Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 27E

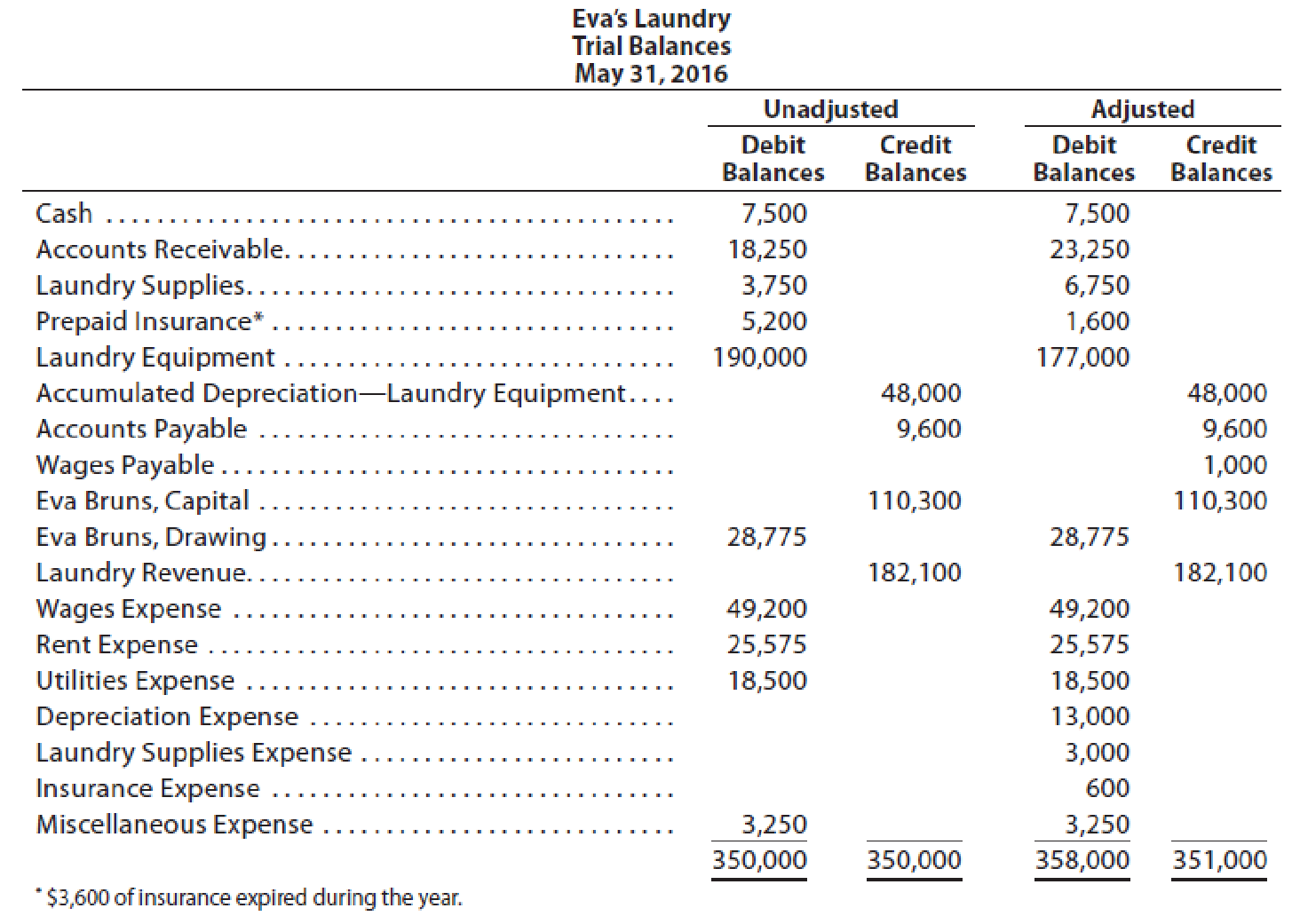

The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this general accounting question with the appropriate accounting analysis techniques?

Please explain the correct approach for solving this general accounting question.

Can you help me solve this general accounting question using the correct accounting procedures?

Chapter 3 Solutions

Financial Accounting

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (a) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - Prob. 7DQCh. 3 - Does every adjusting entry affect net income for a...Ch. 3 - Prob. 9DQCh. 3 - Prob. 10DQ

Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - The supplies account had a beginning balance of...Ch. 3 - The prepaid insurance account had a beginning...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - Prob. 4PEBCh. 3 - At the end of the current year, 23,570 of fees...Ch. 3 - At the end of the current year, 17,555 of fees...Ch. 3 - We-Sell Realty Co. pays weekly salaries of 11,800...Ch. 3 - Prospect Realty Co. pays weekly salaries of 27,600...Ch. 3 - Prob. 7PEACh. 3 - The estimated amount of depreciation on equipment...Ch. 3 - For the year ending August 31, 2016, Mammalia...Ch. 3 - For the year ending April 30, 2016, Urology...Ch. 3 - For each of the following errors, considered...Ch. 3 - For each of the following errors, considered...Ch. 3 - Prob. 10PEACh. 3 - Prob. 10PEBCh. 3 - Classify the following items as (a) prepaid...Ch. 3 - The following accounts were taken from the...Ch. 3 - The balance in the supplies account, before...Ch. 3 - The supplies and supplies expense accounts at...Ch. 3 - At March 31, the end of the first month of...Ch. 3 - The balance in the prepaid insurance account,...Ch. 3 - The prepaid insurance account had a balance of...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - Prob. 9ECh. 3 - At the end of the current year, 22,650 of fees...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - The adjusting entry for accrued fees was omitted...Ch. 3 - Ocular Realty Co. pays weekly salaries of 16,600...Ch. 3 - Prob. 14ECh. 3 - Accrued salaries owed to employees for October 30...Ch. 3 - Assume that the error in Exercise 3-15 was not...Ch. 3 - Art Imaging Company was organized on April 1 of...Ch. 3 - The estimated amount of depreciation on equipment...Ch. 3 - The balance in the equipment account is...Ch. 3 - Prob. 20ECh. 3 - For a recent period, the balance sheet for Costco...Ch. 3 - Prob. 22ECh. 3 - The accountant for Healthy Life Company, a medical...Ch. 3 - If the net income for the current year had been...Ch. 3 - On December 31, a business estimates depreciation...Ch. 3 - The unadjusted and adjusted trial balances for...Ch. 3 - The accountant for Evas Laundry prepared the...Ch. 3 - The following data (in millions) are taken from...Ch. 3 - Prob. 29ECh. 3 - On March 31, 2016, the following data were...Ch. 3 - Selected account balances before adjustment for...Ch. 3 - Reliable Repairs Service, an electronics repair...Ch. 3 - Good Note Company specializes in the repair of...Ch. 3 - Rowland Company is a small editorial services...Ch. 3 - At the end of April, the first month of...Ch. 3 - Prob. 1PBCh. 3 - Selected account balances before adjustment for...Ch. 3 - Crazy Mountain Outfitters Co., an outfitter store...Ch. 3 - The Signage Company specializes in the maintenance...Ch. 3 - Reece Financial Services Co., which specializes in...Ch. 3 - At the end of August, the first month of...Ch. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Daryl Kirby opened Squid Realty Co. on January 1,...Ch. 3 - Prob. 2CPCh. 3 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY