Concept explainers

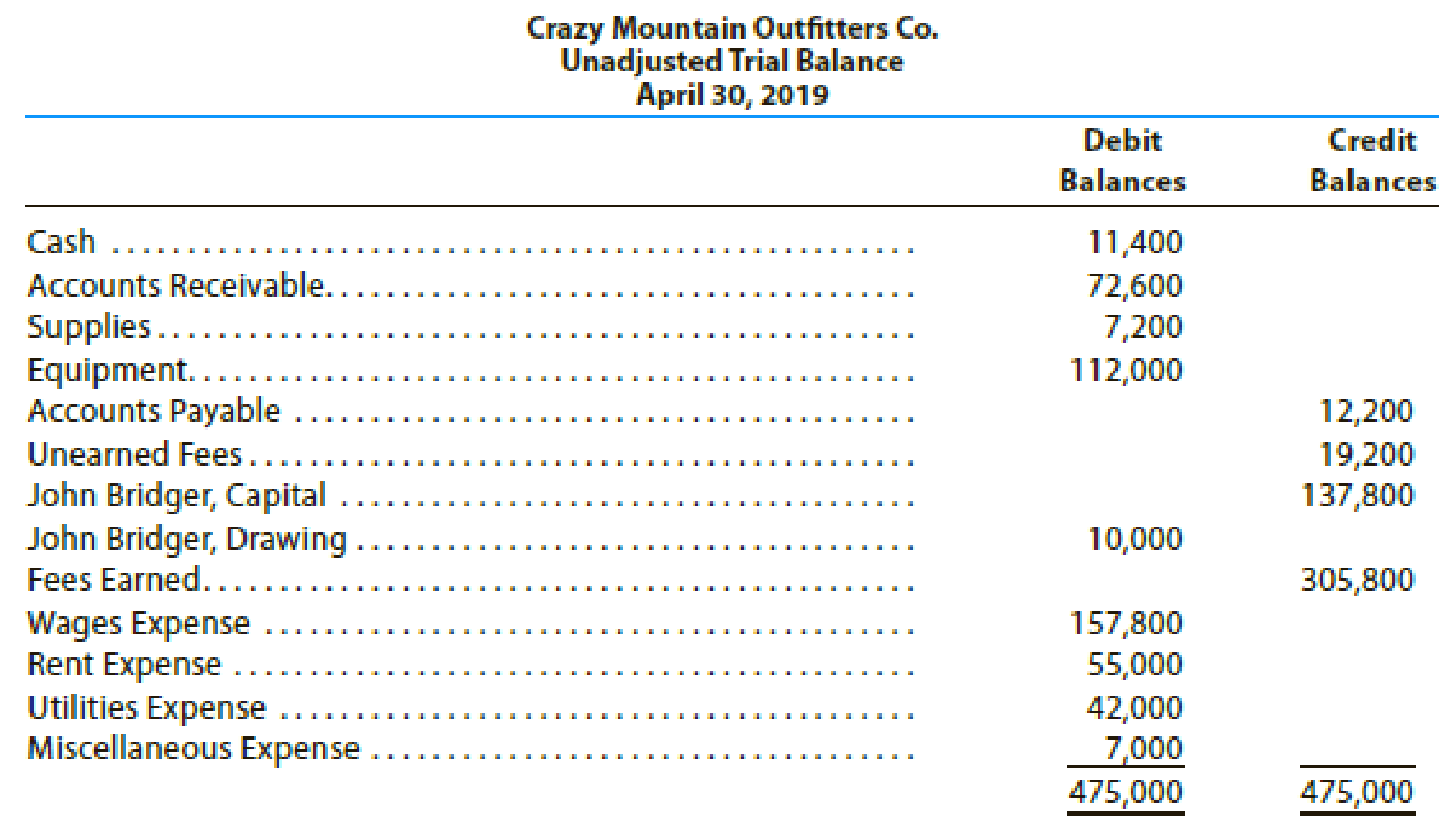

Crazy Mountain Outfitters Co., an outfitter store for fishing treks, prepared the following unadjusted

For preparing the

- • Supplies on hand on April 30 were $1,380.

- • Fees earned but unbilled on April 30 were $3,900.

- •

Depreciation of equipment was estimated to be $3,000 for the year. - • Unpaid wages accrued on April 30 were $2,475.

- • The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $14,140 of the services was provided between April 1 and April 30.

Instructions

- 1. Journalize the adjusting entries necessary on April 30, 2019.

- 2. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. before the adjusting entries.

- 3. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. after the adjusting entries.

- 4. Determine the effect of the adjusting entries on John Bridger, Capital.

(1)

Record the adjusting entries on April 30, 2019 of CMO Company.

Answer to Problem 3PB

Adjusting Entries: Adjusting entries indicates those entries, which are passed in the books of accounts at the end of one accounting period. These entries are passed in the books of accounts as per the revenue recognition principle and the expenses recognition principle to adjust the revenue, and the expenses of a business in the period of their occurrence.

Adjusted Trial Balance: Adjusted trial balance is a trial balance prepared at the end of a financial period, after all the adjusting entries are journalized and posted. It is prepared to prove the equality of the total debit and credit balances.

Rule of Debit and Credit:

Debit - Increase in all assets, expenses & dividends, and decrease in all liabilities and stockholders’ equity.

Credit - Increase in all liabilities and stockholders’ equity, and decrease in all assets & expenses.

The following entry shows the adjusting entry for supplies on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Supplies Expense (1) | 5,820 | |

| Supplies | 5,820 | ||

| (To record the supplies expense at the end of the accounting period) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Explanation of Solution

Justification for journal entry

- Supplies expense is a component of stockholders’ equity, and it decreased the stockholders’ equity by $5,820. So debit supplies expense by $5,820.

- Supplies are an asset for the business, and it is decreased by $5,820. So credit supplies by $5,820.

Working Note 1:

Calculation of fees earned for the accounting period

The following entry shows the adjusting entry for accrued fees unearned on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Accounts Receivable | 3,900 | |

| Fees earned | 3,900 | ||

| (To record the accounts receivable at the end of the year.) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Accounts Receivable is an asset, and it is increased by $3,900. So debit Accounts receivable by $3,900.

- Fees earned are component of stockholders’ equity and increased it by $3,900. So credit fees earned by $3,900.

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Depreciation expense | 3,000 | |

| Accumulated Depreciation | 3,000 | ||

| (To record the depreciation on office equipment for the current year.) |

Table (3)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $3,000.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $3,000. So credit accumulated depreciation by $3,000.

The following entry shows the adjusting entry for wages expense on April 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| April 30 | Wages expenses | 2,475 | |

| Wages Payable | 2,475 | ||

| (To record the wages accrued but not paid at the end of the accounting period.) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Wages expense is a component of Stockholders ‘equity, and it decreased it by $2,475. So debit wage expense by $2,475.

- Wages Payable is a liability, and it is increased by $2,475. So credit wages payable by $2,475.

The following entry shows the adjusting entry for unearned fees on June 30.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| June 30 | Unearned Fees | 14,140 | |

| Fees earned | 14,140 | ||

| (To record the fees earned from services at the end of the accounting period.) |

Table (5)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Justification for journal entry

- Unearned fees are a liability, and it is decreased by $14,140. So debit unearned rent by $14,140.

- Fees earned are a component of Stockholders’ equity, and it is increased by $14,140. So credit rent revenue by $14,140.

(2)

Determine the revenues, expenses and net income of CMO Company before adjusting entries.

Answer to Problem 3PB

The revenues, expenses and net income before adjusting entries of CMO Company are stated below:

- Revenue = $305,800 (given)

- Expenses = $261,800 (W.N-1)

- Net income = $44,000 (W.N-2)

Explanation of Solution

Working Note 1: Calculation of expenses before adjusting entries:

Working Note 2: Calculation of net income before adjusting entries

Hence, the revenues, expenses and net income of CMO Company are $305,800, $261,800 and $44,000 respectively.

(3)

Determine the revenues, expenses and net income of CMO Company after adjusting entries

Answer to Problem 3PB

The revenues, expenses and net income after adjusting entries of CMO Company are stated below:

- Revenue = $323,840 (W.N-4)

- Expenses = $273,095 (W.N-3)

- Net income = $50,745 (W.N-5)

Explanation of Solution

Working Note 3: Calculation of expenses after adjusting entries:

Working Note 4: Calculation of revenue after adjusting entries:

Working Note 5: Calculation of net income after adjusting entries

Hence, the revenues, expenses and net income of CMO Company are $323,840, $273,095 and $50,745 respectively.

(4)

Determine the effect of the adjusting entries on the capital of CMO Company.

Answer to Problem 3PB

The capital of CMO Company will be increased by $10,745 after the adjusting entry.

Explanation of Solution

Due to the adjusting entry there is an increase in the net income of $10,745

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- I am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardPlease show me how to solve this financial accounting problem using valid calculation techniques.arrow_forward

- I need guidance with this financial accounting problem using the right financial principles.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- What is the amount of operating cash flowarrow_forwardYamamoto Corporation began the accounting period with $92,000 of merchandise, and the net cost of purchases was $318,000. A physical inventory showed $104,000 of merchandise unsold at the end of the period. The cost of goods sold by Yamamoto Corporation for the period is __. need helparrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- An asset owned by Crescent Manufacturing has a book value of $36,000 on June 30, Year 5. The asset has been depreciated at an annual rate of $8,000 using the straight-line method. Assuming the asset is sold on June 30, Year 5 for $39,500, how should the company record the transaction? a. Neither a gain nor a loss is recognized on this type of transaction. b. A gain on sale of $3,500. c. A gain on sale of $5,000. d. A loss on sale of $3,500. e. A loss on sale of $5,000.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you explain the correct approach to solve this financial accounting question?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning