Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 29P

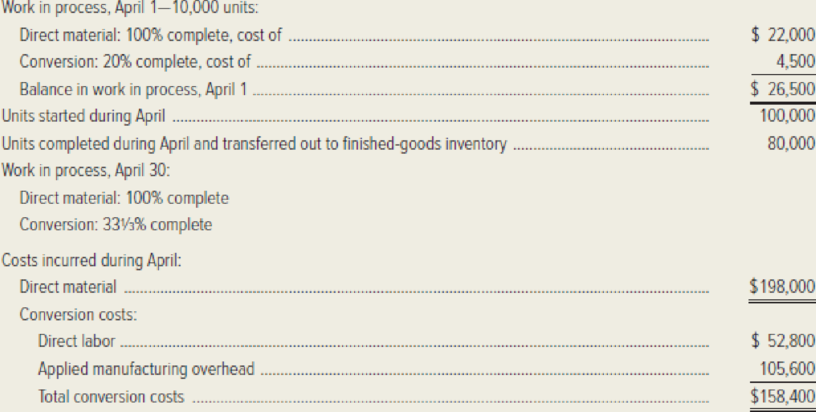

Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process.

Required: Prepare schedules to accomplish each of the following process-costing steps for the month of April. Use the weighted-average method of

- 1. Analysis of physical flow of units.

- 2. Calculation of equivalent units.

- 3. Computation of unit costs.

- 4. Analysis of total costs.

- 5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: the April 1 work-in-process costs were $66,000 for direct material and $18,000 for conversion.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute the target net income

What is riverside manufacturings gross profit? ? General Accounting

What is the degree of operating leverage of majestic collectibles

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 4 - Explain the primary differences between job-order...Ch. 4 - List five types of manufacturing in which process...Ch. 4 - Prob. 3RQCh. 4 - What are the purposes of a product-costing system?Ch. 4 - Define the term equivalent unit and explain how...Ch. 4 - List and briefly describe the purpose of each of...Ch. 4 - Show how to prepare a journal entry to enter...Ch. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - Prob. 10RQ

Ch. 4 - How would the process-costing computations differ...Ch. 4 - Explain the concept of operation costing. How does...Ch. 4 - Prob. 13RQCh. 4 - In each case below, fill in the missing amount.Ch. 4 - Rainbow Glass Company manufactures decorative...Ch. 4 - Terra Energy Company refines a variety of...Ch. 4 - The Evanston plant of Fit-for-Life Foods...Ch. 4 - Idaho Lumber Company grows, harvests, and...Ch. 4 - Otsego Glass Company manufactures window glass for...Ch. 4 - Savannah Textiles Company manufactures a variety...Ch. 4 - The following data pertain to Tulsa Paperboard...Ch. 4 - The November production of MVPs Minnesota Division...Ch. 4 - Timing Technology, Inc. manufactures timing...Ch. 4 - Piscataway Plastics Company manufactures a highly...Ch. 4 - The following data pertain to the Vesuvius Tile...Ch. 4 - Triangle Fastener Corporation accumulates costs...Ch. 4 - Moravia Company processes and packages cream...Ch. 4 - Albany Company accumulates costs for its product...Ch. 4 - Goodson Corporation assembles various components...Ch. 4 - A-1 Products manufactures wooden furniture using...Ch. 4 - The following data pertain to the Hercules Tire...Ch. 4 - Scrooge and Zilch, a public accounting firm in...Ch. 4 - GroFast Company manufactures a high-quality...Ch. 4 - Plasto Corporation manufactures a variety of...Ch. 4 - (Contributed by Roland Minch.) Glass Glow Company...Ch. 4 - Orbital Industries of Canada, Inc. manufactures a...Ch. 4 - Laredo Leather Company manufactures high-quality...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the company degree of operating leveragearrow_forwardNonearrow_forwardDenver Enterprises has fixed costs of $3,150,000. It has a unit selling price of $15.50, unit variable cost of $6.80, and a target net income of $850,000. Compute the required sales in units to achieve its target net income. Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY