Concept explainers

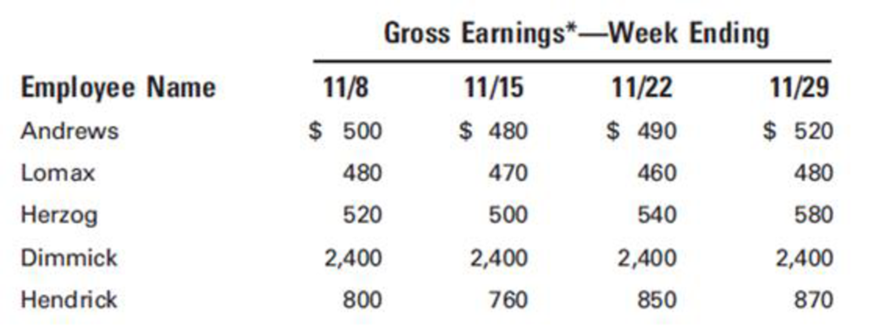

An analysis of the payroll for the month of November for CinMar Inc. reveals the information shown:

*All regular time

Andrews, Lomax, and Herzog are production workers, and Dimmick is the plant manager. Hendrick is in charge of the office.

Cumulative earnings paid (before deductions) in this calendar year prior to the payroll period ending November 8 were as follows: Andrews, $21,200; Lomax, $6,800; Herzog, $11,500; Dimmick, $116,200; and Hendrick, $32,800.

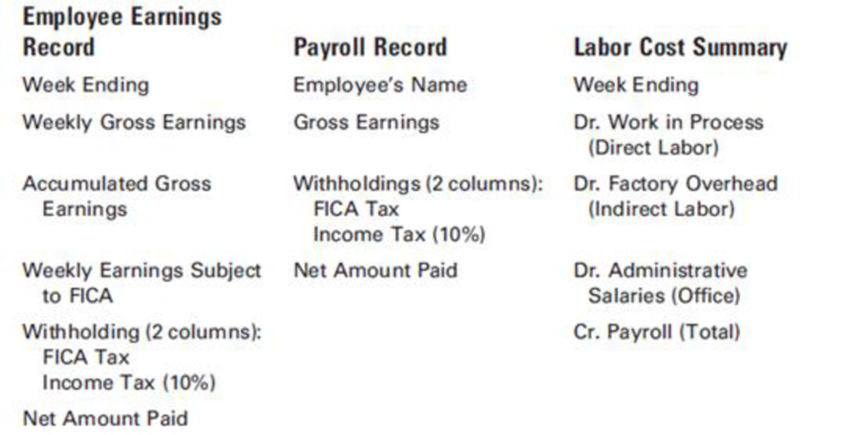

The solution to this problem requires the following forms, using the indicated column headings:

- 1. Prepare an employee earnings record for each of the five employees.

- 2. Prepare a payroll record for each of the four weeks.

- 3. Prepare a labor cost summary for the month.

- 4. Prepare

journal entries to record the following:- a. The payroll for each of the four weeks.

- b. The payment of wages for each of the four payrolls.

- c. The distribution of the monthly labor costs per the labor cost summary.

- d. The company's payroll taxes covering the four payroll periods.

1.

Organize an employee earning record for each employee of C Company.

Explanation of Solution

Payroll Account:

A payroll account is a separate checking account for the company to record the payment of the payroll checks to their employees. A payroll account includes the money a company pays to their employees like salaries, wages, bonuses and withheld taxes.

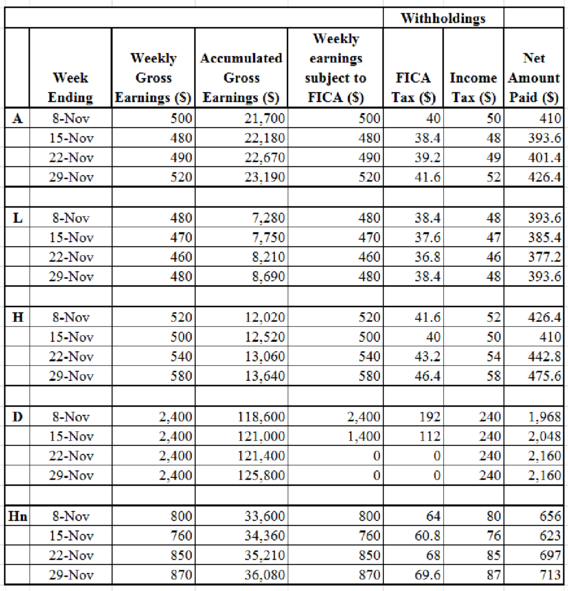

Employee Earning Records

Table.1

2.

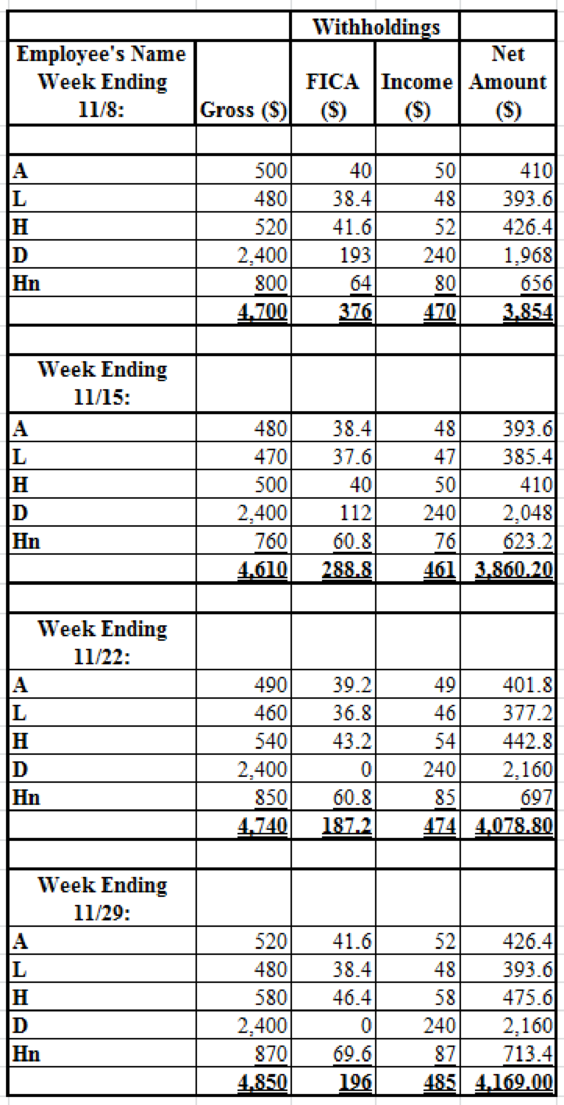

Organize a payroll record for each of the four weeks of C Company.

Explanation of Solution

Table.2

3.

Prepare a labor cost summary for C Company for the entire month of November

Explanation of Solution

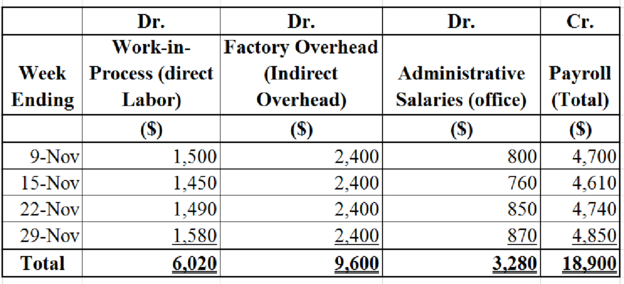

Table.3

4.

Journalize the following transactions of C Company.

Explanation of Solution

a.

Pass journal entries to record the payroll for each of the four weeks.

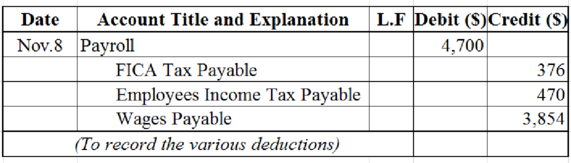

Table.4

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,700.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $376.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $470.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 3,854.

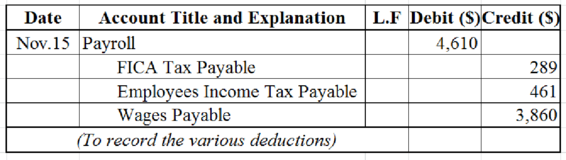

Table.5

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,610.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $289.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $461.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 3,860.

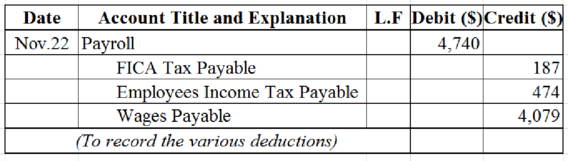

Table.6

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,740.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $187.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $474.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $4,049.

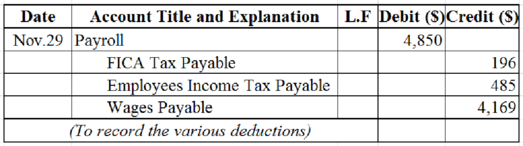

Table.7

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,850.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $196.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $485.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 4,169.

b.

Pass journal entries to record the payment of wages for each of the four weeks.

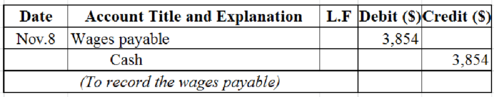

Table.8

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $3,854.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $3,854.

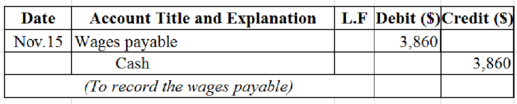

Table.9

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $3,860.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $3,860.

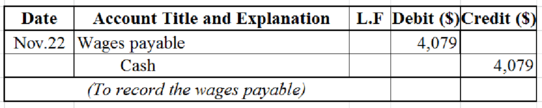

Table.10

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $4,079.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $4,079.

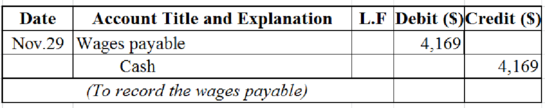

Table.11

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $4,169.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $4,169.

c.

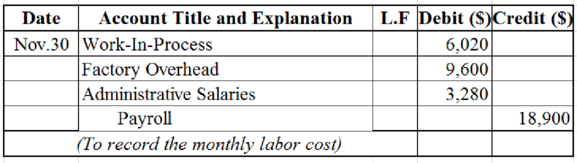

Pass journal entry to record the distribution of monthly labor cost per the labor cost summary.

Table.13

- Work-in-Process is an asset account and it increased. Therefore debit the work-in-process account by $6,020.

- Factory overhead is a liability account and it increased. Therefore, debit the factory overhead account by $9,600.

- Administrative salaries are and expense account and it increased. Therefore, debit the administrative salaries account by $3,280.

- Payroll account is an expense account and it decreased. Therefore, credit the payroll account by $18,900.

d.

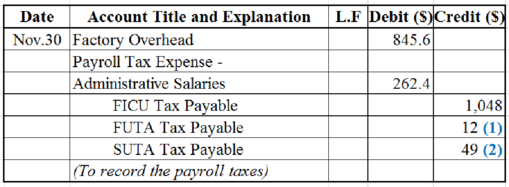

Pass journal entries to record the payroll taxes of C Company that covers the four payroll periods.

Table.13

Working Notes:

(1) Compute the value of FUTA tax payable.

(2) Compute the value of SUTA tax payable.

- Factory overhead is an expense account and it increased. Therefore, debit the factory overhead account by $845.6.

- Administrative salaries are an expense account and it increased. Therefore, debit the administrative salaries account by $262.4.

- FICU tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $1,048.

- FUTA tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $12.

- SUTA tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $49.

Want to see more full solutions like this?

Chapter 3 Solutions

Principles of Cost Accounting

- When a company incurs an expense but does not yet pay it, what is the entry?A. Debit Expense, Credit CashB. Debit Liability, Credit ExpenseC. Debit Expense, Credit LiabilityD. No entry neededarrow_forwardDont use ai What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesi need help ..arrow_forward

- Get the Correct Answer with calculation of this General Accounting Questionarrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardHello Dear Tutor Please Need Answer of this Question as possible fast and Correctarrow_forward15. The balance in the dividends account is closed to:A. CashB. RevenueC. Retained EarningsD. Common Stock dont use AIarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub