Concept explainers

(a)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

A trial balance is the list of all the ledger accounts. The trial balance is prepared to check the total balance of the debit with the total of the balance of the credit, which must be equal. The trial balance is usually prepared to check accuracy of ledger balances. In trial balance the debit balance are listed in the left column, and credit balance are listed in the right column.

To journalize: The issuance of common stock, the security consultant hired, the rent paid for building, the equipment purchased party for cash and party on account, The payment for advertisement, The bill received for repairing equipment, The service provided on account, The purchase of supply on account, The payment of due for the purchase of equipment, The utility bill received and paid, The cash received for the service rendered, The salaries and wages paid to employees.

(a)

Explanation of Solution

Journalize the issuance of common stock in exchange of cash.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 1 | Cash | 66,000 | |

| Common stock | 66,000 | ||

| (To record the issuance of common stock ) |

Journalize the security consultant hired to work from October 15.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 2 | No entry is required. | ||

Journalize the payment of rent paid for the building.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 4 | Rent expenses | 2,000 | |

| Cash | 2,000 | ||

| (To record the rent paid for the building) |

Journalize the purchase of equipment party for cash and party on account.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 7 | Equipment | 18,000 | |

| Cash | 4,000 | ||

| Accounts Payable | 14,000 | ||

| (To record the purchase of equipment partly on cash and partly on account) |

Journalize the payment of advertisement.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 8 | Advertising expense | 500 | |

| Cash | 500 | ||

| (To record the payment for advertisement) |

Journalize the bill received for the repair of equipments.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 10 | Repair expenses | 390 | |

| Account payable | 390 | ||

| (To record the repair expenses of equipment on account) |

Journalize the service provided for an event on account.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 12 |

| 3,200 | |

| Service Revenue | 3,200 | ||

| (To record the service rendered on account) |

Journalize the supplies purchased on account.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 16 | Supplies | 410 | |

| Accounts payable | 410 | ||

| (To record the purchase of supplies on account) |

Journalize the payment of due for the purchase of equipment on October 7.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 21 | Accounts payable | 14,000 | |

| Cash | 14,000 | ||

| (To record the payment of balance due on equipment, purchased on October 7) |

Journalize the payment of utility bill received.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 24 | Utilities expense | 148 | |

| Cash | 148 | ||

| (To record the payment of utilities bill received) |

Journalize the cash received from customer for the service performed on October 12.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 27 | Cash | 3,200 | |

| Accounts Receivable | 3,200 | ||

| (To record the receipt of cash for the service rendered on October 12 ) |

Journalize the payment of salaries and wages to the employees.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| October 31 | Salaries and Wages Expenses | 5,100 | |

| Cash | 5,100 | ||

| (To record the salaries and wages paid to employees ) |

(b)

To

(b)

Explanation of Solution

(1)

Prepare T-accounts for the Cash account:

| Cash | |||

| Oct. 1 | $66,000 | Oct. 4 | $2,000 |

| 27 | $ 3,200 | 7 | $4,000 |

| 8 | $500 | ||

| 21 | $14,000 | ||

| 24 | $148 | ||

| 31 | $5,100 | ||

| Total | 69,200 | Total | 25748 |

| Bal. | $ 43,452 | ||

Table (1)

(2)

Prepare T-accounts for the Common Stock account:

| Common Stock Account | |||

| Oct.1 | $66,000 | ||

| Bal. | $66,000 | ||

Table (2)

(3)

Prepare T-accounts for the Rent Expenses account:

| Rent Expenses Account | |||

| Oct. 4 | $2,000 | ||

| Bal. | $ 2,000 | ||

Table (3)

(4)

Prepare T-accounts for the Equipment account:

| Equipment Account | |||

| Oct. 7 | $ 4,000 | ||

| 7 | $14,000 | ||

| Bal. | $ 18,000 | ||

Table (4)

(5)

Prepare T-accounts for the Accounts Payable account:

| Accounts Payable Account | |||

| Oct. 21 | $14,000 | Oct. 7 | $14,000 |

| 10 | $ 390 | ||

| 16 | $ 410 | ||

| Total | 14,000 | Total | 14,800 |

| Bal. | $ 800 | ||

Table (5)

(6)

Prepare T-accounts for the Advertising Expenses account:

| Advertising Expenses Account | |||

| Oct. 8 | $ 500 | ||

| Bal. | $ 500 | ||

Table (6)

(7)

Prepare T-accounts for the Supplies account:

| Supplies | |||

| Oct. 16 | $ 410 | ||

| Bal. | $ 410 | ||

Table (7)

(8)

Prepare T-accounts for the Repairs Expenses account:

| Repair Expenses Account | |||

| Oct. 10 | $ 390 | ||

| Bal. | $ 390 | ||

Table (8)

(9)

Prepare T-accounts for the Utilities Expenses account:

| Utilities Expenses Account | |||

| Oct. 24 | $ 148 | ||

| Bal. | $ 148 | ||

Table (9)

(10)

Prepare T-accounts for the Accounts Receivables account:

| Accounts Receivable | |||

| Oct. 12 | $ 3,200 | Oct. 27 | $3,200 |

| Bal. | $ 0 | ||

Table (10)

(11)

Prepare T-accounts for the Salaries and Wages Expenses account:

| Salaries and wages expenses | |||

| Oct. 31 | $ 5,100 | ||

| Bal. | $ 5,100 | ||

Table (11)

(12)

Prepare T-accounts for the Service Revenue account:

| Service Revenue Account | |||

| Oct.12 | $3,200 | ||

| Bal. | $3,200 | ||

Table (12)

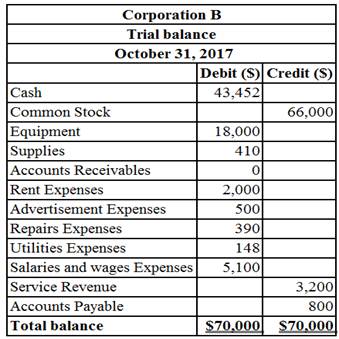

(c)

To Prepare: The trial balance.

(c)

Answer to Problem 3.18E

Table (1)

Explanation of Solution

The total of the debit side should be equal to the total of the credit side of the trial balance. The accounts payable account, common stock account, and service revenue account are placed in the credit column because; it shows a normal credit balance. Similarly, cash account, supplies account, equipment account, advertisement expense account, salaries and wages account, and rent expense account are placed in the debit column because it shows a normal debit balance.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this financial accounting question with accurate accounting calculations?arrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

- Please provide the solution to this financial accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College