Concept explainers

Problem 4-5A

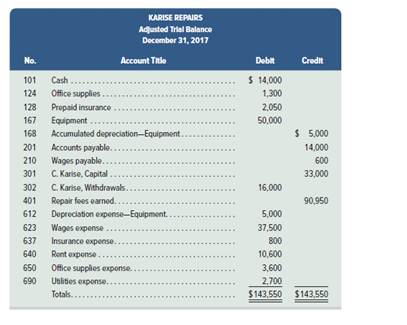

Preparing trial balances, closing entries, and financial statements

C3 P2 P3

The adjusted

Required

a. Prepare an income statement and a statement of owner’s equity for the year 2017, and a classified

There are no owner investments in 2017.

b. Enter the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and

the last two columns for a post-closing trial balance. Insert an Income Summary account as the last item in the trial balance.

C. Enter closing entry information in the six- column table and prepare

Check (1) Ending capital balance. $47.750 Net income. $30.750

(2) P-C trial balance totals. $67.350

Analysis Component

4. Assume for this part only that

a. None of the $8oo insurance expense had expired during the year. Instead, assume it is a prepayment of the next period’s insurance protection.

b. There are no earned and unpaid wages at the end of the year. (Hint: Reverse the $600 wages payable accrual.)

Describe the financial statement changes that would result from these two assumptions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamental Accounting Principles

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forward

- I am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning