1.

To analyze: The effects of the January transaction on the

1.

Explanation of Solution

The accounting equation implies the relationship between the assets, liabilities, and the

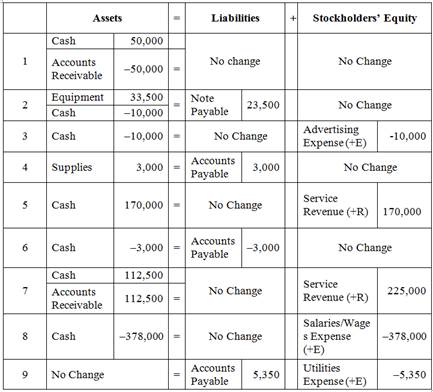

The effects of the accounting equation for the September events using a table are indicated as follows:

Table (1)

Note:

SE refers to Stockholder’s equity.

E refers to Expenses.

R refers to Revenues.

2.

To prepare:

2.

Explanation of Solution

Journal:

Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Journal entries for September events are prepared as follows:

|

Date |

Account Title and Explanation | Debit ($) | Credit ($) | |

| 1. | Cash (A+) | 50,000 | ||

| 50,000 | ||||

| (To record the cash receipt from customer for the service rendered already) | ||||

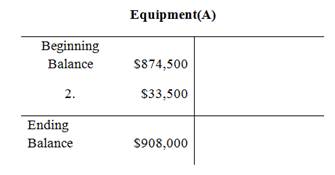

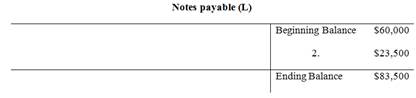

| 2. | Equipment (A+) | 33,500 | ||

| Cash (A–) | 10,000 | |||

| Notes Payable (L+) | 23,500 | |||

| (To record the purchase of equipment partly for cash and partly by signing a note) | ||||

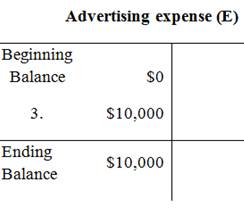

| 3. | Advertising Expense | 10,000 | ||

| Cash (A–) | 10,000 | |||

| (To record the payment made for advertising expenses) | ||||

| 4. | Supplies (A+) | 3,000 | ||

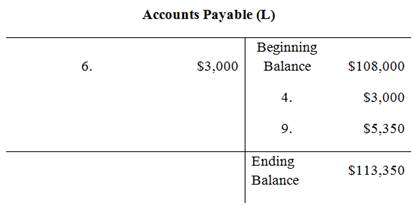

| Accounts Payable (L+) | 3,000 | |||

| (To record the supplies purchased on accounts) | ||||

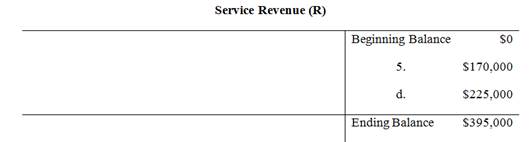

| 5. | Cash (A+) | 170,000 | ||

| Service Revenue (R+, SE+) | 170,000 | |||

| (To record cash received for the service provided on account ) | ||||

| 6. | Accounts Payable (L–) | 3,000 | ||

| Cash (A–) | 3,000 | |||

| (To record the payment made for the supplies purchased on account) | ||||

| 7. | Cash (A+) | 112,500 | ||

| Accounts Receivable (A+) | 112,500 | |||

| Service Revenue (R+, SE+) | 225,000 | |||

| (To record the sales made partly for cash and partly on account ) | ||||

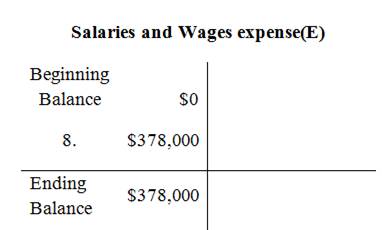

| 8. | Salaries and Wages Expense (E+, SE–) | 378,000 | ||

| Cash (A–) | 378,000 | |||

| (To record the payment of wages expenses to employees) | ||||

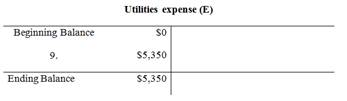

| 9. | Utilities Expense (E+, SE–) | 5.350 | ||

| Accounts Payable (L+) | 5.350 | |||

| (To record the utilities expenses incurred which are to be paid later) | ||||

Table (2)

3.

To create: The T accounts for the

3.

Explanation of Solution

T-account:

An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account

- The left or debit side

- The right or credit side

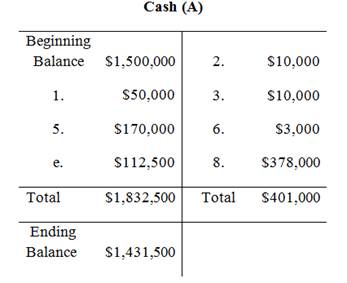

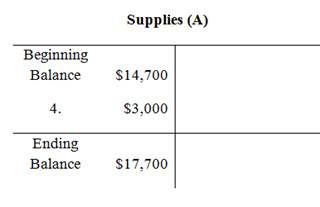

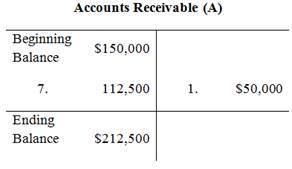

The posting of the journal entries to the T accounts are as follows:

4.

To prepare: An unadjusted

4.

Explanation of Solution

Unadjusted trial balance:

Unadjusted trial balance is that statement which contains complete list of accounts with their unadjusted balances. This statement is prepared at the end of every financial period.

An unadjusted trial balance of corporation V for the month ended January 31, 2015 is prepared as follows:

| Corporation V | ||

| Unadjusted Trial Balance | ||

| At January 31, 2015 | ||

| Particulars | Debit ($) | Credit ($) |

| Cash | $1,431,500 | |

| Accounts Receivable | 212,500 | |

| Supplies | 17,700 | |

| Equipment | 908,000 | |

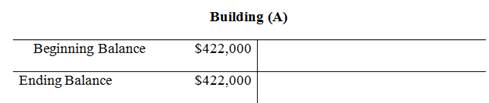

| Building | 422,000 | |

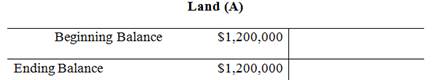

| Land | 1,200,000 | |

| Accounts Payable | $113,350 | |

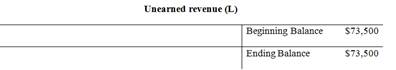

| Unearned Revenue | 73,500 | |

| Notes Payable | 83,500 | |

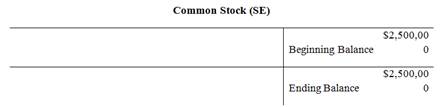

| Common Stock | 2,500,000 | |

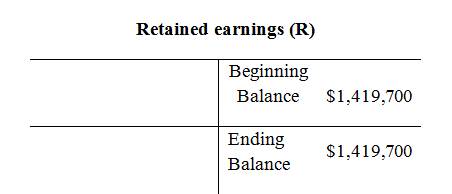

| Retained Earnings | 1,419,700 | |

| Service Revenue | 395,000 | |

| Salaries and Wages Expense | 378,000 | |

| Advertising Expense | 10,000 | |

| Utilities Expense | 5,350 | |

| Total | $4,585,050 | $4,585,050 |

Table (3)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $4,585,050.

5.

To prepare: An income statement of corporation V for the year ended January 31, 2015.

5.

Explanation of Solution

Income statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

An income statement of corporation V for the year ended December 31is prepared as follows:

|

Corporation V Income Statement For the yearEnded January 31, 2015 |

||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Service Revenue | $395,000 | |

| Total Revenues | 395,000 | |

|

Less: Expenses: |

||

| Salaries and Wages Expense | 378,000 | |

| Advertising Expense | 10,000 | |

| Utilities Expense | 5,350 | |

| Total Expenses | 393,350 | |

| Net Loss | $1,650 | |

Table (4)

6.

To prepare: The statement of retained earnings of Corporation Vfor the year ended January 31, 2015.

6.

Explanation of Solution

Statement of Retained Earnings:

Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

The statement of retained earnings of Corporation Vfor the year ended January 31, 2015 is prepared as follows.

| Corporation V | |

| Statement of Retained Earnings | |

| For the Year Ended January 31, 2015 | |

| Particulars | $ |

| Retained Earnings, January 1, 2015 | 1,419,700 |

| Less: Net Loss | 1,650 |

| Dividends | 0 |

| Retained Earnings, December 31 | 1,421,350 |

Table (5)

7.

To create: A classified balance sheet of Corporation V for the year ended January 31, 2015.

7.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

A classified balance sheet of Corporation V for the year ended January 31, 2015 is prepared as follows:

| Corporation V | ||

| Balance Sheet | ||

| At January 31, 2015 | ||

| Assets: | $ | $ |

| Current Assets | ||

| Cash | $1,431,500 | |

| Accounts Receivable | 212,500 | |

| Supplies | 17,700 | |

| Total Current Assets | 1,661,700 | |

| Equipment | 908,000 | |

| Building | 422,000 | |

| Land | 1,200,000 | |

| Total Assets | $4,191,700 | |

| Liabilities: | ||

| Current Liabilities | ||

| Accounts Payable | $113,350 | |

| Unearned Revenue | 73,500 | |

| Total Current Liabilities | 186,850 | |

| Notes Payable | 83,500 | |

| Total Liabilities | 270,350 | |

| Stockholders’ Equity | ||

| Common Stock | 2,500,000 | |

| Retained Earnings | 1,421,350 | |

| Total Stockholders’ Equity | 3,921,350 | |

| Total Liabilities and Stockholders’ Equity | $4,191,700 | |

Table (6)

8.

To calculate: The net profit margin of the company.

8.

Explanation of Solution

The net profit margin of the Company is determined as follows:

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals of Financial Accounting

- Financial accountingarrow_forwardBased on the attached amortization schedule, what is the amount for the interest expense and amortization expense that is missing from the ledger? 2 year term, 8 quarterly payments, 6% rate Initial lease $136768arrow_forwardSouthern Company leased high-tech electronic equipment from Edison Leasing on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $136,768. 2 year lease, with 8 quarterly payments of $18,000 each, 6% interest rate. What is the amortization schedule for this loan starting Jan 1, 2024?arrow_forward

- Questi 8arrow_forwardPrice and Efficiency Variances (22 points) The Livingston Corporation manufactures lamps. It has set up the following standards per finished unit for direct materials and direct manufacturing labor: 「 Direct Materials: 10 lb. at $5.20 per lb. Direct Manufacturing Labor: 0.5 hour at $30 per hour $52 $15.00 The number of finished unit budgeted for January 2017 was 9,940; 9,900 units were actually produced. Actual Results in January 2017 were as follows: 1.200 Direct Materials: 97,500 lb. used Direct Manufacturing Labor: 4,900 hours budg $155,575 During the month, materials purchases amounts to 99,400 lb., at a total cost of $536,760. Input price variances are isolated upon purchase. Input efficiency variances are isolated at the time of usage. Requirement Computer the January 2017 price and efficiency variances of direct materials and direct manufacturing labor. (Put a U for Unfavorable and a F for Favorable variances) 53670 Actual Costs Incurred Costs (Actual Input Qty. Actual Input…arrow_forwardMaple Grove Trading presents the following financial information Description Operating Expenses Amount 60,000 Sales Returns and Allowances 7,000 Sales Discounts Sales Revenue Cost of Goods Sold 10,000 200,000 95,000 What is Maple Grove Trading's gross profit? a. $98,000 b. $85,000 c. $88,000 d. $75,000arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning