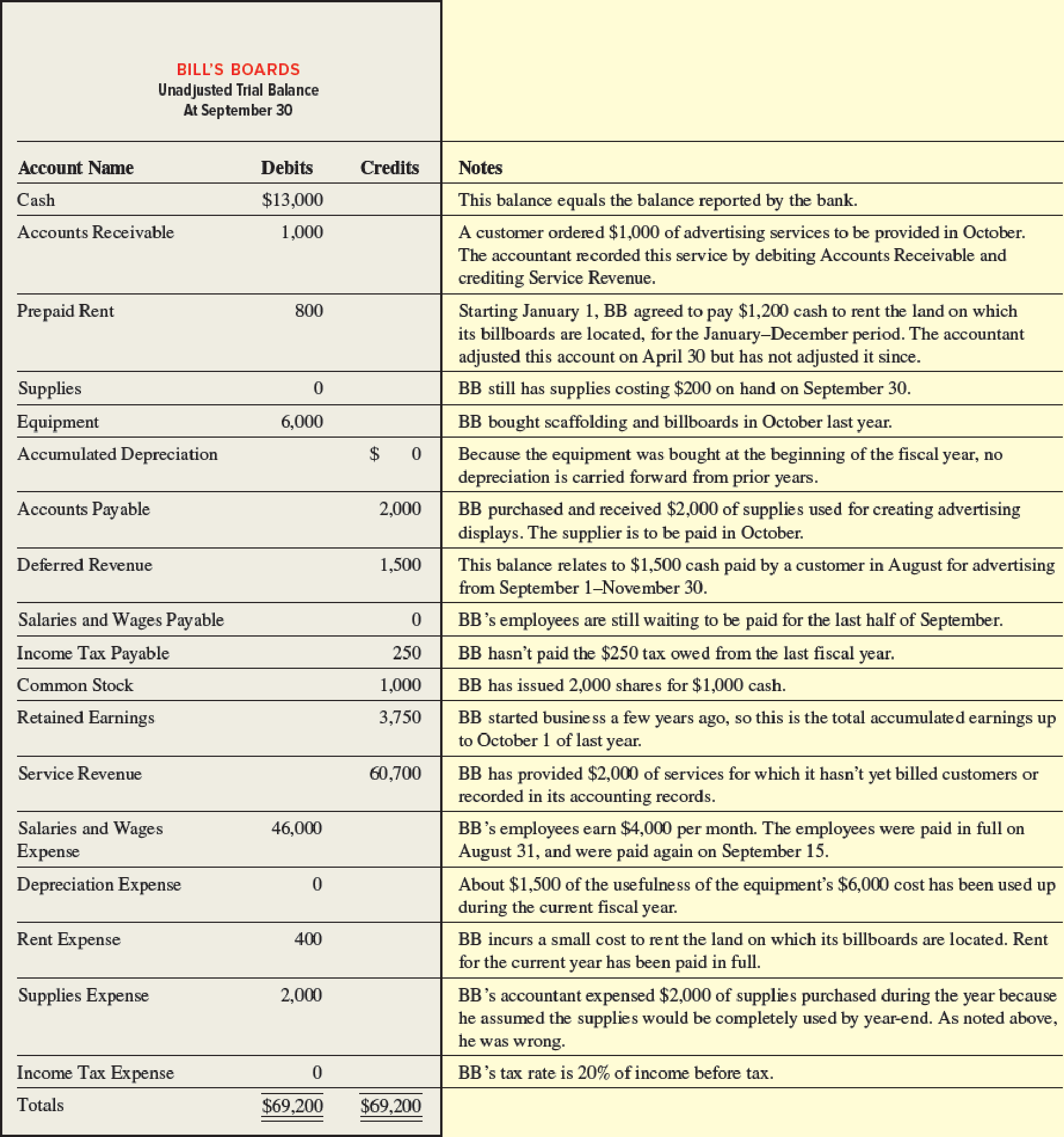

Bill’s Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting so he hired a friend to “keep the books.” Unfortunately, William did not review his friend’s work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB’s September 30 fiscal year-end. You have reviewed the balances with William and made notes shown in the right column.

Required:

- 1. Use the notes to determine and record the adjusting

journal entries needed on September 30 to (a) fix the premature recording of advertising revenue, (b) update the rent accounts, (c) account for the use of equipment, (d) update deferred revenue, (e) accrue revenue not yet billed, (f ) accrue unpaid wages, (g) correct the supplies accounts, and (h) accrue income taxes for the year. - 2. Post the adjusting journal entries from requirement 1 to T-accounts to determine new adjusted balances, and prepare an adjusted trial balance. (If you are completing this exercise using the general ledger tool in Connect, this requirement will be completed automatically for you.)

- 3. Using the adjusted account balances from requirement 2, prepare an income statement, statement of

retained earnings , and classifiedbalance sheet .

a.

Record the adjusting journal entries needed on September 30.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Record the adjusting journal entries needed on September 30 as follows:

| Date | Particulars | Debit ($) | Credit ($) | |

| (a) | Service Revenue (+R, +SE) | 1,000 | ||

| Accounts Receivable (+A) | 1,000 | |||

| (To record the service revenue recognized on account) | ||||

| (b) | Rent Expense (+E, –SE) (1) | 500 | ||

| Prepaid Rent (–A) | 500 | |||

| (To record the interest expense incurred at the end of the accounting year) | ||||

| (c) | Depreciation Expense (+E, –SE) | 1,500 | ||

| Accumulated Depreciation (+xA, –A) | 1,500 | |||

| (To record the depreciation expense incurred at the end of the accounting year) | ||||

| (d) | Deferred Revenue (–L) (2) | 500 | ||

| Service Revenue (+R, +SE) | 500 | |||

| (To record the service revenue recognized at the end of the accounting year) | ||||

| (e) | Accounts Receivable (+A) | 2,000 | ||

| Service Revenue (+R, +SE) | 2,000 | |||

| (To record the service revenue earned on account) | ||||

| (f) | Salaries and Wages Expense (+E, –SE) (3) | 2,000 | ||

| Salaries and Wages Payable (+L) | 2,000 | |||

| (To record the salaries and wages expense incurred at the end of the accounting year) | ||||

| (g) | Supplies (+A) | 200 | ||

| Supplies Expense (–E, +SE) | 200 | |||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| (h) | Income Tax Expense (+E, –SE) ( 5) | 2,000 | ||

| Income Tax Payable (+L) | 2,000 | |||

| (To record the income tax expense incurred at the end of the accounting year) |

Table (1)

Working note 1:

Calculate the value of rent expense.

Working note 2:

Calculate the value of deferred revenue.

Working note 3:

Calculate the value of salaries and wages expense (adjusted).

Working note 4:

Calculate the unadjusted net income.

Working note 5:

Calculate the value of income tax expense:

Note: Supplies costing of $200 on hand on September 30 is considered as the supplies expense incurred at the end of the accounting year.

b.

Post the adjusting journal entries to T-accounts to determine the new adjusted balance and prepare the adjusted trial balance.

Explanation of Solution

Post the adjusting journal entries to T-accounts to determine the new adjusted balance as follows:

| Cash (A) | |||

| Beg. | 13,000 | ||

| 13,000 | |||

| Supplies (A) | |||

| Beg. | 0 | ||

| g. | 200 | ||

| 200 | |||

| Accounts Payable (L) | |||

| 2,000 | Beg. | ||

| 2,000 | |||

| Income Tax Payable (L) | |||

| 250 | Beg. | ||

| 2,000 | h. | ||

| 2,250 | |||

| Service Revenue (R) | |||

| a. | 1,000 | 60,700 | Beg. |

| 500 | d. | ||

| 2,000 | e. | ||

| 62,200 | |||

| Rent Expense (E) | |||

| Beg. | Beg. 400 | ||

| b. | 500 | ||

| 900 | |||

| Accounts Receivable (A) | |||

| Beg. | 1,000 | ||

| e. | 2,000 | 1,000 | a. |

| 2,000 | |||

| Equipment (A) | |||

| Beg | 6,000 | ||

| 6,000 | |||

| Deferred Revenue (L) | |||

| 1,500 | Beg. | ||

| d. | 500 | ||

| 1,000 | |||

| Common Stock (SE) | |||

| 1,000 | Beg. | ||

| 1,000 | |||

| Salaries and Wages Expense (E) | |||

| Beg. | 46,000 | ||

| f. | 2,000 | ||

| 48,000 | |||

| Supplies Expense (E) | |||

| Beg. | 2,000 | ||

| 200 | g. | ||

| 1,800 | |||

| Prepaid Rent (A) | |||

| Beg. | 800 | ||

| 500 | (b) | ||

| 300 | |||

| Accumulated Depreciation (xA) | |||

| 0 | Beg. | ||

| 1,500 | c. | ||

| 1,500 | |||

| Salaries and Wages Payable (L) | |||

| 0 | Beg. | ||

| 2,000 | f. | ||

| 2,000 | |||

| Retained Earnings (SE) | |||

| 3,750 | Beg. | ||

| 3,750 | |||

| Depreciation Expense (E) | |||

| Beg. | 0 | ||

| c. | 1,500 | ||

| 1,500 | |||

| Income Tax Expense | |||

| Beg. | 0 | ||

| h. | 2,000 | ||

| 2,000 | |||

Prepare the adjusted trial balance as follows:

| Company B | ||

| Adjusted Trial Balance | ||

| September, 30 | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 13,000 | |

| Accounts Receivable | 2,000 | |

| Prepaid Rent | 300 | |

| Supplies | 200 | |

| Equipment | 6,000 | |

| Accumulated Depreciation | 1,500 | |

| Accounts Payable | 2,000 | |

| Deferred Revenue | 1,000 | |

| Salaries and Wages Payable | 2,000 | |

| Income Tax Payable | 2,250 | |

| Common Stock | 1,000 | |

| Retained Earnings | 3,750 | |

| Service Revenue | 62,200 | |

| Salaries and Wages Expense | 48,000 | |

| Supplies Expense | 1,800 | |

| Depreciation Expense | 1,500 | |

| Rent Expense | 900 | |

| Income Tax Expense | 2,000 | |

| Totals | 75,700 | 75,700 |

Table (2)

c.

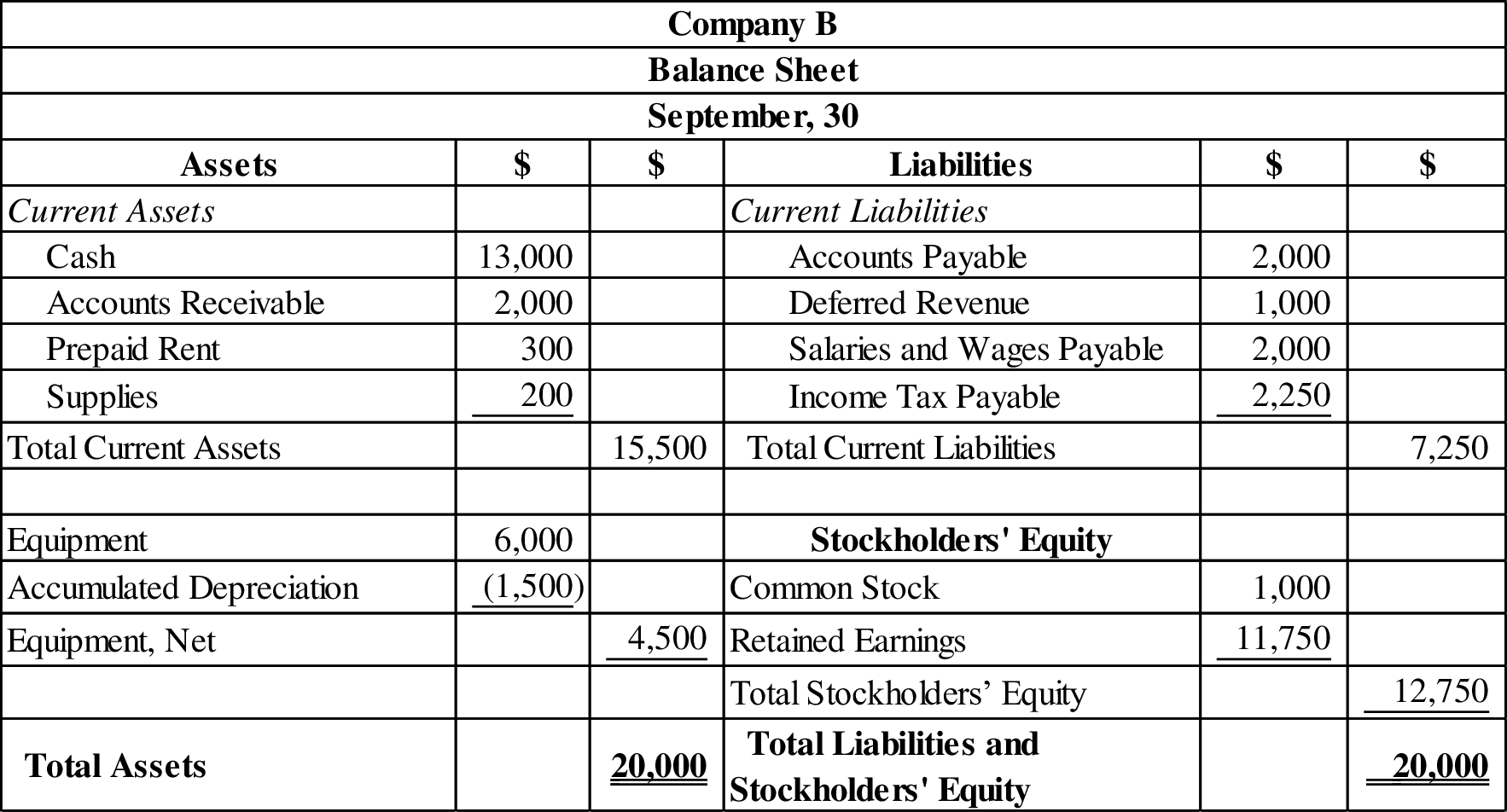

Prepare an income statement, statement of retained earnings, and classified balance sheet of company B.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare an income statement, statement of retained earnings, and classified balance sheet as follows:

| Company B | ||

| Income Statement | ||

| For the Year Ended September 30 | ||

| Particulars | $ | $ |

| Service Revenue | 62,200 | |

| Less: Expenses | ||

| Salaries and Wages Expense | 48,000 | |

| Supplies Expense | 1,800 | |

| Depreciation Expense | 1,500 | |

| Rent Expense | 900 | |

| Income Tax Expense | 2,000 | |

| Total Expenses | 54,200 | |

| Net Income | 8,000 | |

Table (3)

| Company B | |

| Statement of Retained Earnings | |

| For the Year Ended September 30 | |

| Particulars | $ |

| Beginning Balance | 3,750 |

| Add: Net Income | 8,000 |

| Less: Dividends | - |

| Ending Balance | 11,750 |

Table (4)

Figure (1)

Want to see more full solutions like this?

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING LL

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardDetermine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forward

- If total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forward

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College