Concept explainers

Problem 4-1A

Applying the accounting cycle

C1 C2 P2P3

On April 1, 2017, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month.

April 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company.

2 The company rented furnished office space by paying $1,800 cash for the first month’s (April) rent.

3 The company purchased $1,000 of office supplies for cash.

to The company paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins on AprIl 11.

14 The company paid $1,600 cash for two weeks’ salaries earned by employees.

24 The company collected $8,000 cash on commissions from airlines on tickets obtained for customers.

28 The company paid $ 1,600 cash for two weeks’ salaries earned by employees.

29 The company paid $350 cash for minor repairs to the company’s computer.

30 The company paid $750 cash for this month’s telephone bill.

30 Nozomi withdrew $1,500 cash from the company for personal use.

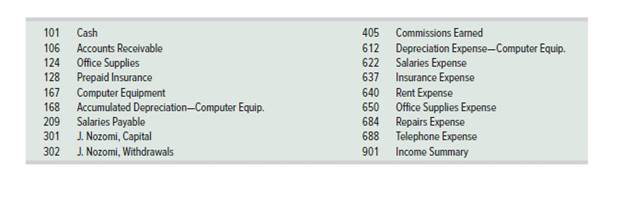

The company’s chart of accounts follows:

Required

1. Use the balance column format to set up each ledger account listed in its chart of accounts.

2. Prepare

3. Prepare an unadjusted

4. Use the following information to journalize and post

a. Two-thirds (or $133) of one month’s insurance coverage has expired.

b. At the end of the month. $600 of office supplies are still available.

c. This month’s

d. Employees earned S42o of unpaid and unrecorded salaries as of month-end.

e. The company earned $1,750 of commissions that are not yet billed at month-end.

5. Prepare the adjusted trial balance as of April 30. Prepare the income statement and the statement of owner’s equity for the month of April

and the balance sheet at April 30,2017.

6. Prepare journal entries to close the temporary accounts and

7. Prepare a post- closing trial balance.

Check (3) Unadj trial balance totals $58.000

(4a) Dr Insurance Expense $133

(5) Net income $2,197 J Nozom. Capital (4130/2017). $50.697. Total assets. $51.117

(7) P.C mal balance totals $51,617

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamental Accounting Principles

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning