Concept explainers

a.

Find the population standard deviation for each type of investment.

Find the riskiest and least risky investments.

a.

Answer to Problem 38E

- The standard deviation for Stocks, bills and bonds are 15.821, 1.99, and 9.35 respectively.

- The risk is highest for stock investment and the risk is lowest for bill investment.

Explanation of Solution

Calculation:

The annual percentage returns for the years 1993-2012, for the three categories of investments, stock, Treasure bills and Treasure bonds are given. The measure of risk of the investment can be expressed by standard deviation.

Standard deviation:

Let

Finding mean:

Software procedure:

Step-by-step procedure to find mean using the MINITAB software:

- Choose Stat > Basic Statistics > Display

Descriptive Statistics . - In Variables enter the columns Stocks, Bills, Bonds.

- Choose option statistics, and select N total, Mean.

- Click OK.

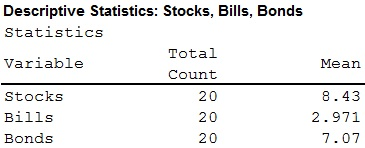

Output using the MINITAB software is given below:

- From the MINITAB output the mean of Stocks, Bills and Bonds are 8.43, 2.971 and 7.07 respectively.

Standard deviation for Stocks:

The deviation, deviation’s squares are calculated below:

| x | ||

| 13.72 | 5.29 | 27.9841 |

| 2.14 | –6.29 | 39.5641 |

| 33.45 | 25.02 | 626.0004 |

| 26.01 | 17.58 | 309.0564 |

| 22.64 | 14.21 | 201.9241 |

| 16.1 | 7.67 | 58.8289 |

| 25.22 | 16.79 | 281.9041 |

| –6.18 | –14.61 | 213.4521 |

| –7.1 | –15.53 | 241.1809 |

| –16.76 | –25.19 | 634.5361 |

| 25.32 | 16.89 | 285.2721 |

| 3.15 | –5.28 | 27.8784 |

| –0.61 | –9.04 | 81.7216 |

| 16.29 | 7.86 | 61.7796 |

| 6.43 | –2 | 4 |

| –33.84 | –42.27 | 1,786.753 |

| 18.82 | 10.39 | 107.9521 |

| 11.02 | 2.59 | 6.7081 |

| 5.53 | –2.9 | 8.41 |

| 7.26 | –1.17 | 1.3689 |

| Total |

Substitute

Thus, the standard deviation for stocks is 15.821.

Standard deviation for Bills:

The deviation, deviation’s squares are calculated below:

| x | ||

| 2.98 | 0.009 | 0.0001 |

| 3.99 | 1.019 | 1.0384 |

| 5.52 | 2.549 | 6.4974 |

| 5.02 | 2.049 | 4.1984 |

| 5.05 | 2.079 | 4.3222 |

| 4.73 | 1.759 | 3.0941 |

| 4.51 | 1.539 | 2.3685 |

| 5.76 | 2.789 | 7.7785 |

| 3.67 | 0.699 | 0.4886 |

| 1.66 | –1.311 | 1.7187 |

| 1.03 | –1.941 | 3.7675 |

| 1.23 | –1.741 | 3.0311 |

| 3.01 | 0.039 | 0.0015 |

| 4.68 | 1.709 | 2.9207 |

| 4.64 | 1.669 | 2.7856 |

| 1.59 | –1.381 | 1.9072 |

| 0.14 | –2.831 | 8.0146 |

| 0.13 | –2.841 | 8.0713 |

| 0.03 | –2.941 | 8.6495 |

| 0.05 | –2.921 | 8.5322 |

| Total |

Substitute

Thus, the standard deviation for stocks is 1.99.

Standard deviation for Bonds:

The deviation, deviation’s squares are calculated below:

| x | ||

| 14.21 | 7.14 | 50.9796 |

| –8.04 | –15.11 | 228.3121 |

| 23.48 | 16.41 | 269.2881 |

| 1.43 | –5.64 | 31.8096 |

| 9.94 | 2.87 | 8.2369 |

| 14.92 | 7.85 | 61.6225 |

| –8.25 | –15.32 | 234.7024 |

| 16.66 | 9.59 | 91.9681 |

| 5.57 | –1.5 | 2.2500 |

| 15.12 | 8.05 | 64.8025 |

| 0.38 | –6.69 | 44.7561 |

| 4.49 | –2.58 | 6.6564 |

| 2.87 | –4.2 | 17.6400 |

| 1.96 | –5.11 | 26.1121 |

| 10.21 | 3.14 | 9.8596 |

| 20.1 | 13.03 | 169.7809 |

| –11.12 | –18.19 | 330.8761 |

| 8.46 | 1.39 | 1.9321 |

| 16.04 | 8.97 | 80.4609 |

| 2.97 | –4.1 | 16.8100 |

| Total |

Substitute

Thus, the standard deviation for bonds is 9.35.

- Hence, the standard deviation for Stocks, bills and bonds are 15.821, 1.99 9.35 respectively.

- If the standard deviation is high, the risk is also higher.

- Here, the standard deviation for Stocks is highest, therefore the risk is also highest in stock investment.

- The standard deviation for bills is lowest, therefore the risk is also lowest in bill investment.

b.

Explain whether the result is same as the theory or not.

b.

Answer to Problem 38E

The result is same as the theory.

Explanation of Solution

It is given that the long term loans are riskier than short-term loans. The treasure bills are short term loans and the treasure bonds are long term loans.

- From part (a), the standard deviation for Stocks, bills and bonds are 15.821, 1.99 9.35 respectively.

It is known that the higher standard deviation implies the higher risk.

The standard deviation for the treasure bonds (long term) is more than the standard deviation for the treasure bills (short-term). That is,

Therefore, long term loans are riskier than short-term loans.

Hence, the result is same as the theory.

c.

Find the mean return for each class of the investment.

c.

Answer to Problem 38E

The result follows the theory.

Explanation of Solution

- It is given that if any investment has more risk the mean return will also be more.

- From part (a), the mean of Stocks, Bills and Bonds are 8.43, 2.971 and 7.07 respectively.

The mean for the treasure bonds (long term) is more than the mean for the treasure bills (short-term). That is,

Therefore, long term loans has more mean.

Hence, the result follows the theory.

Want to see more full solutions like this?

Chapter 3 Solutions

Essential Statistics

- What would you say about a set of quantitative bivariate data whose linear correlation is -1? What would a scatter diagram of the data look like? (5 points)arrow_forwardBusiness discussarrow_forwardAnalyze the residuals of a linear regression model and select the best response. yes, the residual plot does not show a curve no, the residual plot shows a curve yes, the residual plot shows a curve no, the residual plot does not show a curve I answered, "No, the residual plot shows a curve." (and this was incorrect). I am not sure why I keep getting these wrong when the answer seems obvious. Please help me understand what the yes and no references in the answer.arrow_forward

- a. Find the value of A.b. Find pX(x) and py(y).c. Find pX|y(x|y) and py|X(y|x)d. Are x and y independent? Why or why not?arrow_forwardAnalyze the residuals of a linear regression model and select the best response.Criteria is simple evaluation of possible indications of an exponential model vs. linear model) no, the residual plot does not show a curve yes, the residual plot does not show a curve yes, the residual plot shows a curve no, the residual plot shows a curve I selected: yes, the residual plot shows a curve and it is INCORRECT. Can u help me understand why?arrow_forwardYou have been hired as an intern to run analyses on the data and report the results back to Sarah; the five questions that Sarah needs you to address are given below. please do it step by step on excel Does there appear to be a positive or negative relationship between price and screen size? Use a scatter plot to examine the relationship. Determine and interpret the correlation coefficient between the two variables. In your interpretation, discuss the direction of the relationship (positive, negative, or zero relationship). Also discuss the strength of the relationship. Estimate the relationship between screen size and price using a simple linear regression model and interpret the estimated coefficients. (In your interpretation, tell the dollar amount by which price will change for each unit of increase in screen size). Include the manufacturer dummy variable (Samsung=1, 0 otherwise) and estimate the relationship between screen size, price and manufacturer dummy as a multiple…arrow_forward

- Here is data with as the response variable. x y54.4 19.124.9 99.334.5 9.476.6 0.359.4 4.554.4 0.139.2 56.354 15.773.8 9-156.1 319.2Make a scatter plot of this data. Which point is an outlier? Enter as an ordered pair, e.g., (x,y). (x,y)= Find the regression equation for the data set without the outlier. Enter the equation of the form mx+b rounded to three decimal places. y_wo= Find the regression equation for the data set with the outlier. Enter the equation of the form mx+b rounded to three decimal places. y_w=arrow_forwardYou have been hired as an intern to run analyses on the data and report the results back to Sarah; the five questions that Sarah needs you to address are given below. please do it step by step Does there appear to be a positive or negative relationship between price and screen size? Use a scatter plot to examine the relationship. Determine and interpret the correlation coefficient between the two variables. In your interpretation, discuss the direction of the relationship (positive, negative, or zero relationship). Also discuss the strength of the relationship. Estimate the relationship between screen size and price using a simple linear regression model and interpret the estimated coefficients. (In your interpretation, tell the dollar amount by which price will change for each unit of increase in screen size). Include the manufacturer dummy variable (Samsung=1, 0 otherwise) and estimate the relationship between screen size, price and manufacturer dummy as a multiple linear…arrow_forwardExercises: Find all the whole number solutions of the congruence equation. 1. 3x 8 mod 11 2. 2x+3= 8 mod 12 3. 3x+12= 7 mod 10 4. 4x+6= 5 mod 8 5. 5x+3= 8 mod 12arrow_forward

- Scenario Sales of products by color follow a peculiar, but predictable, pattern that determines how many units will sell in any given year. This pattern is shown below Product Color 1995 1996 1997 Red 28 42 21 1998 23 1999 29 2000 2001 2002 Unit Sales 2003 2004 15 8 4 2 1 2005 2006 discontinued Green 26 39 20 22 28 14 7 4 2 White 43 65 33 36 45 23 12 Brown 58 87 44 48 60 Yellow 37 56 28 31 Black 28 42 21 Orange 19 29 Purple Total 28 42 21 49 68 78 95 123 176 181 164 127 24 179 Questions A) Which color will sell the most units in 2007? B) Which color will sell the most units combined in the 2007 to 2009 period? Please show all your analysis, leave formulas in cells, and specify any assumptions you make.arrow_forwardOne hundred students were surveyed about their preference between dogs and cats. The following two-way table displays data for the sample of students who responded to the survey. Preference Male Female TOTAL Prefers dogs \[36\] \[20\] \[56\] Prefers cats \[10\] \[26\] \[36\] No preference \[2\] \[6\] \[8\] TOTAL \[48\] \[52\] \[100\] problem 1 Find the probability that a randomly selected student prefers dogs.Enter your answer as a fraction or decimal. \[P\left(\text{prefers dogs}\right)=\] Incorrect Check Hide explanation Preference Male Female TOTAL Prefers dogs \[\blueD{36}\] \[\blueD{20}\] \[\blueE{56}\] Prefers cats \[10\] \[26\] \[36\] No preference \[2\] \[6\] \[8\] TOTAL \[48\] \[52\] \[100\] There were \[\blueE{56}\] students in the sample who preferred dogs out of \[100\] total students.arrow_forwardBusiness discussarrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman