Concept explainers

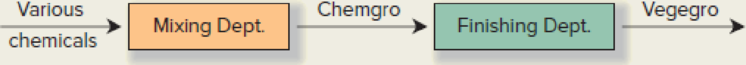

GroFast Company manufactures a high-quality fertilizer, which is used primarily by commercial vegetable growers. Two departments are involved in the production process. In the Mixing Department, various chemicals are entered into production. After processing, the Mixing Department transfers a chemical called Chemgro to the Finishing Department. There the product is completed, packaged, and shipped under the brand name Vegegro.

In the Mixing Department, the raw material is added at the beginning of the process. Labor and overhead are applied continuously throughout the process. All direct departmental overhead is traced to the departments, and plant overhead is allocated to the departments on the basis of direct-labor. The plant overhead rate for 20x2 is $.40 per direct-labor dollar.

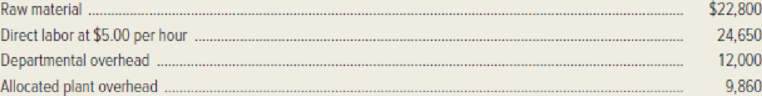

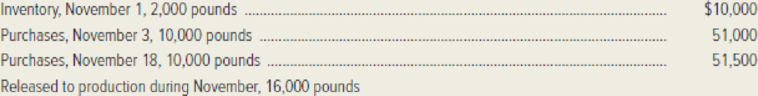

The following information relates to production during November 20x2 in the Mixing Department.

- a. Work in process, November 1 (4,000 pounds, 75 percent complete as to conversion):

- b. Raw material:

- c. Direct-labor cost, $103,350

- d. Direct departmental overhead costs, $52,000

- e. Transferred to Finishing Department, 15,000 pounds

- f. Work in process, November 30, 5,000 pounds, 20 percent complete

The company uses weighted-average

Required:

- 1. Prepare a production report for the Mixing Department for November 20x2. The report should show:

- a. Equivalent units of production by cost factor (i.e., direct material and conversion).

- b. Cost per equivalent unit for each cost factor. (Round your answers to the nearest cent.)

- c. Cost of Chemgro transferred to the Finishing Department.

- d. Cost of the work-in-process inventory on November 30, 20x2, in the Mixing Department.

- 2. Prepare

journal entries to record the following events:- a. Release of direct material to production during November.

- b. Incurrence of direct-labor costs in November.

- c. Application of overhead costs for the Mixing Department (direct departmental and allocated plant overhead costs.)

- d. Transfer of Chemgro out of the Mixing Department.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- How much would you expect quarterly net operating income to increase?arrow_forwardAcp Distributors purchased a cooling system for its storage warehouse at a cost of $92,500. The cooling system has an estimated residual value of $7,000 and an estimated useful life of 10 years. What is the amount of the annual depreciation computed by the straight-line method?arrow_forwardNonearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,