Concept explainers

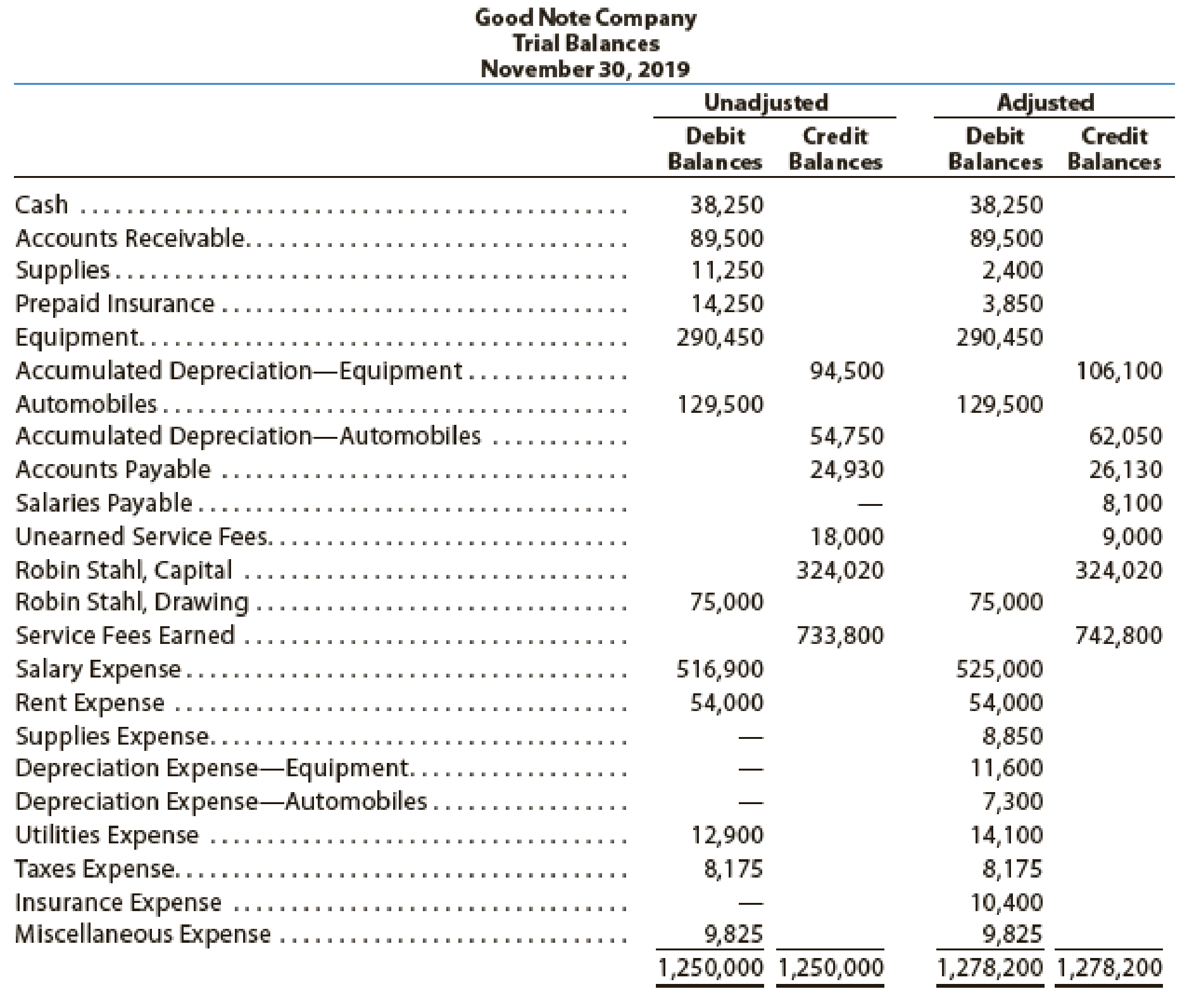

Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following

Instructions

Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one

Prepare adjusting entries in the books of Company GN at the end of the year.

Answer to Problem 4PA

Adjusting entries: Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

An adjusting entry for Supplies expenses: In this case, Company GN recognized the supplies expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the supplies expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Supplies expenses (1) | 8,850 | |||

| November | 30 | Supplies | 8,850 | ||

| (To record the supplies expenses incurred at the end of the year) | |||||

Table (1)

Explanation of Solution

Working note 1: Calculate the value of supplies expense

Justification for journal entry

- Supplies expense decreases the value of owner’s equity by $8,850; hence debit the supplies expenses for $8,850.

