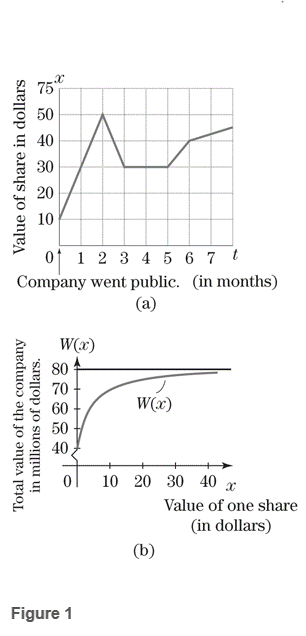

Effect of Stocks on Total Assets of a Company After a computer software company went public, the price of one share of its stock fluctuated according to the graph in Fig1 (a). the total worth of the company depended on the value of one share and was estimated to be

Where

Find the total value of the company when

Find

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Calculus & Its Applications (14th Edition)

- 3.9 (A/B). A beam ABCDE, with A on the left, is 7 m long and is simply supported at Band E. The lengths of the various portions are AB 1-5m, BC = 1-5m, CD = 1 m and DE : 3 m. There is a uniformly distributed load of 15kN/m between B and a point 2m to the right of B and concentrated loads of 20 KN act at 4 and 0 with one of 50 KN at C. (a) Draw the S.F. diagrams and hence determine the position from A at which the S.F. is zero. (b) Determine the value of the B.M. at this point. (c) Sketch the B.M. diagram approximately to scale, quoting the principal values. [3.32 m, 69.8 KNm, 0, 30, 69.1, 68.1, 0 kNm.]arrow_forward4. Verify that V X (aẢ) = (Va) XẢ + aV X Ả where Ả = xyz(x + y + 2) A and a = 3xy + 4zx by carrying out the detailed differentiations.arrow_forward3. For each of the arrow or quiver graphs shown below, determine analytically V°C and V X Č. From these analytical solutions, identify the extrema (+/-) and plot these points on the arrow graph. (a) C = −✰CosxSiny + ŷSinxCosy -π<ׂу<π Ty (b) C = −xSin2y + ŷCos2y x, y<π -π< (c) C = −xCosx + ŷSiny -π< x, y < πarrow_forward

- 7.10 (B/C). A circular flat plate of diameter 305 mm and thickness 6.35 mm is clamped at the edges and subjected to a Uniform lateral pressure of 345 kN/m². Evaluate: (a) the central deflection, (b) the position and magnitude of the maximum radial stress. C6.1 x 10 m; 149.2 MN/m².] 100 200arrow_forward3.15 (B). A beam ABCD is simply supported at B and C with ABCD=2m; BC 4 m. It carries a point load of 60 KN at the free end A, a Uniformly distributed load of 60 KN/m between B and C and an anticlockwise moment of 80 KN m in the plane of the beam applied at the free end D. Sketch and dimension the S.F. and B.M. diagrams, and determine the position and magnitude of the maximum bending moment. CEL.E.] CS.F. 60, 170, 70KN, B.M. 120, +120.1, +80 kNm, 120.1 kNm at 2.83 m to right of 8.7arrow_forward7.1 (A/B). A Uniform I-section beam has flanges 150 mm wide by 8 mm thick and a web 180 mm wide and 8 mm thick. At a certain section there is a shearing force of 120 KN. Draw a diagram to illustrate the distribution of shear stress across the section as a result of bending. What is the maximum shear stress? [86.7 MN/m².arrow_forward

- 1. Let Ả = −2x + 3y+42, B = - - 7x +lý +22, and C = −1x + 2y + 42. Find (a) Ả X B (b) ẢX B°C c) →→ Ả B X C d) ẢB°C e) ẢX B XC.arrow_forward3.13 (B). A beam ABC, 6 m long, is simply-supported at the left-hand end A and at B I'm from the right-hand end C. The beam is of weight 100 N/metre run. (a) Determine the reactions at A and B. (b) Construct to scales of 20 mm = 1 m and 20 mm = 100 N, the shearing-force diagram for the beam, indicating thereon the principal values. (c) Determine the magnitude and position of the maximum bending moment. (You may, if you so wish, deduce the answers from the shearing force diagram without constructing a full or partial bending-moment diagram.) [C.G.] C240 N, 360 N, 288 Nm, 2.4 m from A.]arrow_forward5. Using parentheses make sense of the expression V · VXVV · Å where Ả = Ã(x, y, z). Is the result a vector or a scaler?arrow_forward

- 3.10 (A/B). A beam ABCDE is simply supported at A and D. It carries the following loading: a distributed load of 30 kN/m between A and B, a concentrated load of 20 KN at B, a concentrated load of 20 KN at C, a concentrated load of 10 KN at E; a distributed load of 60 kN/m between 0 and E. Span AB = 1.5 BC = CD = DE 1 m. Calculate the value of the reactions at A and D and hence draw the S.F. and B.M. diagrams. What are the magnitude and position of the maximum B.M. on the beam? [41.1, 113.9 KN, 28.15 kNm; 1.37 m from A.J m,arrow_forward3.14 (B). A beam ABCD, 6 m long, is simply-supported at the right-hand end and at a point B Im from the left-hand end A. It carries a vertical load of 10 KN at A, a second concentrated load of 20 KN at C, 3 m from D, and a uniformly distributed load of 10 kN/m between C and D. Determine: (a) the values of the reactions at B and 0, (6) the position and magnitude of the maximum bending moment. [33 KN, 27 KN, 2.7 m from D, 36.45k Nm.]arrow_forward3.17 (B). A simply supported beam has a span of 6 m and carries a distributed load which varies in a linea manner from 30 kN/m at one support to 90 kN/m at the other support. Locate the point of maximum bendin moment and calculate the value of this maximum. Sketch the S.F. and B.M. diagrams. [U.L.] [3.25 m from l.h. end; 272 KN m 30. 90arrow_forward

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw HillAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw HillAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt