Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6PB

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney:

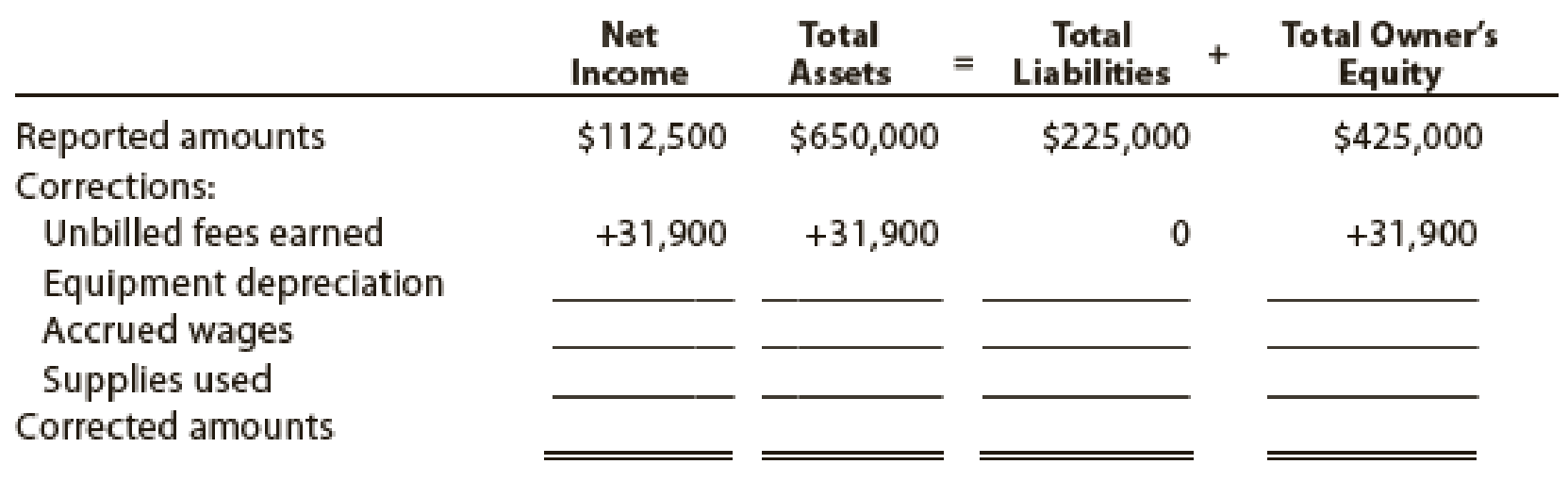

In preparing the financial statements, adjustments for the following data were overlooked:

- • Unbilled fees earned at August 31, $31,900.

- •

Depreciation of equipment for August, $7,500. - • Accrued wages at August 31, $5,200.

- • Supplies used during August, $3,000.

Instructions

- 1.

Journalize the entries to record the omitted adjustments. - 2. Determine the correct amount of net income for August and the total assets, liabilities, and owner’s equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please provide the correct answer to this general accounting problem using valid calculations.

Can you explain the correct methodology to solve this general accounting problem?

Can you solve this general accounting question with the appropriate accounting analysis techniques?

Chapter 3 Solutions

Financial Accounting

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (a) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - Prob. 7DQCh. 3 - Does every adjusting entry affect net income for a...Ch. 3 - Prob. 9DQCh. 3 - Prob. 10DQ

Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - The supplies account had a beginning balance of...Ch. 3 - The prepaid insurance account had a beginning...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - Prob. 4PEBCh. 3 - At the end of the current year, 23,570 of fees...Ch. 3 - At the end of the current year, 17,555 of fees...Ch. 3 - We-Sell Realty Co. pays weekly salaries of 11,800...Ch. 3 - Prospect Realty Co. pays weekly salaries of 27,600...Ch. 3 - Prob. 7PEACh. 3 - The estimated amount of depreciation on equipment...Ch. 3 - For the year ending August 31, 2016, Mammalia...Ch. 3 - For the year ending April 30, 2016, Urology...Ch. 3 - For each of the following errors, considered...Ch. 3 - For each of the following errors, considered...Ch. 3 - Prob. 10PEACh. 3 - Prob. 10PEBCh. 3 - Classify the following items as (a) prepaid...Ch. 3 - The following accounts were taken from the...Ch. 3 - The balance in the supplies account, before...Ch. 3 - The supplies and supplies expense accounts at...Ch. 3 - At March 31, the end of the first month of...Ch. 3 - The balance in the prepaid insurance account,...Ch. 3 - The prepaid insurance account had a balance of...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - Prob. 9ECh. 3 - At the end of the current year, 22,650 of fees...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - The adjusting entry for accrued fees was omitted...Ch. 3 - Ocular Realty Co. pays weekly salaries of 16,600...Ch. 3 - Prob. 14ECh. 3 - Accrued salaries owed to employees for October 30...Ch. 3 - Assume that the error in Exercise 3-15 was not...Ch. 3 - Art Imaging Company was organized on April 1 of...Ch. 3 - The estimated amount of depreciation on equipment...Ch. 3 - The balance in the equipment account is...Ch. 3 - Prob. 20ECh. 3 - For a recent period, the balance sheet for Costco...Ch. 3 - Prob. 22ECh. 3 - The accountant for Healthy Life Company, a medical...Ch. 3 - If the net income for the current year had been...Ch. 3 - On December 31, a business estimates depreciation...Ch. 3 - The unadjusted and adjusted trial balances for...Ch. 3 - The accountant for Evas Laundry prepared the...Ch. 3 - The following data (in millions) are taken from...Ch. 3 - Prob. 29ECh. 3 - On March 31, 2016, the following data were...Ch. 3 - Selected account balances before adjustment for...Ch. 3 - Reliable Repairs Service, an electronics repair...Ch. 3 - Good Note Company specializes in the repair of...Ch. 3 - Rowland Company is a small editorial services...Ch. 3 - At the end of April, the first month of...Ch. 3 - Prob. 1PBCh. 3 - Selected account balances before adjustment for...Ch. 3 - Crazy Mountain Outfitters Co., an outfitter store...Ch. 3 - The Signage Company specializes in the maintenance...Ch. 3 - Reece Financial Services Co., which specializes in...Ch. 3 - At the end of August, the first month of...Ch. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Daryl Kirby opened Squid Realty Co. on January 1,...Ch. 3 - Prob. 2CPCh. 3 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY