College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 5PB

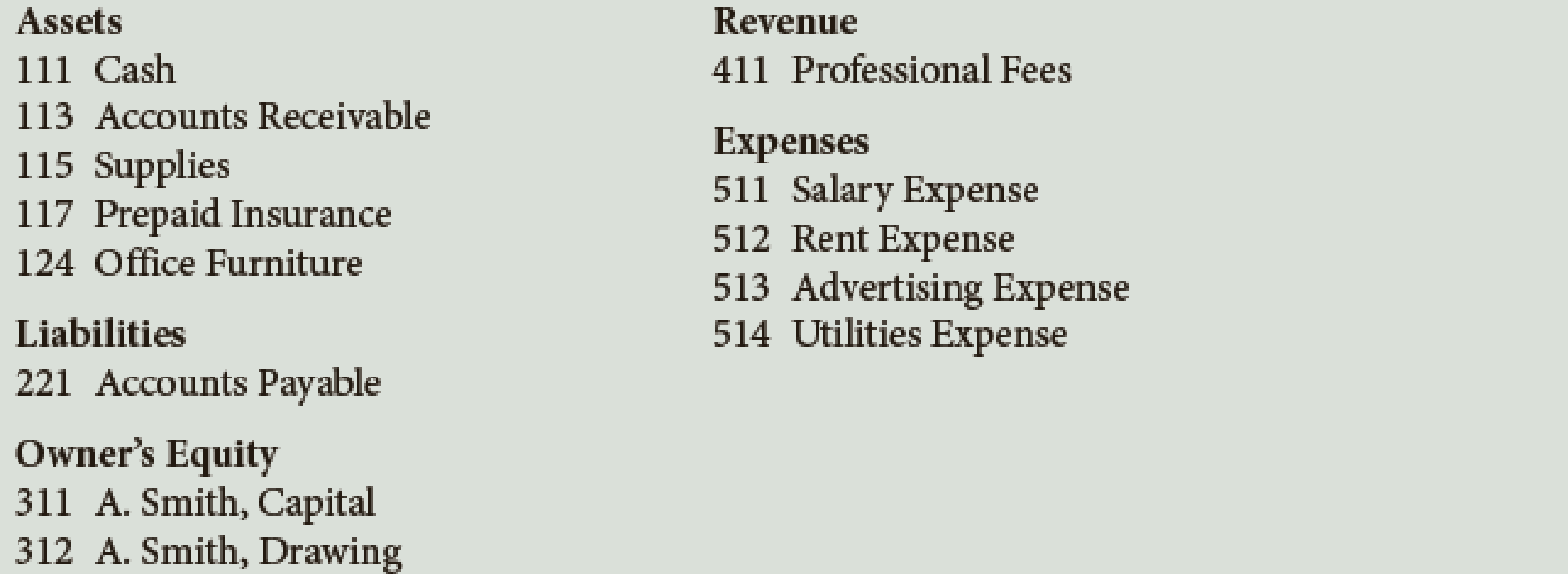

Following is the chart of accounts of Smith Financial Services:

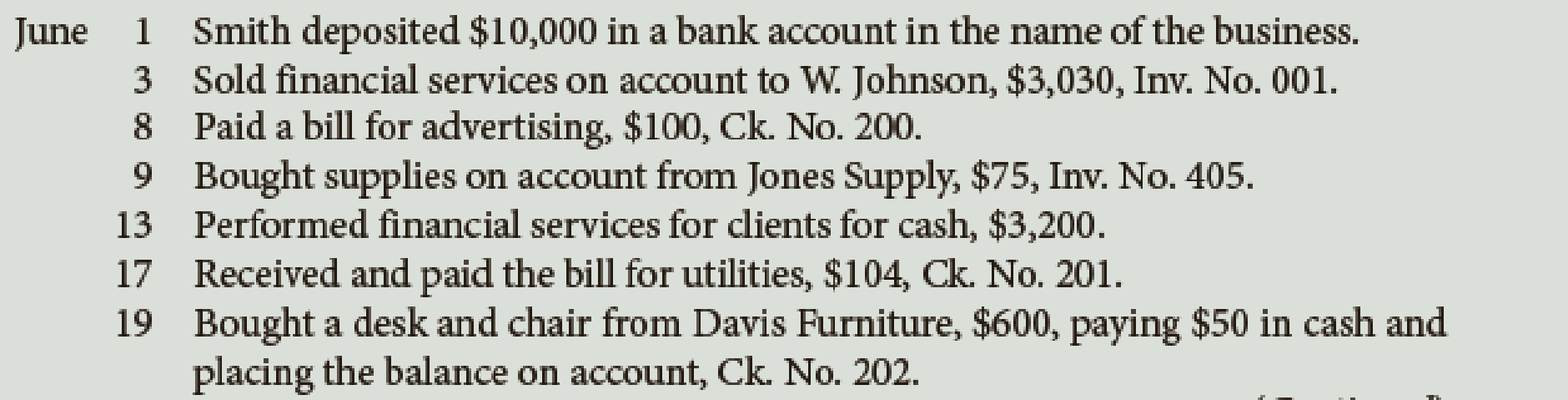

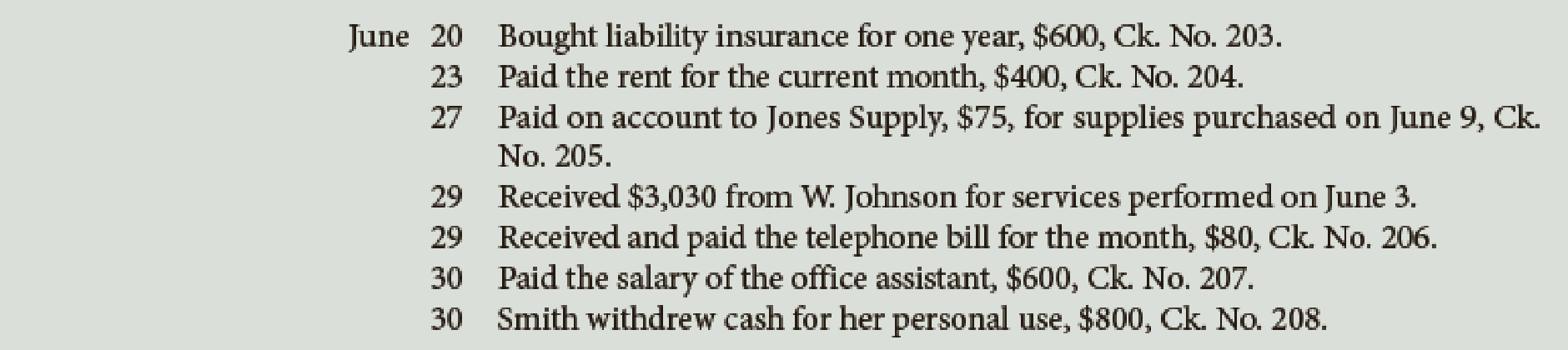

Smith completed the following transactions during June (the first month of business):

Required

- 1. Journalize the transactions for June in the general journal.

- 2.

Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) - 3. Prepare a

trial balance as of June 30, 20–. - 4. Prepare an income statement for the month ended June 30, 20–.

- 5. Prepare a statement of owner’s equity for the month ended June 30, 20–.

- 6. Prepare a

balance sheet as of June 30, 20–.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Tulsa's gross profit percentage is: financial accounting

Provide answer A b

Contribution margin is

Chapter 3 Solutions

College Accounting (Book Only): A Career Approach

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the gross profit?arrow_forwardKelvin enterprises has the following reported amountsarrow_forwardDepartment A had 15,000 units in work in process that were 60% completed as to labor and overhead at the beginning of the period; 45,600 units of direct materials were added during the period; 42,500 units were completed during the period, and 11,000 units were 80% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories. The number of equivalent units of production for conversion costs for the period was ____ Units. Need Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License