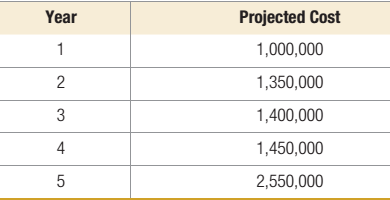

MKM International is seeking to purchase a new CNC machine in order to reduce costs. Two alternative machines are in consideration. Machine 1 costs $500,000 but yields a 15 percent savings over the current machine used. Machine 2 costs $900,000 but yields a 25 percent savings over the current machine used. In order to meet demand, the following

- Based on the

NPV of the cash flows for these five years, which machine should MKM International Purchase? Assume a discount rate of 12 percent. - If MKM International lowered its required discount rate to 8 percent, what machine would it purchase?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Operations Management: Processes And Supply Chains (12th Edition) (what's New In Operations Management)

Additional Business Textbook Solutions

Operations Management, Binder Ready Version: An Integrated Approach

Business in Action (8th Edition)

Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

Operations and Supply Chain Management 9th edition

- Danna Lumus, the marketing manager for a division that produces a variety of paper products, is considering the divisional manager’s request for a sales forecast for a new line of paper napkins. The divisional manager has been gathering data so that he can choose between two different production processes. The first process would have a variable cost of $10 per case produced and total fixed cost of $100,000. The second process would have a variable cost of $6 per case and total fixed cost of $200,000. The selling price would be $30 per case. Danna had just completed a marketing analysis that projects annual sales of 30,000 cases. Danna is reluctant to report the 30,000 forecast to the divisional manager. She knows that the first process would be labor intensive, whereas the second would be largely automated with little labor and no requirement for an additional production supervisor. If the first process is chosen, Jerry Johnson, a good friend, will be appointed as the line supervisor.…arrow_forwardPalisades Eco-Park is a small ecological reserve that admits a relatively small number of visitors on any day, but provides both educational and entertaining lectures, exhibitions, and opportunities to observe nature. The company has collected the following data on labor costs and number of visitors to the park over the last 30 months. Month Labor Cost Visitors 1 $ 26,720 2,600 2 $ 37,555 3,964 3 $ 41,361 4,299 4 $ 32,751 3,398 5 $ 36,022 3,630 6 $ 33,811 3,336 7 $ 33,139 3,372 8 $ 39,671 4,093 9 $ 39,912 4,222 10 $ 48,568 5,463 11 $ 43,627 4,551 12 $ 40,390 4,289 13 $ 35,644 3,694 14 $ 34,330 3,573 15 $ 38,260 3,836 16 $ 27,424 3,210 17 $ 31,732 5,195 18 $ 31,005 4,260 19 $ 28,552 3,689 20 $ 31,049 4,546 21 $ 26,588 3,058 22 $ 25,515 2,744 23 $ 29,899 4,997 24 $ 31,204 5,838 25 $ 29,099 3,964 26 $ 32,795 5,007 27 $ 29,650 4,572 28 $ 30,970 4,665 29 $ 29,429 3,841 30 $ 28,846 3,174 Required: a. Estimate the labor…arrow_forwardPendryl Office Supplies is evaluating the profitability of leasing a photocopier for its customers to use on a self serve basis at 10 cents/copy. The copier may be leased for $300 per month plus 1.5 cents per copy on a full service contract. Pendryl can purchase paper at $5 per 500 sheet ream. Toner costs $100 per bottle, which in normal use will last for 5000 pages. Pendryl thinks that there are additional other costs of 0.5 cents per copy. A. How many copies per month must be sold in order to break even? (6000 copies/month) B. What will be the increase in monthly profit for each 1000 copies sold above the break-even point? ($50 per month)arrow_forward

- Agarwal Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a PO.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? Year 0. 1 3 6. Growth rate NA NA NA NA 50.00% 25.00% 8.00% Dividends PO.000 PO.000 PO.000 P0.250 PO.375 PO.469 PO.506 O P10.45 O P10.99 OP9.94 O P10.72 O P10.19arrow_forwardA manager must decide which type of machine to buy, A, B, or C. Machine costs (per individual machine) are as follows: Machine Cost $50,000 A B $40,000 C $70,000 Product forecasts and processing times on the machines are as follows: PROCCESSING TIME PER UNIT (minutes) Annual Product Demand 1 2 3 4 18,000 25,000 15,000 9,000 A 1 5 4 5 A B C B Click here for the Excel Data File 6531 Total processing time in minutes per machine: a. Assume that only purchasing costs are being considered. Compute the total processing time required for each machine type to meet demand, how many of each machine type would be needed, and the resulting total purchasing cost for each machine type. The machines will operate 8 hours a day, 220 days a year. (Enter total processing times as whole numbers. Round up machine quantities to the next higher whole number. Compute total purchasing costs using these rounded machine quantities. Enter the resulting total purchasing cost as a whole number.) C 2 1 2 6arrow_forwardPlease complete all work in excel. Use excel to make any necessary calculations and be sure to identify your answer, including units (if necessary). Answers that need formulas must have them within the answer cell to receive full credit. City is trying to determine future demand for their public pool in order to help with staffing decisions. City thinks that demand could be related to temperature in Fahrenheit. Below is the most recent data from the last two weeks. Pool Attendance Temperature (°F) 150 89 100 82 125 81 130 86 155 93 170 98 200 99 180 87 190 88 140 83 120 82 90 81 130 87 120 93 What is the regression equation? Use the equation to forecast pool attendance if temperature is 88°arrow_forward

- AnaCarolina and Jaco, executive managers at Duke Manufacturing, are tasked with determining appropriate performance metrics for the customer perspective of Duke's balanced scorecard. Which of the following is the best metric for this situation? a. material price variance b. operating throughout c. number of returns due to incorrect products shipped in response to orders d. return on investmentarrow_forwardA manager must decide which type of machine to buy, A, B, or C. Machine costs are as follows: Machine CostA $40,000B $30,000C $80,000Product forecasts and processing times on the machines are as follows: Processing Time per Unit (minutes) Product Annual Demand A B C 1 16000 3 4 2 2 12000 4 4 3 3 6000 5 6 4 4 30000 2 2 1 a.) Assume that machines operate 10 hours a day, 250 days a year. If we only consider purchasing costs, which machine would have the lowest total cost? b.) Assume machines operate 10 hours a day, 250 days a year. If we select machine A, how many machine A do we need? (Use common sense to decide the answer.)arrow_forwardThe bus of company A has planned their capacity in terms of ‘bus-days’. Forecasts show expected annual demands for the next year to average 400,000 full-day passengers and 840,000 half-day passengers. The company has 61 buses, each with an effective capacity of 40 passengers a day for 300 days a year. Breakdowns and other unexpected problems reduce efficiency to 90%. They employ 86 drivers who work an average of 220 days a year, but illness and other absences reduce their efficiency to 85%. If there is a shortage of buses the company can buy extra ones for $110,000 or hire them for $100 a day. If there is a shortage of drivers they can recruit extra ones at a cost of $20,000 a year, or hire them from an agency for $110 a day. How can the company approach its tactical planning? Please recommend company A the best plan and explain in detail the reasons for the selectionarrow_forward

- Charles Lackey operates a bakery in Idaho Falls, Idaho. Because of its excellent product and excellent location, demand has increased by 5555% in the last year. On far too many occasions, customers have not been able to purchase the bread of their choice. Because of the size of the store, no new ovens can be added. At a staff meeting, one employee suggested ways to load the ovens differently so that more loaves of bread can be baked at one time. This new process will require that the ovens be loaded by hand, requiring additional manpower. This is the only production change that will be made in order to meet the increased demand. The bakery currently makes 1,800 loaves per month. Employees are paid $8 per hour. In addition to the labor cost, Charles also has a constant utility cost per month of $800 and a per loaf ingredient cost of $0.35 Current multifactor productivity for 640 work hours per month =0.27loaves/dollar (round your response to three decimal places).arrow_forwardPicture attachedarrow_forwardA rock concert producer has scheduled an outdoor concert. The producer estimates the attendance will depend on the weather according to the following table. Weather Attendance Probability wet, cold 4000 0.1 wet, warm 25000 0.1 dry, cold 30000 0.1 dry, warm 45000 0.7 (a) What is the expected attendance? (b) If tickets cost $ 30 each, the band will cost $ 250,000, plus $ 55,000 for administration. What is the expected profit?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,