- Supplies are an asset, and it decreases the value of asset by $8,850, hence credit the supplies for $8,850.

An adjusting entry for insurance expenses: In this case, Company GN recognized the insurance expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the prepaid expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Insurance expenses (2) | 10,400 | |||

| November | 30 | Prepaid insurance | 10,400 | ||

| (To record the insurance expenses incurred at the end of the year) | |||||

Table (2)

Working note 1: Calculate the value of insurance expense

Justification for journal entry

- Insurance expense decreases the value of owner’s equity by $10,400; hence debit the insurance expenses for $10,400.

- Prepaid insurance is an asset, and it decreases the value of asset by $10,400, hence credit the prepaid insurance for $10,400.

An adjusting entry for depreciation expenses-Equipment: In this case, Company GN recognized the depreciation expenses on equipment at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Equipment (3) | 11,600 | |||

| November | 30 | Accumulated depreciation-Equipment | 11,600 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (3)

Working note 3: Calculate the value of depreciation expense-Equipment

Justification for journal entry

- Depreciation expense decreases the value of owner’s equity by $11,600; hence debit the depreciation expenses for $11,600.

- Accumulated depreciation is a contra-asset account, and it decreases the value of asset by $11,600, hence credit the accumulated depreciation for $11,600.

An adjusting entry for depreciation expenses-Automobiles: In this case, Company GN recognized the depreciation expenses on automobiles at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Automobiles (4) | 7,300 | |||

| November | 30 | Accumulated depreciation-Automobiles | 7,300 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (4)

Working note 4: Calculate the value of depreciation expense-Automobiles

Justification for journal entry

- Depreciation expense decreases the value of owner’s equity by $7,300; hence debit the depreciation expenses for $7,300.

- Accumulated depreciation is a contra-asset account, and it decreases the value of asset by $7,300, hence credit the accumulated depreciation for $7,300.

An adjusting entry for utilities expenses: In this case, Company GN recognized the utilities expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Utilities expenses (5) | 1,200 | |||

| November | 30 | Accounts payable | 1,200 | ||

| (To record the utilities expenses incurred at the end of the year) | |||||

Table (5)

Working note 5: Calculate the value of utilities expense

Justification for journal entry

- Utilities expense decreases the value of owner’s equity by $1,200; hence debit the utilities expenses for $1,200.

- Accounts payable is a liability, and it increases the value of liability by $1,200, hence credit the accounts payable for $1,200.

An adjusting entry for salaries expenses: In this case, Company GN recognized the salaries expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Salaries expenses (6) | 8,100 | |||

| November | 30 | Salaries payable | 8,100 | ||

| (To record the salaries expenses incurred at the end of the year) | |||||

Table (6)

Working note 6: Calculate the value of salaries expense.

Justification for journal entry

- Salaries expense decreases the value of owner’s equity by $8,100; hence debit the salaries expenses for $8,100.

- Salaries payable is a liability, and it increases the value of liability by $8,100, hence credit the salaries payable for $8,100.

An adjusting entry for unearned service fees: In this case, Company GN received cash in advance before the service provided to customer. So, the necessary adjusting entry that the Company GN should record for the unearned fees revenue at the end of the year is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Unearned service fees | 9,000 | |||

| November | 30 | Service fees earned (7) | 9,000 | ||

| (To record the unearned service fees at the end of the year) | |||||

Table (7)

Working note 7: Calculate the value of service fees earned

Justification for journal entry

- Unearned service fees are a liability, and it decreases the value of liability by $9,000, hence debit the unearned service fees for $9,000.

- Service fees earned increases owner’s equity by $9,000; hence credit the service fees earned for $9,000.

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardChapter Six Mini Practice Set Saved Help 30 1 points eBook Print 이 References ALLOUMILITY WUIN UI LIIS CUSUTY SERVICES FOR MEN January 2002. Assume that you are the chief accountant for Eli's Consulting Services. During January, the business will use the same types of records and procedures that you learned about in Chapters 1 through 6. The chart of accounts for Eli's Consulting Services has been expanded to include a few new accounts. Follow the instructions on the Requirements tab to complete the accounting records for the month of January. DATE TRANSACTIONS January 2 Purchased supplies for $14,000; issued Check 1015. January 2 Purchased a one-year insurance policy for $16,800. January 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. January 12 Collected a total of $8,000 on account from credit customers during the first week of January. January 12 Issued Check 1017 for $7,200 to pay for special promotional advertising to new businesses on…arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning