Concept explainers

Learning Goals 2, 3, 4, 5

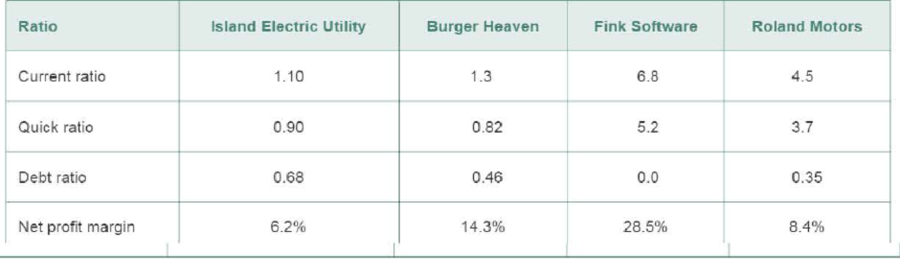

P3-10 Ratio comparisons Robert Arias recently inherited a stock portfolio from his uncle. Wishing to learn more about the companies in which he is now invested, Robert performs a ratio analysis on each one and decides to compare them to one another. Some of his ratios are listed below.

Assuming that his uncle was a wise investor who assembled the portfolio with care, Robert finds the wide differences in these ratios confusing. Help him out.

- a. What problems might Robert encounter in comparing these companies to one another on the basis of their ratios?

- b. Why might the current and quick ratios for the electric utility and the fast-food stock be so much lower than the same ratios for the other companies?

- c. Why might it be all right for the electric utility to carry a large amount of debt, but not the software company?

- d. Why wouldn't investors invest all their money in software companies instead of in less profitable companies? (Focus on risk and return.)

Trending nowThis is a popular solution!

Chapter 3 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Additional Business Textbook Solutions

Foundations Of Finance

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Corporate Finance

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Principles of Accounting Volume 1

Managerial Accounting (4th Edition)

- Nonearrow_forwardUsing the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $7.41 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, E a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond year 4 will be 4% rather than 3%. What effect would this finding have on your responses in parts a and b? a. The value of CoolTech's entire company is $. (Round to the…arrow_forwardPlease Solve In 15mins I will Thumbs-up promisearrow_forward

- Teading Subtle Em... Paragraph Styles QUESTION 3 Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Bloom stock and Stars stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: Stock Bloom Stock Stars State of Probability Return (%) Return (%) Economy Recession Normal 0.35 -20 30 0.40 10 20 Boom 0.25 70 50 Alan has RM100,000 and he plans to invest RM60,000 in Bloom and the remainder in Stars. The market price for Bloom and Stars are RM12 and RM25 respectively. Beta for each stock is 1.2 and 0.5. Required: Compute the expected return and standard deviation for these two stocks. a. b. Compute the expected return and standard deviation of the portfolio.arrow_forwardUsing the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $4.61 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond year 4 will be 3% rather than 2%. What effect would this finding have on your responses in parts a and b? a. The value of CoolTech's entire company is $ Data table (Click on…arrow_forwardUsing the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $22.92 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, E a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond 2023 will be 7% rather than 6%. What effect would this finding have on your responses in parts a and b? a. The value of CoolTech's entire company is $| (Round to the nearest…arrow_forward

- Please correct answer and don't use hand ratingarrow_forwardINV4 5a Your brother-in-law, Bil, fancies himself quite an investor, and he knows your sister, Hermana, also has “a bit of an interest in the markets.” So, he wants you to settle a dispute between them as to who is the better “market player.” Your research into their online brokerage trades has turned up the following performance information: Benchmark Portfolio Bil’s Portfolio Hermana’s Portfolio Weight Return Weight Return Weight Return Stocks 0.6 -5.00% Stocks 0.5 -4.00% Stocks 0.3 -5.00% Bonds 0.3 3.50% Bonds 0.2 2.50% Bonds 0.4 3.50% T-Bills 0.1 1.00% Cash 0.3 1.00% Cash 0.3 1.00% The risk-free rate is 1% and the standard deviation for the Benchmark portfolio is 3.50%, Bil’s portfolio is 5.00%, and Hermana’s portfolio is 3.00%. Compare Bil and Hermana’s performance relative to the benchmark in terms of portfolio returns.arrow_forwardINV4 5c Your brother-in-law, Bil, fancies himself quite an investor, and he knows your sister, Hermana, also has “a bit of an interest in the markets.” So, he wants you to settle a dispute between them as to who is the better “market player.” Your research into their online brokerage trades has turned up the following performance information: Benchmark Portfolio Bil’s Portfolio Hermana’s Portfolio Weight Return Weight Return Weight Return Stocks 0.6 -5.00% Stocks 0.5 -4.00% Stocks 0.3 -5.00% Bonds 0.3 3.50% Bonds 0.2 2.50% Bonds 0.4 3.50% T-Bills 0.1 1.00% Cash 0.3 1.00% Cash 0.3 1.00% The risk-free rate is 1% and the standard deviation for the Benchmark portfolio is 3.50%, Bil’s portfolio is 5.00%, and Hermana’s portfolio is 3.00%. Compare Bil and Hermana’s performance relative to the benchmark in terms of portfolio returns. c. Who is superior in asset allocation?arrow_forward

- Question 3 You just graduated with MBA in Accounting and Finance from the University of Professional Studies and are employed by JEK Investments Ltd, a brokerage firm in Ghana. Kweku The Don, an illiterate businessman, visited your firm for a piece of investment advice and possibly make some investments. Although an accomplished businessman, he was advised by his son to buy some shares on the Ghana Stock Exchange in other to diversify his portfolio. Your boss has asked you to consider either Cronox Industries or Zealous Incorporated The share prices and dividends for the two companies and the returns on the Ghana Stock Exchange are shown below for the period 2016 - 2021. Zealous Incorporated Stock price Dividend Stock price Dividend (GHe) Cronox Industries Year GSE Returns (GHe) Market Returns ) 2016 7.62 55.75 2017 2018 2019 12 0.90 60.00 2.25 0.07 10.75 17 0.95 57.25 48.75 2.50 0.12 1.00 2.75 0.08 2020 15.75 1.06 52.30 2.90 0.23 2021 17.25 1.15 48.75 3.00 0.18 a. Compare the two…arrow_forwardHello i just saw the company policy, this question is the second time i am asking but i would like to get help with question 6arrow_forwardA Report a Problem Revisit Choose the best option Question #2 Time value of money is different over different periods on account of the opportunities with the firm O new business O project finance O reinvestment O forecasting Deepanshu | Support C +1 650-924-9221 +91 80 4719 0917 metti P Type here to searcharrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning