Concept explainers

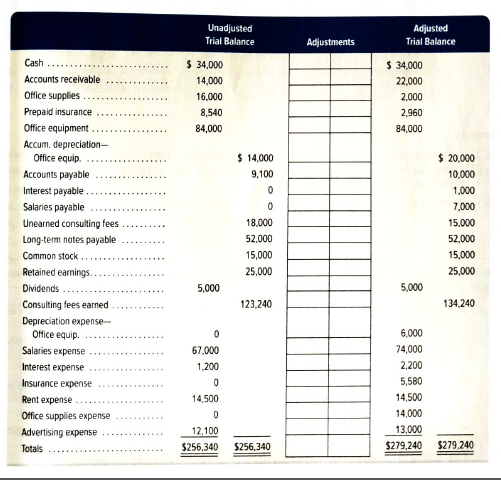

A six-column table for JKL Company follows. The first two columns contain the unadjusted

Required

Analysis Component

1. Analyze the differences between the unadjusted and adjusted trial balances to determine the eight adjustments that likely were made. Show the results of your analysis by inserting these adjustment amounts in the table’s two middle columns Label each adjustment with a letter a through h and provide a short description of each.

Preparation Component

2. Use the information in the adjusted trial balance to prepare the company’s (a) income statement and its statement of

2017, was $25,000, and the current-year dividends were $5,000], and (b) the

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

- In the current year, Palmer Industries incurred $180,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied in the amount of $9,000 for the year. If the predetermined overhead rate was $10.00 per direct labor-hour, how many hours were worked during the year?arrow_forwardDetermine the predetermined shop overhead rate per direct labor hour?arrow_forwardFinancial Accounting Question please answerarrow_forward

- At the beginning of the year, manufacturing overhead for the year was estimated to be $800,000. At the end of the year, actual labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $775,000, and the manufacturing overhead for the year was overapplied by $25,000. If the predetermined overhead rate is based on direct labor hours, then the estimated labor hours at the beginning of the year used in the predetermined overhead rate must have been ___ Hours.arrow_forwardNeed answerarrow_forwardWhat is pinnacle enterprises' 2024 asset turnover ratio on these financial accounting question?arrow_forward

- ???arrow_forwardAt the beginning of the year, manufacturing overhead for the year was estimated to be $315,840. At the end of the year, actual direct labor-hours for the year were 25,800 hours, the actual manufacturing overhead for the year was $308,700, and manufacturing overhead for the year was overapplied by $14,500. If the predetermined overhead rate is based on direct labor-hours, then what must have been the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate?arrow_forwardAt what amount should each of the three assets be recorded?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning