Concept explainers

(Contributed by Roland Minch.) Glass Glow Company manufactures a variety of glass windows in its Egalton plant. In department I, clear glass sheets are produced, and some of these sheets are sold as finished goods. Other sheets made in department I have metallic oxides added in department II to form colored glass sheets. Some of these colored sheets are sold; others are moved to department III for etching and then are sold. The company uses operation costing.

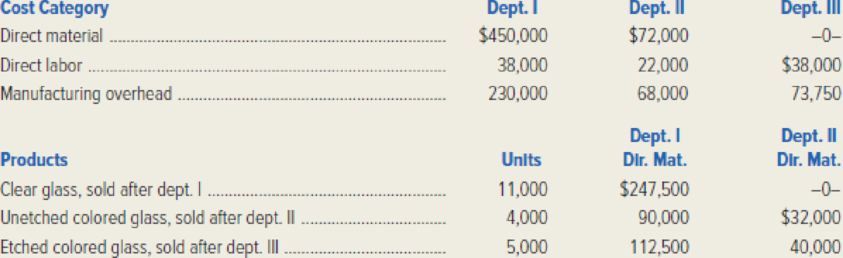

Glass Glow Company’s production costs applied to products in May are given in the following table. There was no beginning or ending inventory of work in process for May.

Each sheet of glass requires the same steps within each operation.

Required: Compute each of the following amounts.

- 1. The conversion cost per unit in department I.

- 2. The conversion cost per unit in department II.

- 3. The cost of a clear glass sheet.

- 4. The cost of an unetched colored glass sheet.

- 5. The cost of an etched colored glass sheet.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning