Principles of Cost Accounting

17th Edition

ISBN: 9781305692862

Author: Edward J. Vanderbeck; Maria R. Mitchell

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 4P

Payroll for piece-rate wage system

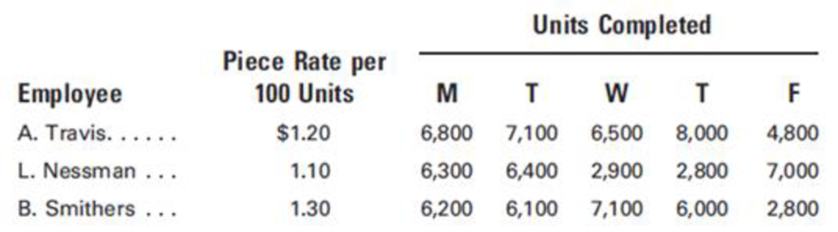

Collier Manufacturing Co. operates on a modified wage plan. During one week’s operation, the following direct labor costs were incurred:

The employees are machine operators. Piece rates vary with the kind of product being produced. A minimum of $70 per day is guaranteed to each employee by union contract.

Required:

- 1. Compute the weekly earnings for Travis, Nessman, and Smithers.

- 2. Prepare

journal entries to:- a. record the week’s payroll, assuming that none of the employees has achieved the maximum base wage for FICA taxes. The income tax withheld for each employee amounts to 10% of gross wages.

- b. record payment of the payroll.

- c. record the employer’s share of payroll taxes, assuming that none of the employees has achieved the maximum base wage for FICA or

unemployment taxes.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

How much is the labor rate variance? Solve this question general Accounting

Hello tutor please provide correct answer general Accounting question

Hii expert please given correct answer general Accounting question

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Proved correct answer accountingarrow_forwardAt the beginning of the year, Dow inventory of $200,000. During th purchased goods costing $800,000 reported ending inventory of $ $1,050,000, their cost of goods sol must be............... The Stacy Company makes and sells R. Budgeted sales for April are $3 budgeted at 30% of sales dollars. If is budgeted at $40,000, the administrative expenses are: -$133,333 - $60,000 - $102,000 - $78,000. CALIN CORPORATION HAS TOTAL CURRENT ASSETS OF $61 $230,000, TOTAL STOCKHOLDERS EQUITY OF $1,183,000, TO $958,000, TOTAL ASSETS OF $1,573,000, AND TOTAL LIABILI THE COMPANY'S WORKING CAPITAL ISarrow_forwardPlease help accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License