Concept explainers

1 and 2

Prepare the T- account and enter the transaction into their respective accounts for calculating the ending balance.

1 and 2

Explanation of Solution

Prepare the T-accounts:

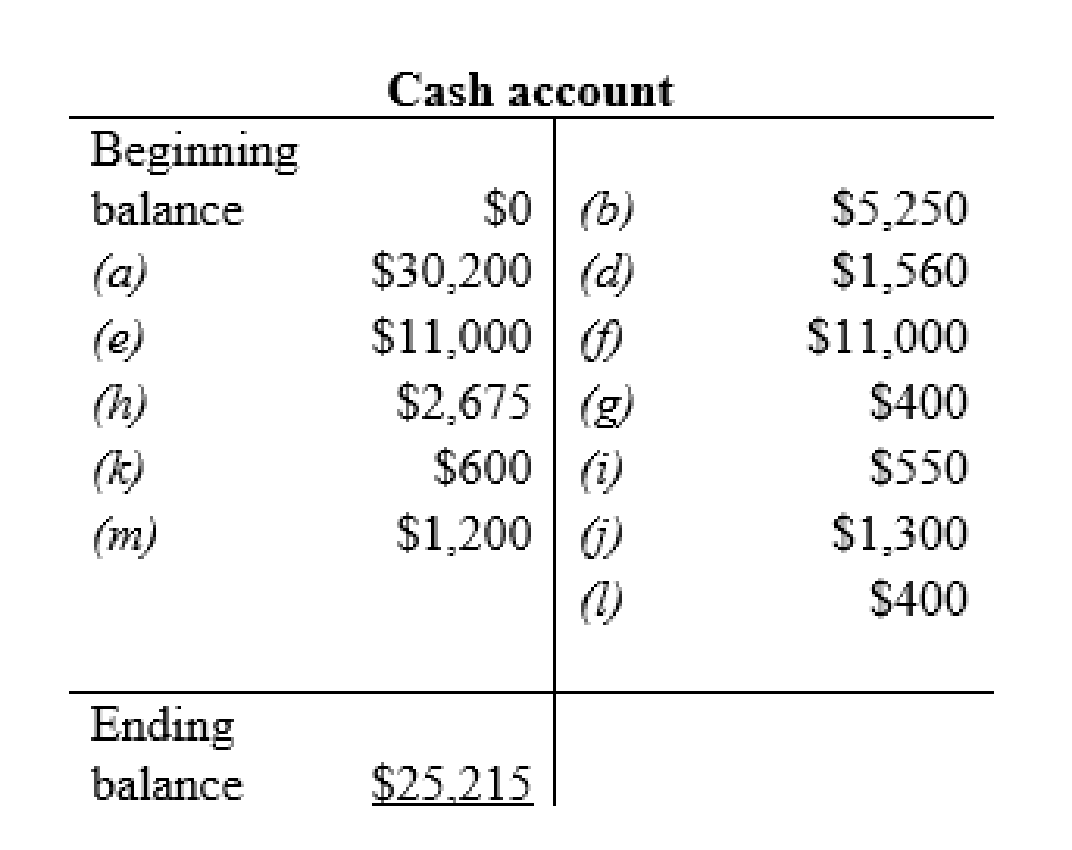

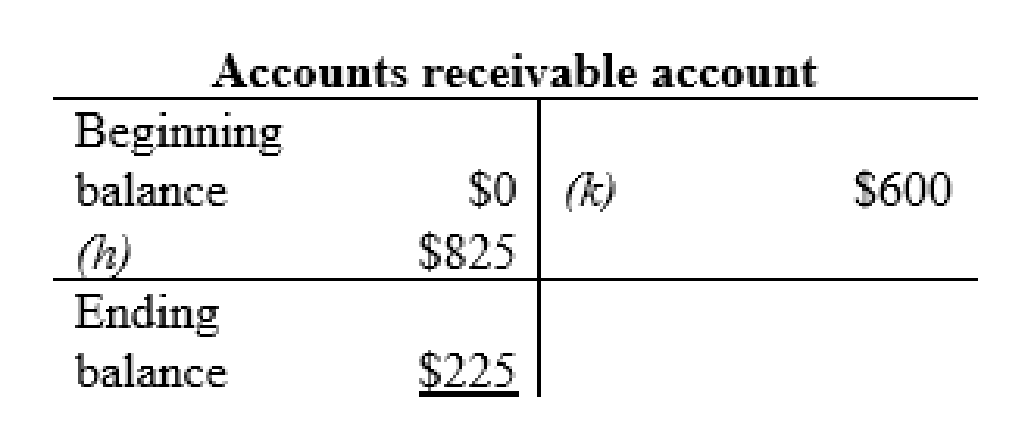

Cash account:

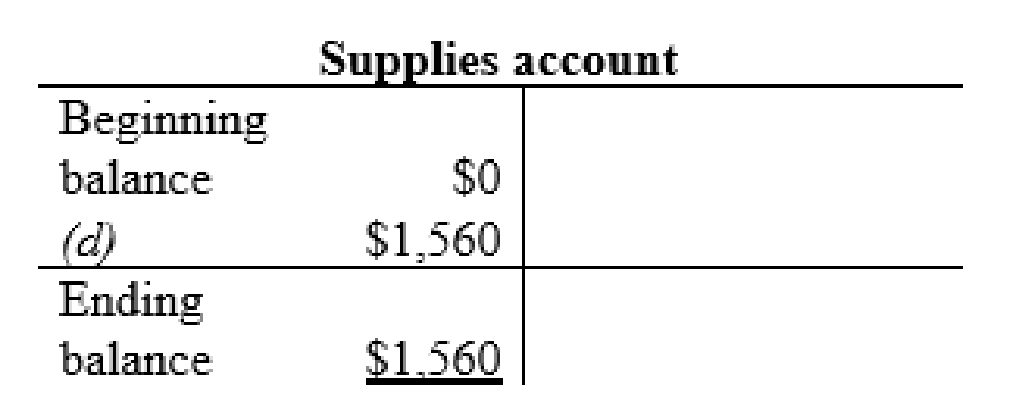

Supplies account:

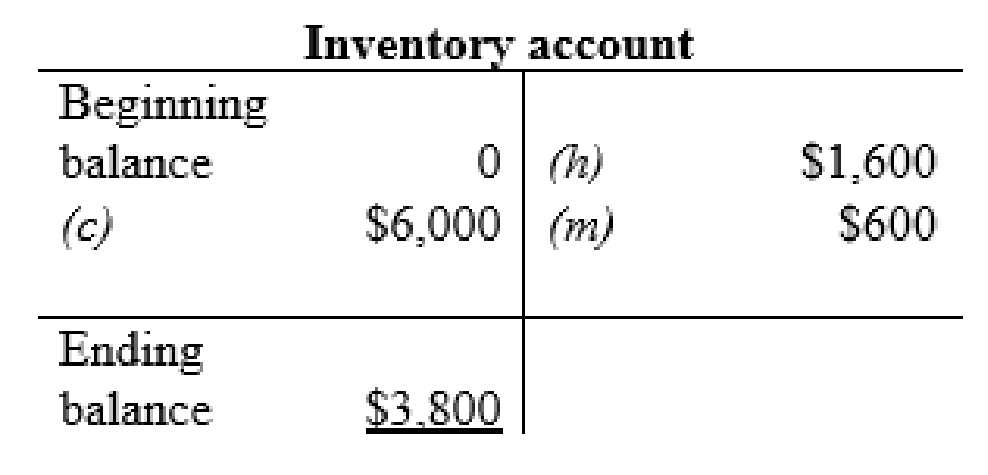

Inventory account:

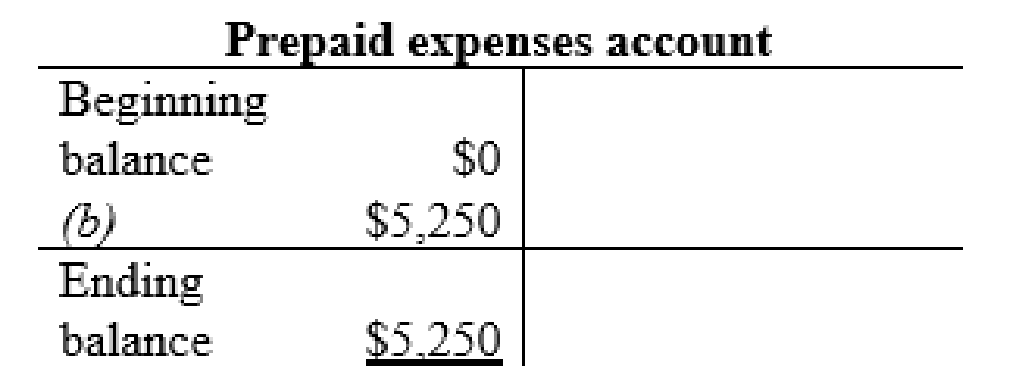

Prepaid expenses account:

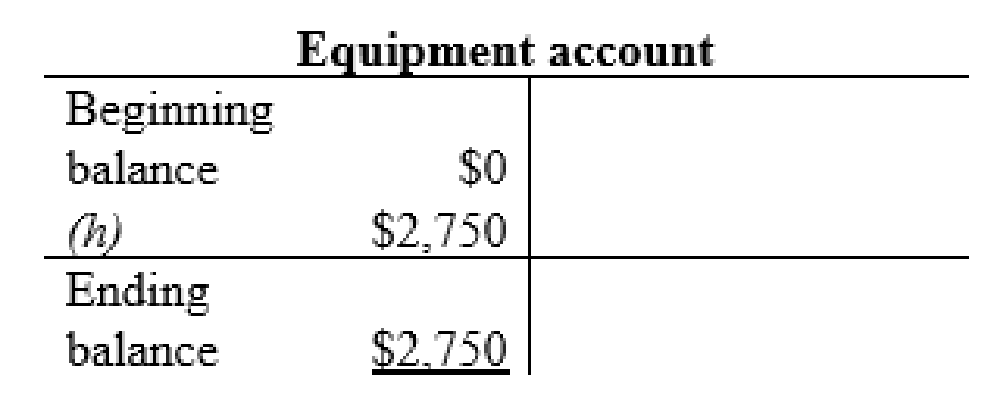

Equipment account:

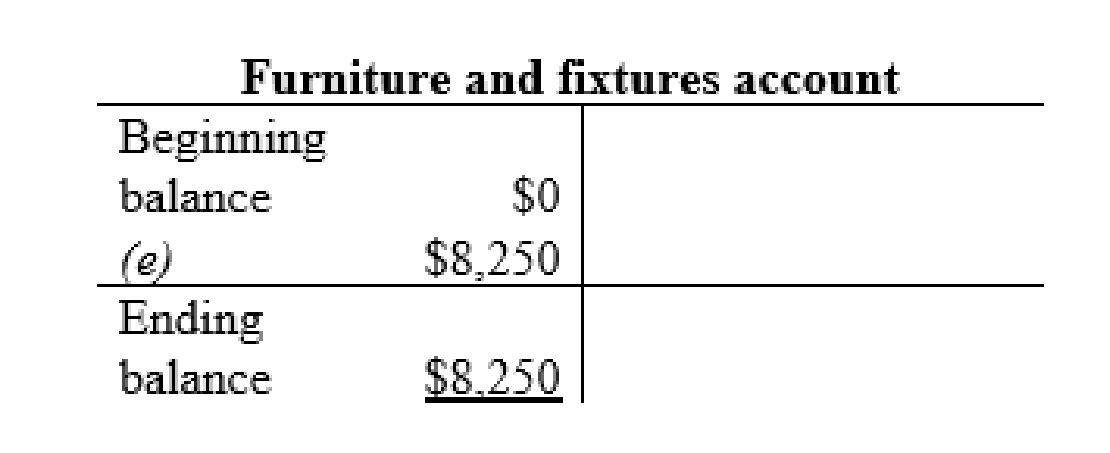

Furniture and fixtures account:

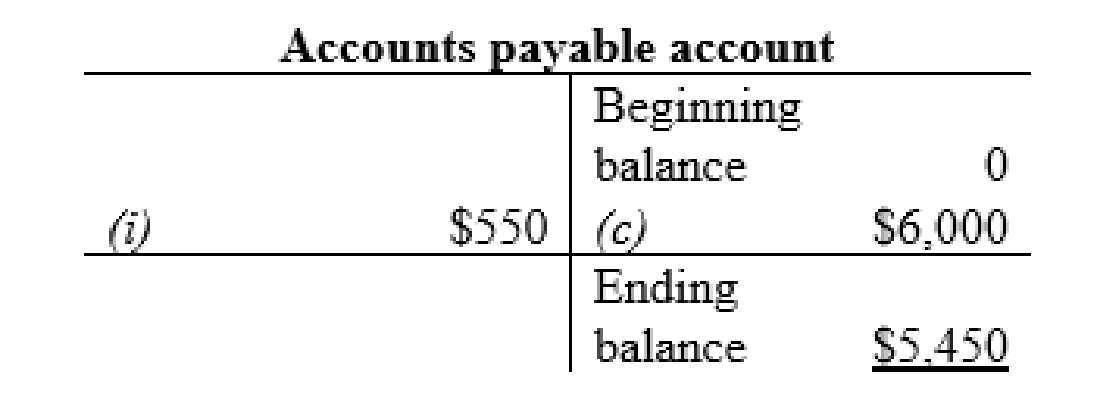

Accounts payable account:

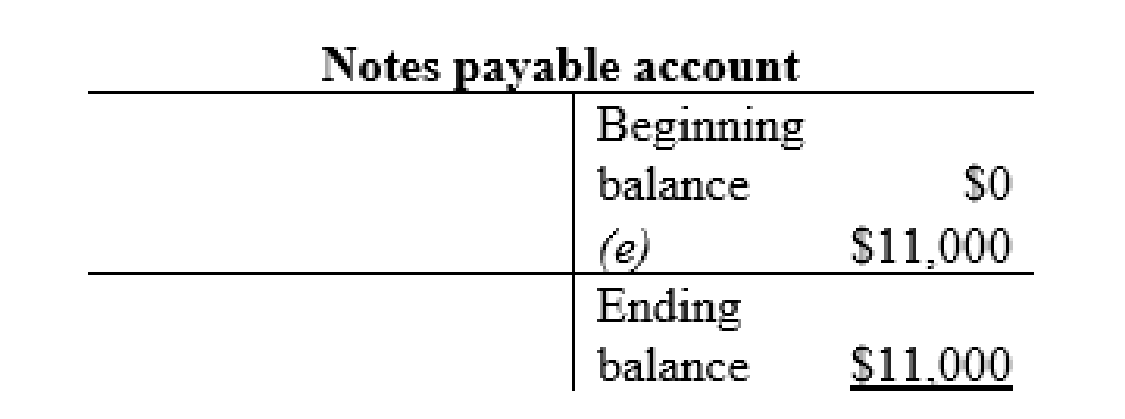

Notes payable account:

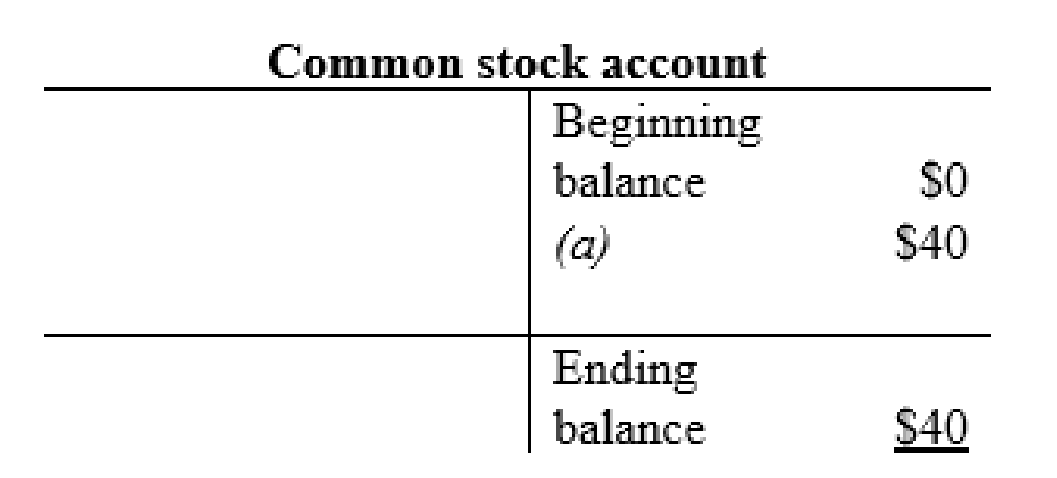

Common stock account:

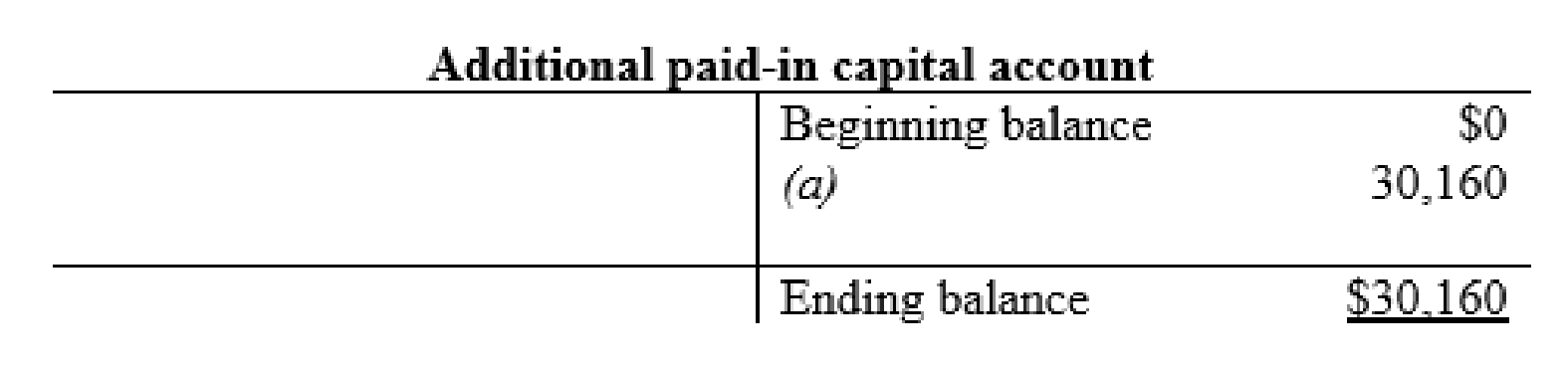

Additional paid-in capital account:

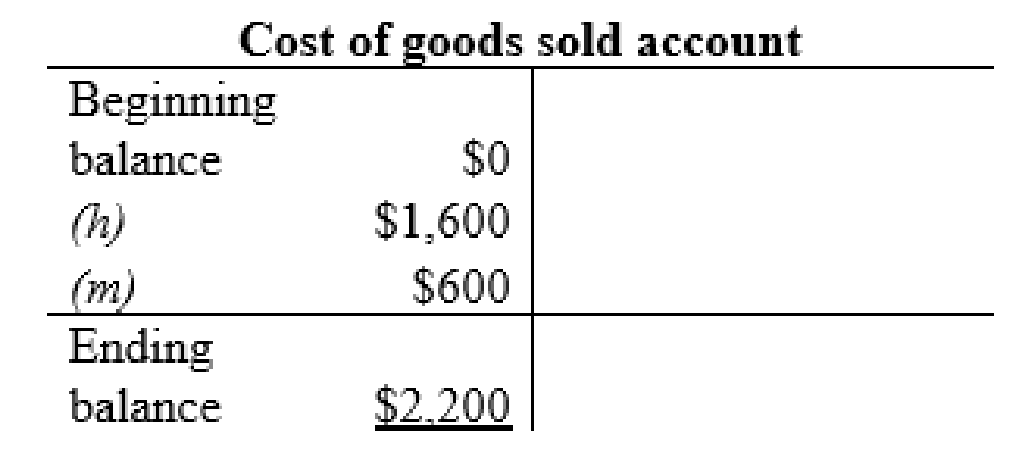

Cost of goods sold account:

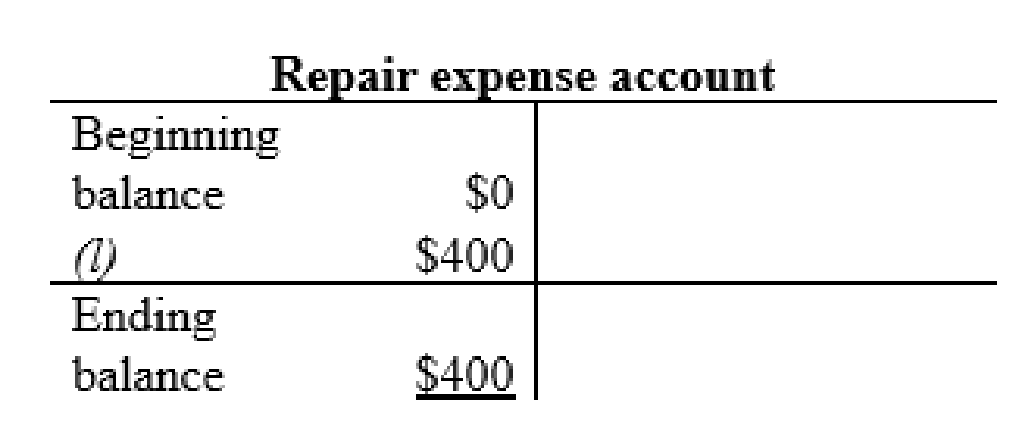

Repair expense account:

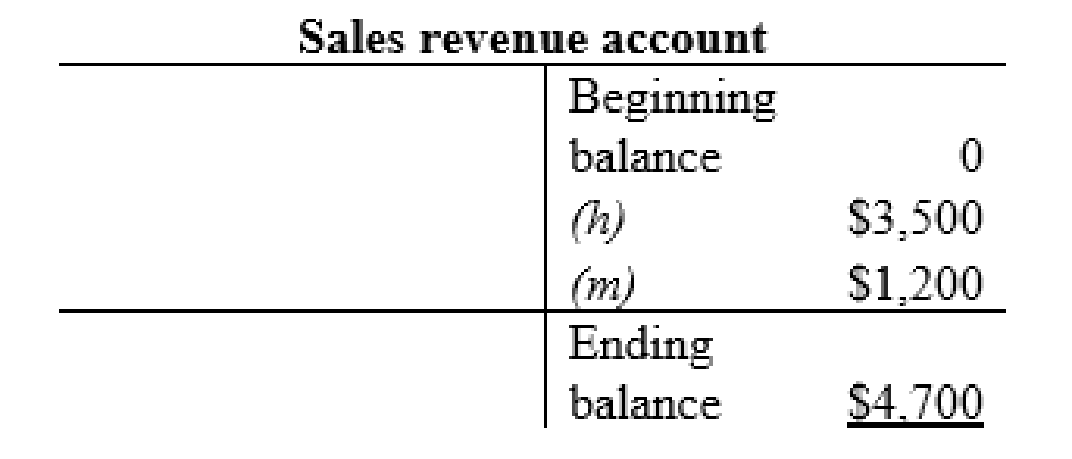

Sales revenue account:

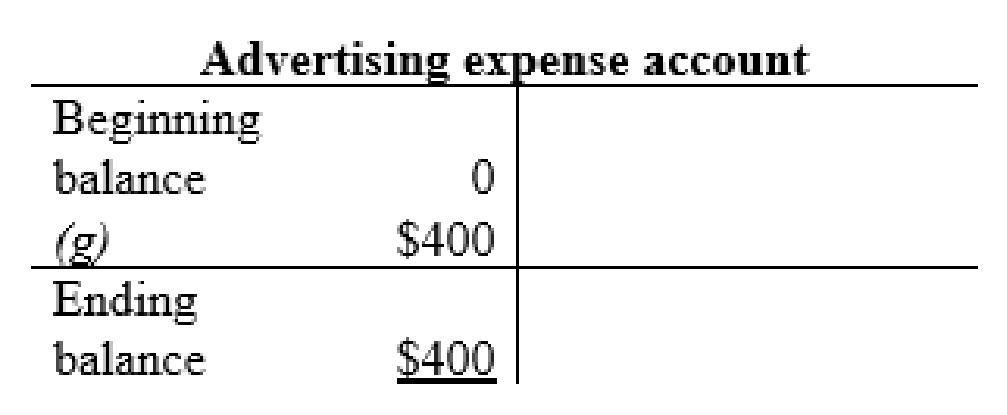

Advertising expense account:

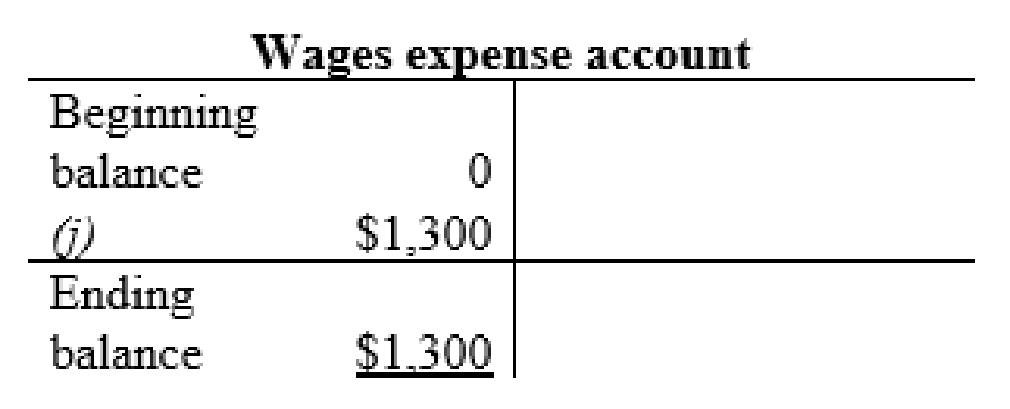

Wages expense account:

Thus, the t-accounts are prepared and the ending balances are calculated.

3.

Prepare an unadjusted income statement for the month February.

3.

Explanation of Solution

Prepare an unadjusted income statement:

| Company KS | ||

| Income statement (unadjusted) | ||

| For the month ended 28th February | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Sales revenue (1) | 4,700 | |

| Total revenues (A) | 4,700 | |

| Expenses: | ||

| Cost of goods sold (2) | 2,200 | |

| Advertising expense | 400 | |

| Wage expense | 1,300 | |

| Repair expense | 400 | |

| Total expenses (B) | 4,300 | |

| Net Income | $400 | |

Table (1)

Working note (1):

Calculate the total sales revenue:

Working note (2):

Calculate the total cost of goods sold:

Hence, the net income of Company KS is $400.

4.

Write a memo to Person K regarding the results of operations during the first month of the business.

4.

Explanation of Solution

MEMO

From

XYZ

To

Person K

Company KS

28th February,

Subject: Results of operations during the first month of the business.

After the evaluation of effects of the transactions of Company KS, one can conclude that the company has earned a profit of $400. But these are based upon unadjusted amounts. There are several expenses such as rent, supplies,

Regards,

XYZ

5.

Compute the net profit margin ratio for each year and explain the reason for promoting the manager.

5.

Explanation of Solution

Compute the net profit margin ratio:

Net profit margin ratio for 2021:

Hence, the net profit margin ratio for the year 2021 is 0.235.

Net profit margin ratio for 2020:

Hence, the net profit margin ratio for the year 2020 is 0.133.

Net profit margin ratio for 2019:

Hence, the net profit margin ratio for the year 2019 is 0.080.

- By evaluating the net profit margin ratio, it is clear that the profit level of the Company has increased.

- This states that the company is very efficient in generating the revenue from the sales and controlling the expenses.

- Based on this the reasons, the company should promote its manager to the next level.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Harmony Cosmetics manufactures beauty products and provides the following production data: WIP Inventory, January 1 O units Units started 30,000 units Units completed and transferred 22,500 units WIP Inventory, December 31 7,500 units Direct materials cost $315,000 $620,000 $350,000 Direct labor cost Manufacturing overhead The units in ending WIP Inventory were 70% complete for materials and 50% complete for conversion costs. On December 31, the cost per equivalent unit for materials would be closest to:arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardGeneral accountingarrow_forward

- What is this firm's debt-equity ratio?arrow_forwardI. Identify if the account title is an Asset, Liability, Equity, Income or Expense. Then, identify which side (Debit or Credit) will be used to record its increase and decrease. Example: Account Title Classification Increase Decrease Cash Asset Debit Credit Account Title Classification Increase Decrease Inventories Service Income Property, Plant and Equipment Insurance Expense Sales Accounts Payable Cost of Sales Withdrawals Notes Payable Unearned Revenues Salaries or Wages Expense Income Summary Accumulated Depreciation Cash Equivalents Mortgage Payable Supplies Expenses Bonds Payable Prepaid Expenses Notes Receivable Accrued Liabilities Capital Telecommunications, Electricity, Fuel and Water Expenses Depreciation Expense Uncollectible Accounts Expense Allowance for Uncollectible Accounts Rent Expense Interest Expense Intangible Assetsarrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education