Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

15th Edition

ISBN: 9780133781106

Author: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.46P

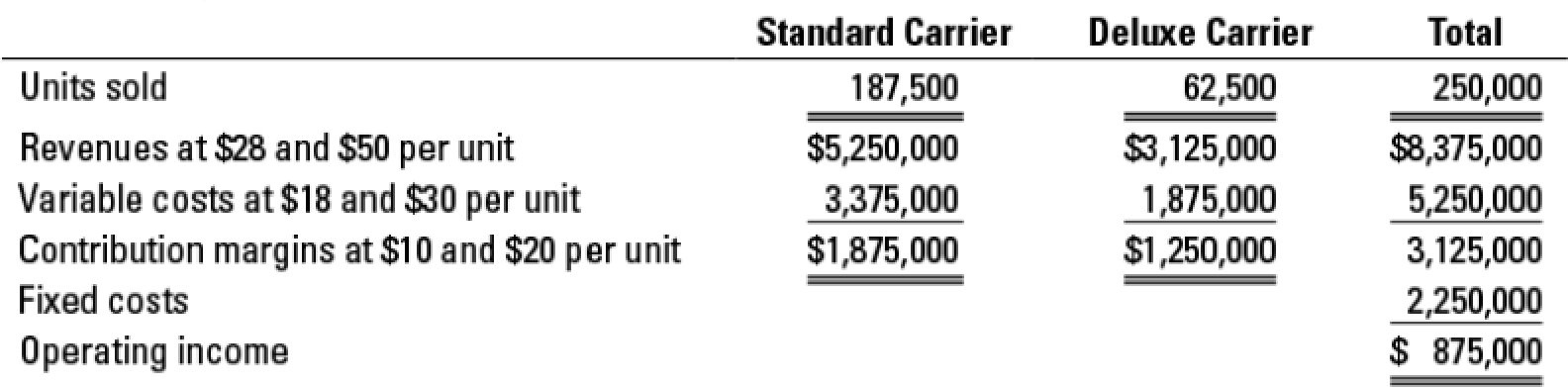

Sales mix, two products. The Stackpole Company retails two products: a standard and a deluxe version of a luggage carrier The

- 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix.

Required

- 2. Compute the breakeven point in units (a) if only standard carriers are sold and (b) if only deluxe carriers are sold.

- 3. Suppose 250,000 units are sold but only 50,000 of them are deluxe. Compute the operating income. Compute the breakeven point in units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?

River is a salaried exempt worker who earns $73,630 per year for a 35-hour workweek. During a biweekly pay period, River worked 105 hours. What is the gross pay?

The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero.

For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017.

As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device.

The company also paid €5,000 to an…

Chapter 3 Solutions

Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.24ECh. 3 - Prob. 3.25ECh. 3 - Prob. 3.26ECh. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.28ECh. 3 - Prob. 3.29ECh. 3 - Prob. 3.30ECh. 3 - Prob. 3.31ECh. 3 - Prob. 3.32ECh. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - Prob. 3.34PCh. 3 - Prob. 3.35PCh. 3 - Prob. 3.36PCh. 3 - Prob. 3.37PCh. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - Prob. 3.39PCh. 3 - Prob. 3.40PCh. 3 - Prob. 3.41PCh. 3 - Prob. 3.42PCh. 3 - Prob. 3.43PCh. 3 - Prob. 3.44PCh. 3 - Prob. 3.45PCh. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.47PCh. 3 - Prob. 3.48PCh. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .arrow_forwardCash flow cyclearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY