Concept explainers

Communications

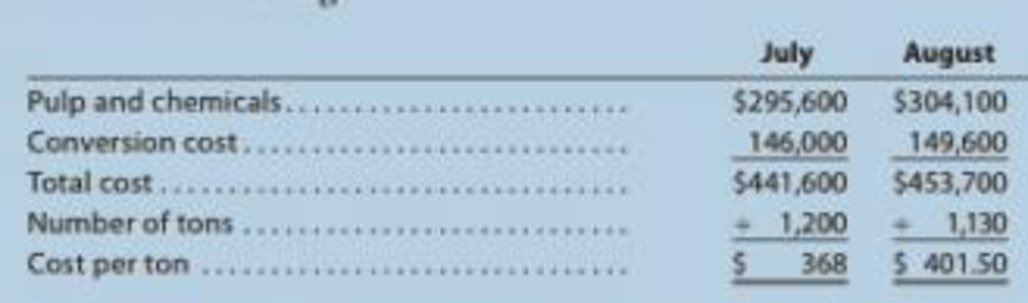

Jamarcus Bradshaw, plant manager of Georgia Paper Company’s papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following:

Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow:

Len: We have two papermaking machines in the department. I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem.

Leann: How does too much pulp result in wasted resources?

Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product; we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs.

Leann: Do you have any other suspicions?

Len: Well, as you know, we have two products—green paper and yellow paper. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving very differently. I don't have any data, but it just seems as though the amount of waste associated with the green paper has increased.

Leann: Why is this?

Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August. This change could be causing the machines to run poorly when making green paper. If this is the case, the cost per ton would increase for green paper.

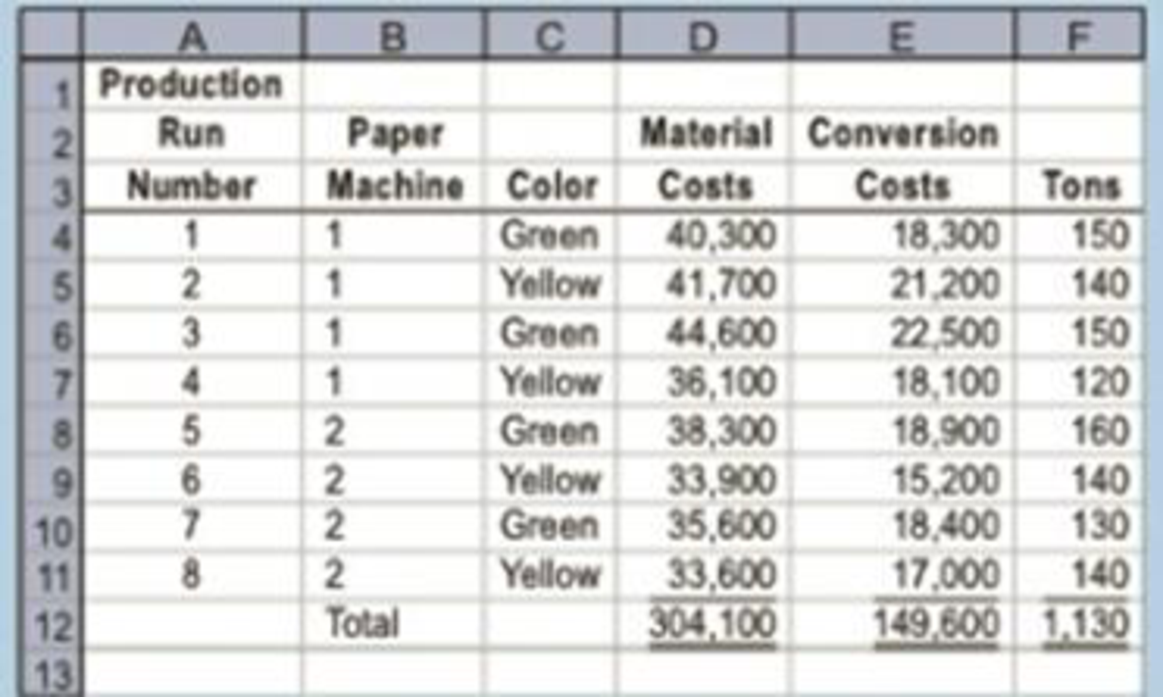

Leann also asked for a database printout providing greater detail on August’s operating results. September 9 Requested by: Leann Brunswick Papermaking Department—August detail

Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to take the data that Leann collected, and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round any calculations to the nearest cent.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Bundle: Managerial Accounting, Loose-leaf Version, 14th - Book Only

- ansarrow_forwardProvide answer with calculationarrow_forwardYour investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 million bond issues, each dated January 1, 2024. Prices were determined by underwriters at different times during the last few weeks. Company 1. BB Corporation Bond Price $ 109 million Stated Rate 11% 2. DD Corporation $ 100 million 3. GG Corporation $ 91 million 10% 9% Each of the bond issues matures on December 31, 2043, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2024, is 10%. Required: Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Most attractive investment Least attractive investmentarrow_forward

- Q ▼ 0 1 / 3 Тт з Problem Set 1 Cariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Brune, and Silver Handles, respectively. The following additional data apply: Projected sales in units Gold Bronze Silver 60,000 100,000 80,000 Per Unit data: Selling price $80 540 560 Direct materials $16 $8 $16 Direct labour $30 $5 518 Overhead cost based on direct labour hours (traditional system) $24 56 $18 Hours per 1,000-unit butch: Direct labour hours Machine hours Setup hours Inspection hours 80 50 20 60 20 # 5 8 8 40 40 20 50 20 8558 Activity Total overhead costs and activity levels for the year are estimated as follows: Overhead costs Activity levels Direct labour hours 5,800 hours Machine hours 4,800 hours Setups $931,000 190 setup hours Inspections $810,000 5,400 inspection hours $1741.000 Required: 1. Using the traditional coding system, determine the operating…arrow_forwardLawrence Industries produces kitchen knives. The selling price is $25 per unit, and the variable costs are $10 per knife. Fixed costs per month are $6,000. If Lawrence Industries sells 30 more units beyond breakeven, how much does profit increase as a result? Answerarrow_forwardCalculate the standard cost per unit for ABC Company.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning