Concept explainers

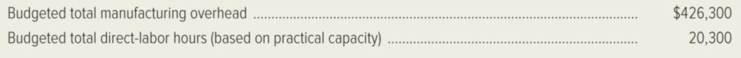

Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing

During March, the firm worked on the following two production jobs:

Job number T81, consisting of 76 trombones

Job number C40, consisting of 110 cornets

The events of March are described as follows:

- a. One thousand square feet of rolled brass sheet metal were purchased on account for $5,000.

- b. Four hundred pounds of brass tubing were purchased on account for $4,000.

- c. The following requisitions were submitted on March 5:

Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)

Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for job number C40)

Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon

All brass used in production is treated as direct material. Valve lubricant is an indirect material.

- d. An analysis of labor time cards revealed the following labor usage for March.

Direct labor: Job number T81, 800 hours at $20 per hour

Direct labor: Job number C40, 900 hours at $20 per hour

Indirect labor: General factory cleanup, $4,000

Indirect labor: Factory supervisory salaries, $9,000

- e.

Depreciation of the factory building and equipment during March amounted to $12,000. - f. Rent paid in cash for warehouse space used during March was $1,200.

- g. Utility costs incurred during March amounted to $2,100. The invoices for these costs were received, but the bills were not paid in March.

- h. March property taxes on the factory were paid in cash, $2,400.

- i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid.

- j. The costs of salaries and

fringe benefits for sales and administrative personnel paid in cash during March amounted to $8,000. - k. Depreciation on administrative office equipment and space amounted to $4,000.

- l. Other selling and administrative expenses paid in cash during March amounted to $1,000.

- m. Job number T81 was completed on March 20.

- n. Half of the trombones in job number T81 were sold on account during March for $700 each.

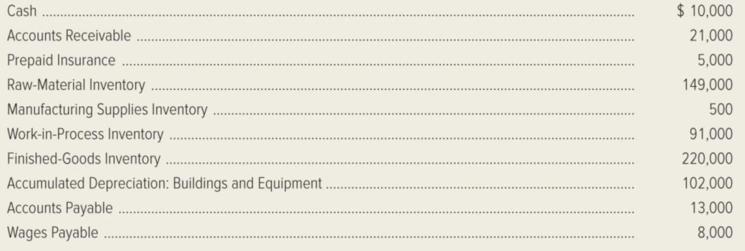

The March 1 balances in selected accounts are as follows:

Required:

- 1. Calculate the company’s predetermined overhead rate for the year.

- 2. Prepare journal entries to record the events of March.

- 3. Set up T-accounts, and

post the journal entries made in requirement (2). - 4. Calculate the over applied or under applied overhead for March. Prepare a

journal entry to close this balance into Cost of Goods Sold. - 5. Prepare a schedule of cost of goods manufactured for March.

- 6. Prepare a schedule of cost of goods sold for March.

- 7. Prepare an income statement for March.

Trending nowThis is a popular solution!

Chapter 3 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning