(a)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

To journalize: The business transactions as given for Company A.

(a)

Answer to Problem 3.5AP

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 1 | Cash | 18,000 | |

| Common stock | 18,000 | ||

| (To record the issuance of common stock ) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 1 | No entry required. | ||

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 2 | Rent expenses | 900 | |

| Cash | 900 | ||

| (To record the office rent paid for the month) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 3 | Supplies | 1,300 | |

| Account payable | 1,300 | ||

| (To record the architectural supplies purchased on account) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 10 | Accounts receivable | 1,900 | |

| Service revenue | 1,900 | ||

| (To record the services performed on account) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 11 | Cash | 700 | |

| Unearned service revenue | 700 | ||

| (To record the cash earned for the service yet to provide.) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 20 | Cash | 2,800 | |

| Service revenue | 2,800 | ||

| (To record the cash received for the service rendered) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 30 | Salaries expense | 1,500 | |

| Cash | 1,500 | ||

| (To record the payment of salaries to secretary – receptionist) |

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| April. 30 | Accounts Payable | 300 | |

| Cash | 300 | ||

| (To record the payment of cash on account) |

Table (1)

Explanation of Solution

April. 1

- Cash is an asset and increased, hence debit cash for $18,000.

- Common stock is a component of

stockholders’ equity and increased, hence credit common stock for $18,000.

April. 1

- This transaction does not have any effect on the

accounting equation of the company since there is no change in the value of assets, liabilities and stockholder’s equity. Hence, no entry is required.

April. 2

- Rent expense is a component of stockholders’ equity and decreased, hence debit rent expenses for $900.

- Cash is an asset and decreased, hence credit cash for $900.

April. 3

- Supply is an asset and increased, hence debit supplies for $1,300.

- Account payable is a liability account and liabilities increased, hence credit account payable for $1,300.

April. 10

- Accounts receivable is an asset and increased, hence debit accounts receivable for $1,900.

- Service revenue is a component of stockholder’s equity account and increased, hence credit service revenue for $1,900.

April. 11

- Cash is an asset and increased, hence debit cash for $700.

- Unearned service revenue is a liability account and increased, hence credit unearned service revenue for $700.

April. 20

- Cash is an asset and increased, hence debit cash for $2,800.

- Service revenue is a component of stockholder’s equity account and increased, hence credit service revenue for $2,800.

April. 30

- Salaries expense is a component of stockholders’ equity and decreased, hence debit salaries expenses for $1,500

- Cash is an asset and decreased, hence credit cash for $1,500.

April. 30

- Account payable is a liability account and decreased, hence debit account payable for $300.

- Cash is an asset and decreased, hence credit cash for $300.

(b)

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

To

(b)

Explanation of Solution

| Cash | |||

| Apr. 1 | $18,000 | Apr. 2 | $900 |

| 11 | $ 700 | 30 | $1,500 |

| 20 | $ 2,800 | 30 | $300 |

| Total | $ 21,500 | Total | 2,700 |

| Bal. | $ 18,800 | ||

Table (1)

| Accounts Receivable | |||

| Apr.10 | $ 1,900 | ||

| Bal. | $ 1,900 | ||

Table (2)

| Supplies | |||

| Apr. 3 | $ 1,300 | ||

| Bal. | $ 1,300 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $ 300 | Apr. 3 | $1,300 |

| Bal. | $ 1,000 | ||

Table (4)

| Unearned Service Revenue | |||

| Apr. 11 | $ 700 | ||

| Bal. | $ 700 | ||

Table (5)

| Common Stock | |||

| Apr.1 | $18,000 | ||

| Bal. | $18,000 | ||

Table (6)

| Service Revenue | |||

| Apr. 10 | $ 1,900 | ||

| Apr. 20 | $ 2,800 | ||

| Bal. | $ 4,700 | ||

Table (7)

| Rent Expenses Account | |||

| Apr. 2 | $ 900 | ||

| Bal. | $ 900 | ||

Table (8)

| Salaries and wages expenses | |||

| Apr. 30 | $ 1,500 | ||

| Bal. | $ 1,500 | ||

Table (9)

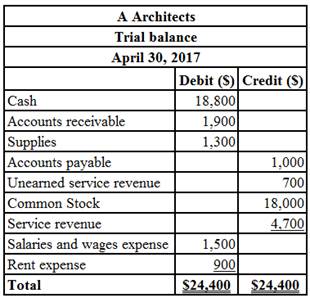

(c)

A trial balance is the summary of all the ledger accounts. The trial balance is prepared to check the total balance of the debit with the total of the balance of the credit column, which must be equal. The trial balance is usually prepared to check accuracy of ledger balances. In trial balance the debit balances are listed in the left column, and credit balances are listed in the right column

To Prepare: The trial balance of Company A as on April 30, 2017.

(c)

Explanation of Solution

Table (1)

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting 8th Edition

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardCompute the depreciation expense for the year ending December 31, 2024, assuming Lansdowne uses straight-line depreciation.arrow_forwardPlease provide the correct solution to this financial accounting question using valid principles.arrow_forward

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning