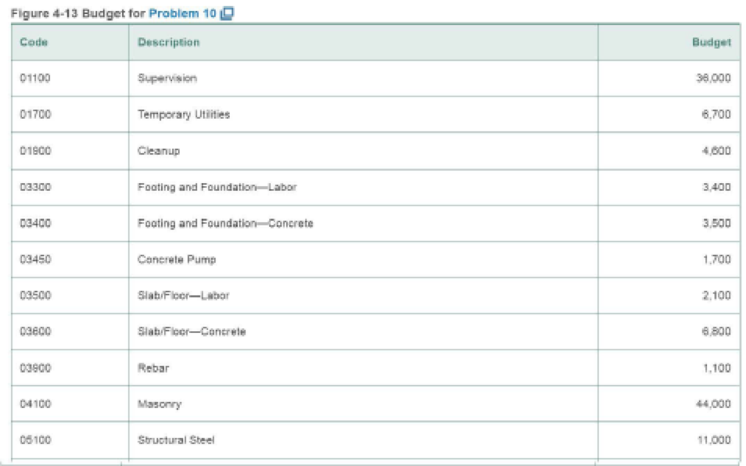

Your company has been hired to act as a construction manager for the construction of a bookstore for a fixed fee of $32,000. When the design was 90% complete, you prepared a budget for the project which is shown in Figure 4-13

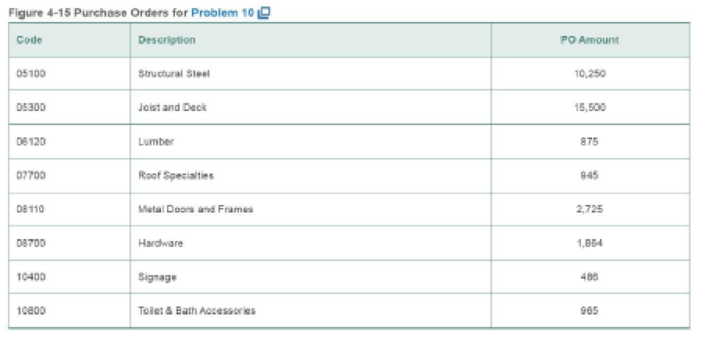

During the buyout, the subcontracts shown in Figure 4-14 were signed and the purchase orders shown in Figure 4-15 were issued. No additional costs are expected tor the contracts in Figure 4-14 and the purchase orders in Figure 4-15. A purchase order has been issued for concrete for $116 per cube yard. This price is 4% below the costs used in the budget.

You have a meeting with the project’s owner to discuss the financial status of the project. Using the committed cost worksheet in Figure 4-1 of the textbook, update the estimated cost at completion and determine if the project is over or under budget.

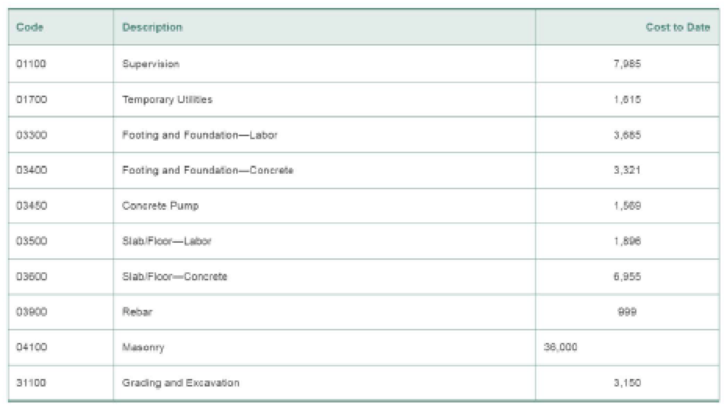

The project in Problem 10 is expected to take 9 months to complete. The costs for the project at the end of the second month are shown in Figure 4-16. You have a meeting with project’s owner to discuss the financial status of the project. Using the committed cost worksheet from Problem 10, update the estimated cost at completion and determine if ne project is over or under budget. The supervision and temporary utility costs should be prorated over the life of the project. The pouring of the footings, foundations, and floor slab are complete.

Figure 4-16 Cost for Problem 10

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Construction Accounting And Financial Management (4th Edition)

- Answer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forwardNeed General Accounting Question solutionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education