Fundamentals of Financial Accounting

5th Edition

ISBN: 9780078025914

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.21ME

Preparing an Income Statement and Calculating Net Profit Margin

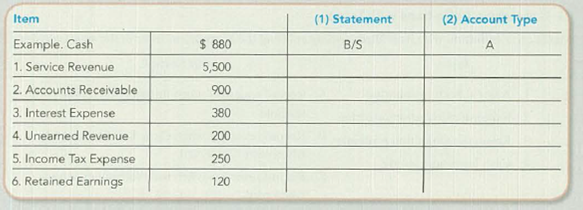

For each of the following items in Time Warner Cable, Inc.’s financial statements, indicate (1) whether it is reported in the income statement (I/S) or

Time Warner Cable also reported $4.340 in operating expenses. Based on the available information, determine the company’s net profit margin expressed as a percent (to one decimal place).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp me

I need help

The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset

No use chatgpt

1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstated

Chapter 3 Solutions

Fundamentals of Financial Accounting

Ch. 3 - Prob. 1QCh. 3 - When accounting was developed in the 14th and 15th...Ch. 3 - Define accrual basis accounting and contrast it...Ch. 3 - Prob. 4QCh. 3 - Prob. 5QCh. 3 - Prob. 6QCh. 3 - Explain the expense recognition principle...Ch. 3 - Explain why stockholders equity is increased by...Ch. 3 - Explain why revenues are recorded as credits and...Ch. 3 - Complete the following table by entering either...

Ch. 3 - Complete the following table by entering either...Ch. 3 - Prob. 12QCh. 3 - Prob. 13QCh. 3 - What is the difference between Accounts Receivable...Ch. 3 - What is the difference between Accounts Payable...Ch. 3 - For each of the following situations, indicate...Ch. 3 - Prob. 17QCh. 3 - Which of the following items is not a specific...Ch. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 4MCCh. 3 - If a company incorrectly records a payment as an...Ch. 3 - Prob. 6MCCh. 3 - Prob. 7MCCh. 3 - Prob. 8MCCh. 3 - Webby Corporation reported the following amounts...Ch. 3 - Prob. 10MCCh. 3 - Prob. 3.1MECh. 3 - Identifying Accrual Basis Revenues The following...Ch. 3 - Identifying Accrual Basis Expenses The following...Ch. 3 - Recording Accrual Basis Revenues For each of the...Ch. 3 - Recording Accrual Basis Expenses For each of the...Ch. 3 - Prob. 3.6MECh. 3 - Prob. 3.7MECh. 3 - Prob. 3.8MECh. 3 - Prob. 3.9MECh. 3 - Identifying Accrual Basis Expenses The following...Ch. 3 - Prob. 3.11MECh. 3 - Recording Accrual Basis Expenses For each of the...Ch. 3 - Prob. 3.13MECh. 3 - Preparing Accrual Basis Journal Entries for...Ch. 3 - Preparing Accrual Basis Journal Entries for...Ch. 3 - Prob. 3.16MECh. 3 - Determining the Accounting Equation Effects of...Ch. 3 - Prob. 3.18MECh. 3 - Preparing an Income Statement and Calculating Net...Ch. 3 - Preparing Financial Statements from a Trial...Ch. 3 - Preparing an Income Statement and Calculating Net...Ch. 3 - Prob. 3.22MECh. 3 - Calculating and Interpreting Net Profit Margin...Ch. 3 - Prob. 3.1ECh. 3 - Matching Definitions with Terms Match each...Ch. 3 - Identifying Accrual Basis Revenues According to...Ch. 3 - Identifying Accrual Basis Revenues According to...Ch. 3 - Identifying Accrual Basis Expenses Under accrual...Ch. 3 - Identifying Accrual Basis Expenses Under accrual...Ch. 3 - Determining Accounting Equation Effects and Net...Ch. 3 - Determining Accounting Equation Effects and Net...Ch. 3 - Recording Journal Entries and Determining Net...Ch. 3 - Prob. 3.10ECh. 3 - Recording Journal Entries and Determining Net...Ch. 3 - Recording and Posting Accrual Basis Journal...Ch. 3 - Prob. 3.13ECh. 3 - Analyzing Transactions from the Perspectives of...Ch. 3 - Prob. 3.15ECh. 3 - Determining Accounting Equation Effects of Several...Ch. 3 - Preparing Journal Entries For each of the...Ch. 3 - Prob. 3.18ECh. 3 - Creating an Unadjusted Trial Balance Based on the...Ch. 3 - Inferring Transactions, Creating Financial...Ch. 3 - Determining the Effects of Various Transactions EZ...Ch. 3 - COACHED PROBLEMS Recording Nonquantitative Journal...Ch. 3 - Prob. 3.2CPCh. 3 - Prob. 3.3CPCh. 3 - Prob. 3.4CPCh. 3 - Prob. 3.1PACh. 3 - Recording Journal Entries Diana Mark is the...Ch. 3 - Analyzing the Effects of Transactions Using...Ch. 3 - Prob. 3.4PACh. 3 - Prob. 3.1PBCh. 3 - Prob. 3.2PBCh. 3 - Analyzing the Effects of Transactions Using...Ch. 3 - Analyzing, Journalizing, and Interpreting Business...Ch. 3 - Prob. 3.1COPCh. 3 - SKIL_S DEVELOPMENT CASES Finding Financial...Ch. 3 - Prob. 3.2SDCCh. 3 - Prob. 3.4SDCCh. 3 - Ethical Decision Making: A Mini-Case Mike Lynch is...Ch. 3 - Accounting for Business Operations Starting in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forwardDon't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forward

- The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forwardNo AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forward

- What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetno aiarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed helparrow_forward

- 4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantDont use AIarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s important need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License