Concept explainers

JLR Enterprises provides consulting services throughout California and uses a

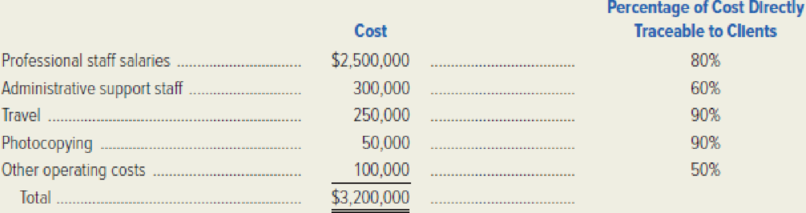

JLR’s director of cost management, Brent Dean, anticipates the following costs for the upcoming year:

The firm’s partners desire to make a $640,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.

On March 10, JLR completed work on a project for Martin Manufacturing. The following costs were incurred: professional staff salaries, $41,000; administrative support staff, $2,600; travel, $4,500; photocopying, $500; and other operating costs, $1,400.

Required:

- 1. Determine JLR’s total traceable costs for the upcoming year and the firm’s total anticipated overhead.

- 2. Calculate the predetermined overhead rate. The rate is based on total costs traceable to client jobs.

- 3. What percentage of cost will JLR add to each job to achieve its profit target?

- 4. Determine the total cost of the Martin Manufacturing project. How much would Martin be billed for services performed?

- 5. Notice that only 50 percent of JLR’s other operating cost is directly traceable to specific client projects. Cite several costs that would be included in this category and difficult to trace to clients.

- 6. Notice that 80 percent of the professional staff cost is directly traceable to specific client projects. Cite several reasons that would explain why this figure isn’t 100 percent.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

- What would be the effect on income from operations?arrow_forwardHello tutor answer these general accounting questionarrow_forwardAlam Store recorded the following: cash sales $52,000, credit sales $78,000, sales return $6,000, sales allowances $4,300, and early payment discount taken by customers $3,600. Calculate the net sales.arrow_forward

- What is the production cost per unit?arrow_forwardAegis Corp. has assets of $215,630 and liabilities of $97,425. Then the firm receives $30,215 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?helparrow_forwardCalculate the inventory turnover ratio of this financial accounting questionarrow_forward

- Financial Accounting Problem: A project requires an investment of $4,500 and has a net present value of $810. If the IRR is 10%, what is the profitability index for the project?arrow_forwardCalculate variable manufacturing overheadarrow_forwardWhat is the labor efficiency variance for April?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning