1.

Journalize the given transactions.

1.

Explanation of Solution

Journalize the given transactions:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| a | Cash (+A) | $9,500 | |

| Consulting fees revenue (+R) (+SE) | $9,500 | ||

| (To record the fees earned) | |||

| b | Cash (+A) | $1,200 | |

| Common stock (+SE) | $10 | ||

| Additional paid-in capital (+SE) | $1,190 | ||

| (To record the purchase of building) | |||

| c | Office equipment (+A) | $640 | |

| Cash (-A) | $160 | ||

| Short-term notes payable (+L) | $480 | ||

| (To record the purchase of equipment on account) | |||

| d | Cash (+A) | $890 | |

| Unearned revenue (+L) | $890 | ||

| (To record the unearned revenue) | |||

| e | Supplies (+A) | $470 | |

| Accounts payable (-L) | $470 | ||

| (To record the purchase of supplies on account) | |||

| f | Utilities expense (+E) (-SE) | $1,800 | |

| Cash (-A) | $1,800 | ||

| (To record the utilities expense) | |||

| g | $1,620 | ||

| Consulting fees revenue (+R) (+SE) | $1,620 | ||

| (To record the fees earned) | |||

| h | Cash (+A) | $2,980 | |

| Accounts receivable (-A) | $2,980 | ||

| (To record the cash receivable from customer) | |||

| i | Salaries expense (+E) (-SE) | $6,210 | |

| Cash (-A) | $5,300 | ||

| Salaries payable (+L) | $910 | ||

| (To record the payment of cash for accounts payable) | |||

| j | Short term investments (+A) | $1,230 | |

| Prepaid expenses (+A) | $800 | ||

| Cash (-A) | $2,030 | ||

| (To record the cash receivable from customer) | |||

| k | Cash (+A) | $10 | |

| Interest revenue (+R) (-SE) | $10 | ||

| (To record the interest revenue) |

Table (1)

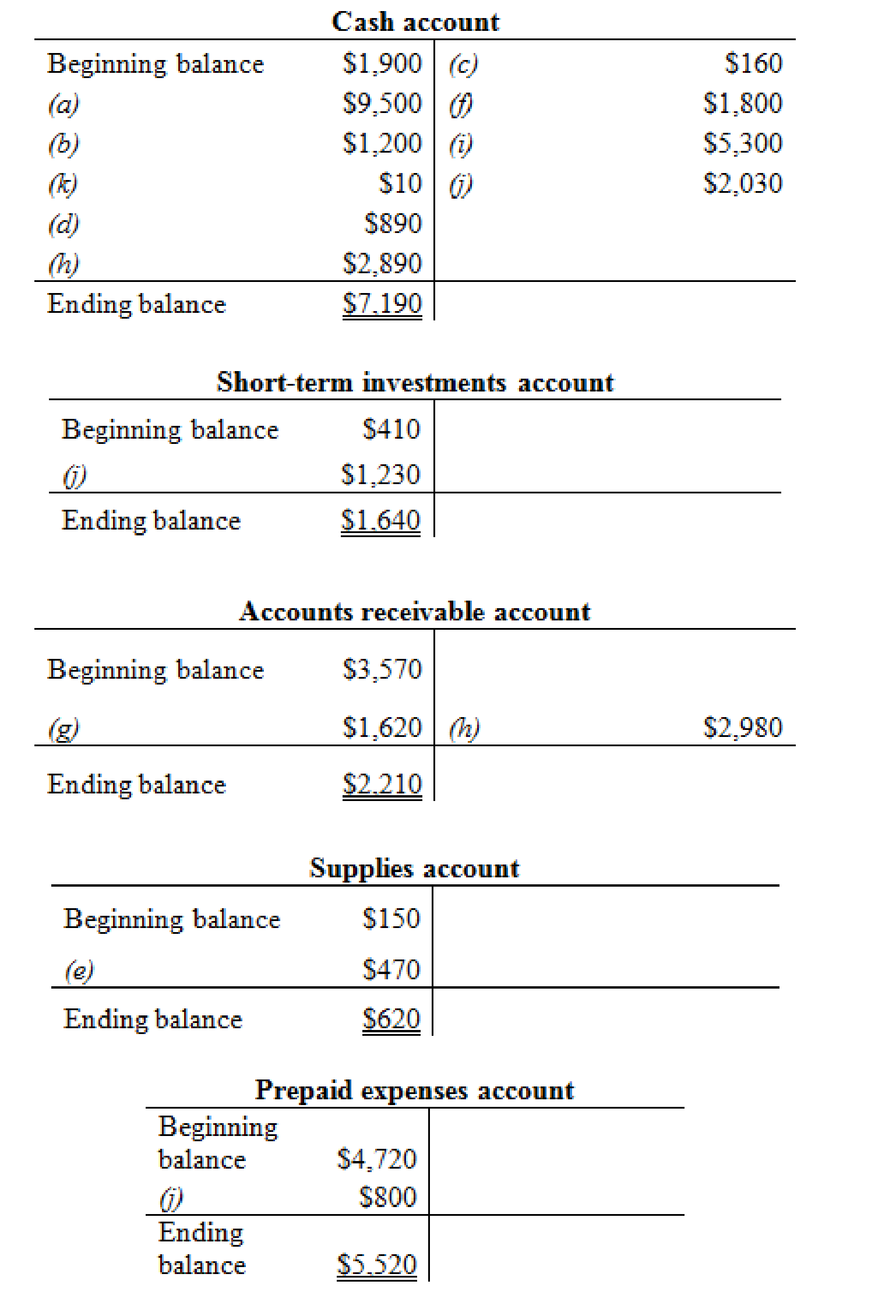

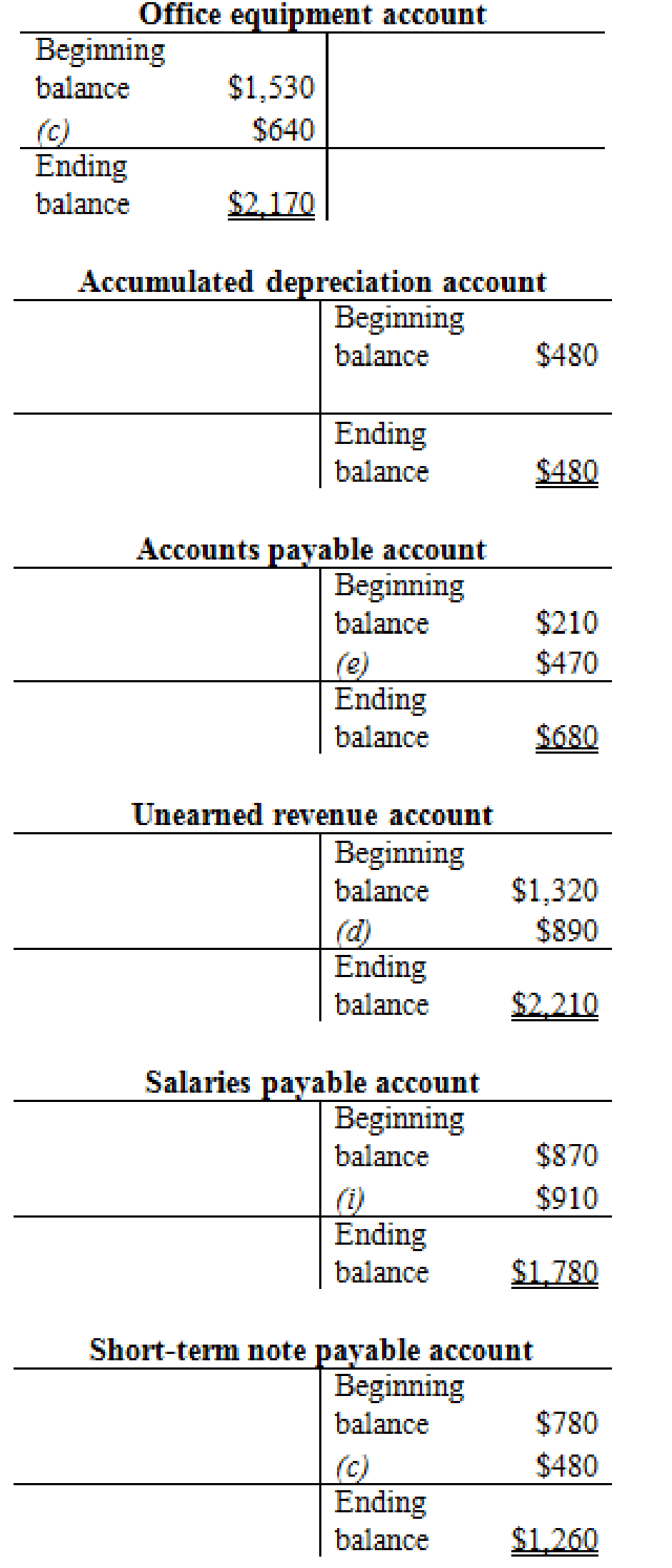

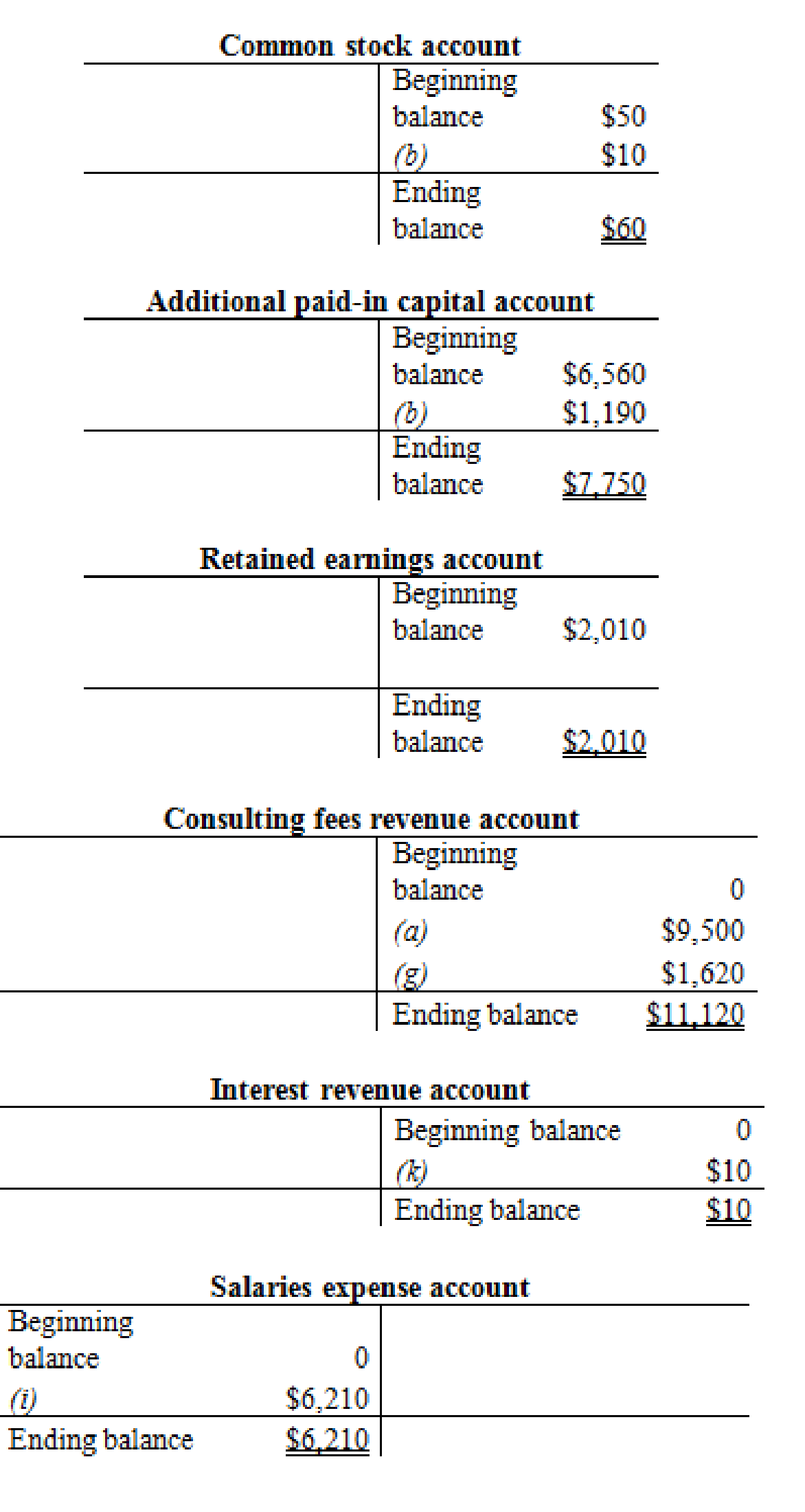

2

Prepare the T- account and enter the transaction into their respective accounts for calculating the ending balance.

2

Explanation of Solution

Prepare the T-accounts:

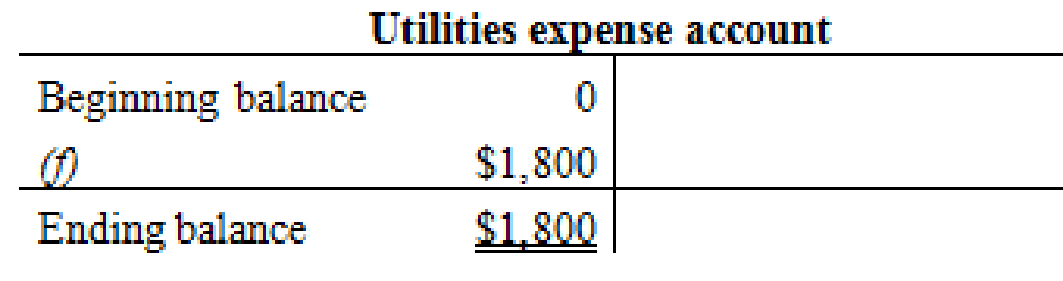

Figure (1)

Figure (2)

Figure (3)

Figure (4)

Thus, the T-accounts are prepared and the ending balances are calculated.

3.

Ascertain the amount for the given equations at the end of the January.

3.

Explanation of Solution

For the equation

For the equation

Working note (1):

Calculate the revenues:

Working note (2):

Calculate the expenses:

Working note (3):

Calculate the net income:

| Particulars | Amount($) | Amount ($) |

| Revenues | (1) 11,130 | |

| Less: Expenses | (2) 8,010 | |

| Net income | $3,120 |

Table (2)

4.

Calculate the net income under cash basis of accounting and explain the reason in which manner the net income differs from accrual basis of accounting.

4.

Explanation of Solution

Calculate the net income under cash basis accounting:

| Particulars | Amount ($) | Amount ($) |

| Cash receipts | (4) 14,580 | |

| Less: Cash payments | (5) 9,290 | |

| Net income | $5,290 |

Table (3)

Net income of Incorporation C under cash basis of accounting is $5,290.

Working note (4):

Calculate the cash receipts:

Working note (5):

Calculate the cash payments:

- According to the cash basis of accounting, the net income is $5,290 which higher than the accrual basis of accounting.

- The recording of the expenses and revenues differ from the accrual basis of accounting.

- Hence, the net income is different for the accrual basis of accounting and cash basis of accounting.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- A town council is considering converting an abandoned mall into a community arts center. They estimate the benefit to the community to be worth $2,400,000. Contractors have estimated a net cost to build the center and refurbish the property to be $3,400,000. Should they proceed with the project? a. 0.71 and Yes b. 0.71 and No c. 1.42 and Yes d. 1.42 and No. Provide accurate answer to this general accounting problemarrow_forwardA firm has net working capital of $720, net fixed assets of $2,980, and sales of $7,800. How many dollars worth of sales are generated from every $1 in total assets? solve this General accounting problemarrow_forwardHi expert please given correct answer with accounting questionarrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardHi expert please given correct answer with General accountingarrow_forwardFor external financial reporting, which costing method is required? a) Variable costing b) Standard costing c) Direct costing d) Absorption costing need helparrow_forward

- On January 1, Crestview Finance lends a corporate client $195,000 at an annual interest rate of 6.8%. What is the amount of interest revenue that should be recorded for the quarter ending March 31? Answerarrow_forwardFor external financial reporting, which costing method is required? a) Variable costing b) Standard costing c) Direct costing d) Absorption costing answer thisarrow_forward?!arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education