Concept explainers

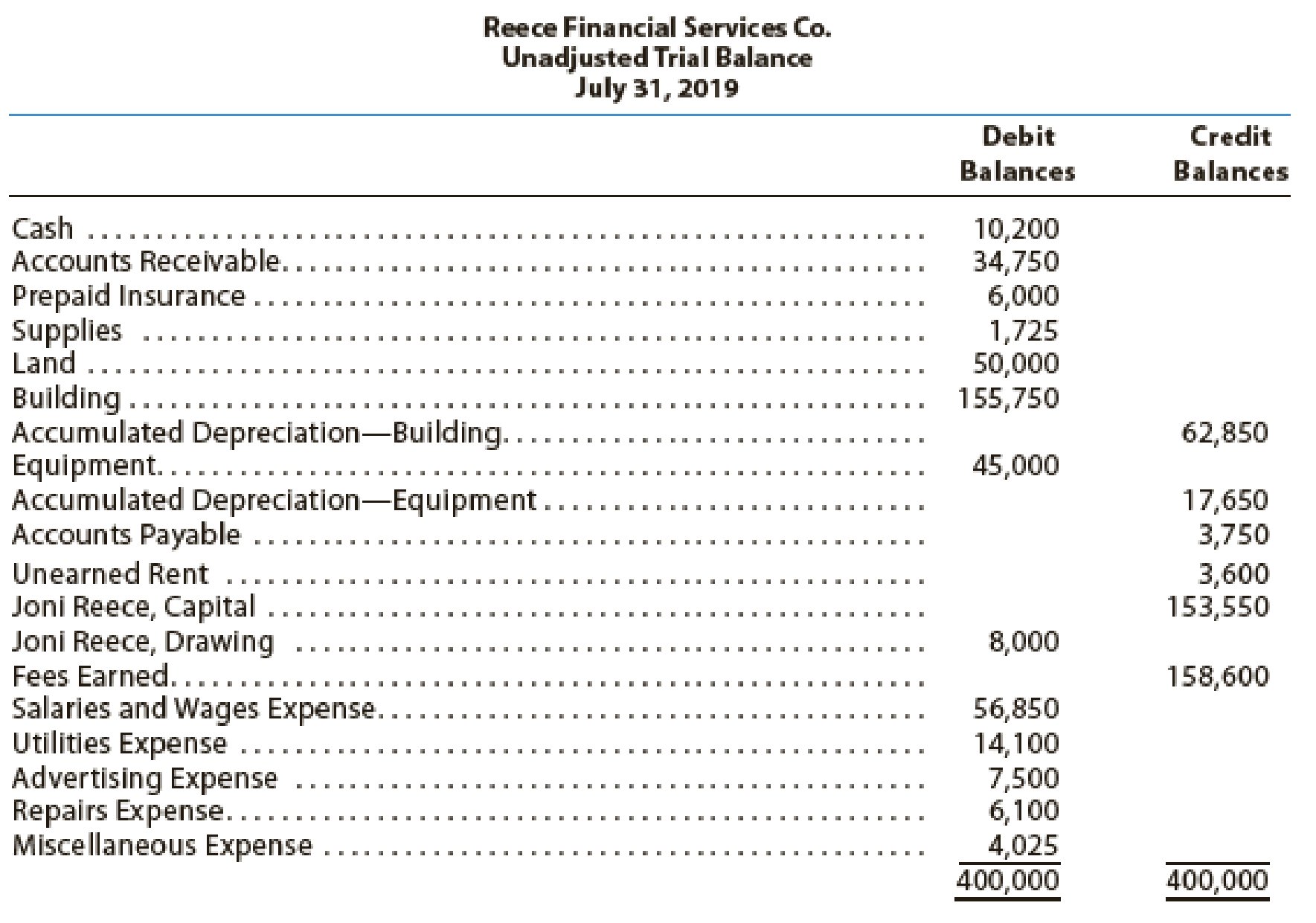

Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted

The data needed to determine year-end adjustments are as follows:

- •

Depreciation of building for the year, $6,400. - • Depreciation of equipment for the year, $2,800.

- • Accrued salaries and wages at July 31, $900.

- • Unexpired insurance at July 31, $1,500.

- • Fees earned but unbilled on July 31, $10,200.

- • Supplies on hand at July 31, $615.

- • Rent unearned at July 31, $300.

Instructions

- 1. Journalize the

adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense—Building, Depreciation Expense—Equipment, and Supplies Expense. - 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.

(1)

Record the adjusting entries on July 31, 2019 of Company RFS.

Answer to Problem 5PB

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Depreciation expense | 6,400 | |

| Accumulated Depreciation- building | 6,400 | ||

| (To record the depreciation on building for the current year.) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Explanation of Solution

Description of journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $6,400.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $6,400. So credit accumulated depreciation by $6,400.

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Depreciation expense | 2,800 | |

| Accumulated Depreciation- equipment | 2,800 | ||

| (To record the depreciation on equipment for the current year.) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $2,800.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $2,800. So credit accumulated depreciation by $2,800.

The following entry shows the adjusting entry for Salary and wages expense on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Salary and wages expense | 900 | |

| Wages Payable | 900 | ||

| (To record the salary and wages accrued but not paid at the end of the accounting period.) |

Table (3)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Salary and wages expense is a component of Stockholders ‘equity, and it decreased it by $900. So debit wage expense by $900.

- Salary and wages payable is a liability, and it is increased by $900. So credit Salary and wages payable by $900.

The following entry shows the adjusting entry for unexpired insurance on July 31.

| Date | Description |

Post. Ref |

Debit ($) |

Credit ($) |

| July 31 | Insurance expense (1) | 4,500 | ||

| Prepaid insurance | 4,500 | |||

| (To record the insurance expense incurred at the end of the year) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Working note 1: Calculate the value of insurance expense at the end of the year

Description of journal entry

- Insurance expense is a component of owners’ equity, and decreased it by $4,500 hence debit the insurance expense for $4,500.

- Prepaid insurance is an asset, and it decreases the value of asset by $4,500, hence credit the prepaid insurance for $4,500.

The following entry shows the adjusting entry for accrued fees unearned on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Accounts Receivable | 10,200 | |

| Fees earned | 10,200 | ||

| (To record the accounts receivable at the end of the year.) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Accounts Receivable is an asset, and it is increased by $10,200. So debit Accounts receivable by $10,200.

- Fees earned are component of stockholders’ equity, and it increased it by $10,200. So credit fees earned by $10,200.

The following entry shows the adjusting entry for supplies on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Supplies Expense (2) | 1,110 | |

| Supplies | 1,110 | ||

| (To record the supplies expense at the end of the accounting period) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Supplies expense is a component of stockholders’ equity, and it decreased the stockholders’ equity by $1,110. So debit supplies expense by $1,110.

- Supplies are an asset for the business, and it is decreased by $1,110. So credit supplies by $1,110.

Working Note 2: Calculation of Supplies expense for the accounting period

The following entry shows the adjusting entry for Unearned Rent on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Unearned Rent | 3,300 | |

| Rent revenue (3) | 3,300 | ||

| (To record the Rent revenue from services at the end of the accounting period.) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Unearned Rent is a liability, and it is decreased by $3,300. So debit unearned rent by $3,300.

- Rent revenue is a component of Stockholders’ equity, and it is increased by $3,300. So credit rent revenue by $3,300.

Working Notes 3: Calculation of Rent Revenue for the accounting period

(2)

Prepare adjusted trial balance of the Company RFS on July 31, 2019

Answer to Problem 5PB

The adjusted trial balance of the Company RFS is as follows:

| Company RFS | ||

| Trial Balance after Adjustments | ||

| July 31, 2019 | ||

| Particulars | Debit $ | Credit $ |

| Cash | 10,200 | |

| Accounts Receivable(5) | 44,950 | |

| Prepaid Insurance | 1,500 | |

| Supplies | 615 | |

| Land | 50,000 | |

| Building | 155,750 | |

| Accumulated Depreciation - Building(1) | 69,250 | |

| Equipment | 45,000 | |

| Accumulated Depreciation - Equipment(2) | 20,450 | |

| Accounts Payable | 3,750 | |

| Unearned Rent | 300 | |

| Salaries and Wages Payable | 900 | |

| Capital | 153,550 | |

| Drawing | 8,000 | |

| Fees earned | 168,800 | |

| Rent Revenue (7) | 3,300 | |

| Salaries and Wages Expense (3) | 57,750 | |

| Utilities Expense | 14,100 | |

| Advertising Expense | 7,500 | |

| Repairs Expense | 6,100 | |

| Depreciation Expense - building | 6,400 | |

| Depreciation Expense - equipment | 2,800 | |

| Insurance Expense (4) | 4,500 | |

| Supplies Expense (6) | 1,110 | |

| Miscellaneous Expense | 4,025 | |

| 420,300 | 420,300 | |

Explanation of Solution

Working Notes:

1. Calculation of accumulated depreciation- building

2. Calculation of accumulated depreciation- equipment

3. Calculation of Salaries and Wages expenses

4. Calculate the value of insurance expense at the end of the year

5. Calculation of accounts receivable

6. Calculation of Supplies expense for the accounting period

7. Calculation of rent revenue

Hence, the total of debit and credit column of the adjusted trial balance matches and they have a total balance of $420,300.

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT