EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475950

Author: Datar

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.51P

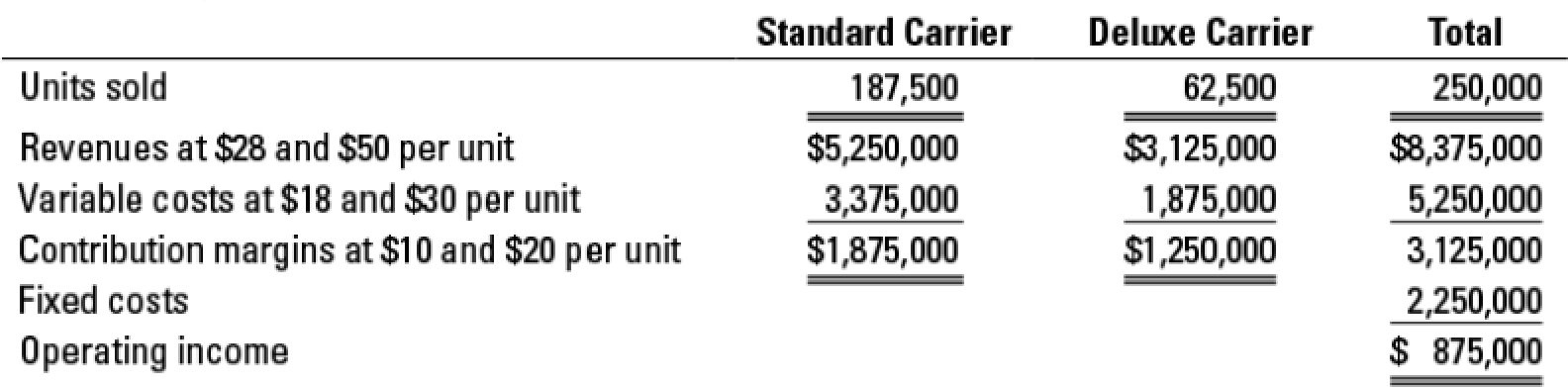

Sales mix, two products. The Stackpole Company retails two products: a standard and a deluxe version of a luggage carrier The

- 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix.

Required

- 2. Compute the breakeven point in units (a) if only standard carriers are sold and (b) if only deluxe carriers are sold.

- 3. Suppose 250,000 units are sold but only 50,000 of them are deluxe. Compute the operating income. Compute the breakeven point in units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute the breakeven point in units, assuming that the company achieves its planned sales mix.

Finch Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options: a

skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products

follow.

Budgeted sales in units (a)

Expected sales price (b)

Variable costs per unit (c)

Income statements

Sales revenue (a × b)

Variable costs (a × c)

Contribution margin

Fixed costs

Net income

Req A

Req B

Margin of safety

Req C1

Skin Cream

112,000

Skin Cream

Relevant Information

Required:

a. Determine the margin of safety as a percentage for each product.

b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume.

c1. For each product, determine the percentage change in net income that results from the 20 percent increase in sales.

c2. Which product has the highest operating leverage?

d. Assuming that management is pessimistic and risk averse, which product should…

Austin Co. plans to manufacture and sell electronic products. The projected data for

producing its products for a typical year is as follows:

Budgeted sales (in units) 1,200

Selling price per unit

Variable costs per unit

Total fixed costs

$100

$80

$20,000

Income tax rate

20%

Desired profits after tax $16,000

Required) Please answer the following questions and show all your works (formula and

numbers) to get full credits.

a. What are the contribution margin per unit and CM ratio?

b. How many units (per year) would it have to produce in order to break even?

c. To earn the desire after-tax profits, how many units (per year) would it have to

sell/produce?

d. Calculate the margin of safety ratio in the budgets amounts (per year) are sold. Define

what is meant by the MOS.

e. Calculate the degree of operating leverage if the budgets amount (per year) are

sold. Define what is meant by the DOL.

Chapter 3 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Jacks Jax has total fixed costs of 25,000. If the...Ch. 3 - During the current year, XYZ Company increased its...Ch. 3 - Under the contribution income statement, a...Ch. 3 - A company needs to sell 10,000 units of its only...Ch. 3 - Once a company exceeds its breakeven level,...Ch. 3 - Prob. 3.21ECh. 3 - CVP computations. Garrett Manufacturing sold...Ch. 3 - CVP analysis, changing revenues and costs. Sunset...Ch. 3 - CVP exercises. The Deli-Sub Shop owns and operates...Ch. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - CVP analysis, income taxes. Westover Motors is a...Ch. 3 - CVP analysis, income taxes. The Home Style Eats...Ch. 3 - CVP analysis, sensitivity analysis. Perfect Fit...Ch. 3 - CVP analysis, margin of safety. Suppose Morrison...Ch. 3 - Operating leverage. Cover Rugs is holding a 2-week...Ch. 3 - CVP analysis, international cost structure...Ch. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.33ECh. 3 - Prob. 3.34ECh. 3 - Contribution margin, decision making. Welch Mens...Ch. 3 - Contribution margin, gross margin, and margin of...Ch. 3 - Uncertainty and expected costs. Kindmart is an...Ch. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - CVP, target operating income, service firm....Ch. 3 - CVP analysis, margin of safety. Marketing Docs...Ch. 3 - CVP analysis, income taxes. (CMA, adapted) J.T....Ch. 3 - CVP, sensitivity analysis. The Derby Shoe Company...Ch. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - CVP analysis, shoe stores (continuation of 3-43)....Ch. 3 - Prob. 3.45PCh. 3 - Prob. 3.46PCh. 3 - CVP analysis, income taxes, sensitivity. (CMA,...Ch. 3 - Choosing between compensation plans, operating...Ch. 3 - Prob. 3.49PCh. 3 - Multiproduct CVP and decision making. Crystal...Ch. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.52PCh. 3 - Ethics, CVP analysis. Megaphone Corporation...Ch. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a company plans to sell 40000 units of product but sells 60000 units, the most appropriate comparison of the cost data associated with the sales will be by a budget based on O 60000 units of activity. O40000 units of activity. O the original planned level of activity. O 50000 units of activity.arrow_forwardMuhanga Corporation sells three products: R, S, and T. Budgeted information for the upcoming accounting period follows. Product Sales Volume (Units) Selling Price Variable Cost R 17,600 $ 19 $ 13 S 13,600 15 6 T 54,800 16 10 What is the company's weighted-average unit contribution margin?arrow_forwardRequired Question: If Auto Company wants to maintain product mix in the budget, and given the machine minutes constraint and the sales constraint for Trucks and Cars, what is the maximum number of units of each prodcut that the company should sell and what would be the expected total income?arrow_forward

- Two businesses, P Ltd. and Q Ltd. sell the same type of product in the same type of market. Their budgeted profit and loss accounts for the coming year are as under: P Ltd. (Rs.) Q. Ltd. (Rs.) Sales 150000 150000 Variable Cost 120000 100000 Fixed cost 15000 35000 Budgeted Net profit 15000 15000 You are required to: Calculate the break-even point for each business Calculate the sales volume at which each business will earn Rs.5,000 Profit. State which business is likely to earn greater profit in conditions of: Heavy demand for the product Low demand for the product,and,briefly give your argument as well.arrow_forwardTwo businesses, P Ltd. and Q Ltd. sell the same type of product in the same type of market. Their budgeted profit and loss accounts for the coming year are as under: P Ltd. (Rs.) Q. Ltd. (Rs.) Sales 150000 150000 Variable Cost 120000 100000 Fixed cost 15000 35000 Budgeted Net profit 15000 15000 You are required to: Calculate the break-even point for each business Calculate the sales volume at which each business will earn Rs.5,000 Profit. State which business is likely to earn greater profit in conditions of: Heavy demand for the product Low dearrow_forwardCheck my work As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, you've been asked to do some what-if analyses. Following is the budgeted information regarding the coming year: Selling price per unit Variable cost per unit Fixed costs (per year) Required: $ 100.00 63.00 1,227,327 1. What is the breakeven volume, in units and dollars, for the coming year? 2. Assume that the goal of the company is to earn a pretax (operating) profit of $332,001 for the coming year. How many units would the company have to sell to achieve this goal? 3. Assume that of the $63 variable cost per unit the labor-cost component is $29. Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the…arrow_forward

- As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, you've been asked to do some what-if analyses. Following is the budgeted Information regarding the coming year: Selling price per unit Variable cost per unit Fixed costs (per year) Required: $ 100.00 60.00 1,113,040 1. What is the breakeven volume, in units and dollars, for the coming year? 2. Assume that the goal of the company is to earn a pretax (operating) profit of $316,000 for the coming year. How many units would the company have to sell to achieve this goal? 3. Assume that of the $60 variable cost per unit the labor-cost component is $27. Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is…arrow_forwardFinch Company produces two products. Budgeted annual income statements for the two products are provided as follows. Sales Variable cost Contribution margin Fixed cost Net income Budgeted Number 300 300 300 Required A Required B Per Unit @$580 @320 @260 Power Relative percentage for Power Relative percentage for Lite c. Calculate the break-even point in total number of units. d. Determine the number of units of each product Finch must sell to break even. Required: a. Based on budgeted sales, determine the relative sales mix between the two products. b. Determine the weighted-average contribution margin per unit. Budgeted Amount = $174,000 = (96,000) = 78,000 (14,000) $64,000 e. Verify the break-even point by completing the following income statement. f. Determine the margin of safety based on the combined sales of the two products. X Answer is not complete. Complete this question by entering your answers in the tabs below. Budgeted Number 700 700 700 Required C Required D Required E…arrow_forwardAs a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, you've been asked to do some what-if analyses. Following is the budgeted information regarding the coming year: Selling price per unit Variable cost per unit Fixed costs (per year) $ 100.00 70.00 1,200,000 Required: 1. What is the breakeven volume, in units and dollars, for the coming year? 2. Assume that the goal of the company is to earn a pretax (operating) profit of $300,000 for the coming year. How many units would the company have to sell to achieve this goal? 3. Assume that of the $70 variable cost per unit the labor-cost component is $25. Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is…arrow_forward

- ) ML sells three products: Good, Better and Best. The market for the products dictates that the number of products sold are always in the ratio of 3Good:4Better:5Best. Budgeted sales volume and prices, and cost details for the previous period were as follows: Good Better Best Sales units 300 400 500 Selling price per unit GHS80 GHS55 GHS70 Contribution to sales ratio 70% 65% 50% The budgeted total fixed costs for the period were GHS31,200 Required: Calculate for that period: (i) The break-even sales revenue. (ii) The volume of each product that would have needed to be sold if the company had wanted to earn a profit of GHS29,520 in that period.arrow_forwardUse the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] The fixed budget for 20,800 units of production shows sales of $540,800; variable costs of $62,400; and fixed costs of $141,000. If the company actually produces and sells 26,200 units, calculate the flexible budget income. Sales Variable costs Contribution margin Fixed costs Fixed costs ------Flexible Budget------ Variable Amount Total Fixed per Unit Cost $ 20 3 17 $ 142,000 20,800 units 26,200 units $ $ ------Flexible Budget at ------ $ 432,000 $ 64,800 367,200 $ 142,000 225,200 $ 538,000 80,700 457,300 142,000 315,300arrow_forwardA. Determine CTC’s budgeted net income for 20x2. B. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 20x2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY